Neutral Phoenix Mills Ltd for the Target Rs. 1,672 by Motilal Oswal Financial Services Ltd

Earnings lag; retail portfolio resilient

LFL consumption grows 8% in FY25

* The company reported revenue of INR10.2b, -22%/+4% YoY/QoQ (16% below estimate), while EBITDA came in at INR5.6b, -11%/+1% YoY/QoQ (27% below estimate). Margin stood at 55.1%, +708bp/-163bp YoY/QoQ (848bp below our estimate).

* Adj. PAT stood at INR2.7b, -17%/+3% YoY/QoQ (25% below estimate). Margin stood at 26.7%, +170bp/-43bp YoY/QoQ (315bp below estimate).

* In FY25, revenue was down 4% YoY at INR38b, broadly in line with our estimates. EBITDA declined 1% YoY at INR22b (9% below estimate). Margin was up 195bp YoY at 56.7%. Adjusted PAT stood at INR9.8b, down 10% YoY (9% below estimate). PAT margin stood at 25.8%, down 183bp YoY.

* The Board of Directors has recommended a final dividend of INR2.5 per equity share (i.e. 125% of the face value of INR2 each), subject to shareholders’ approval.

Retail witnesses strong consumption and higher occupancy

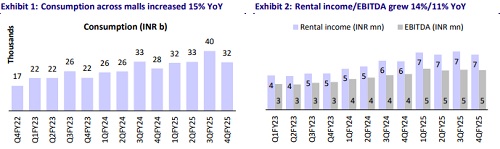

* In 4QFY25, total consumption stood at ~INR32b, up 15% YoY, driven primarily by Phoenix Palassio, the continued ramp-up at Phoenix Mall of the Millennium and Phoenix Mall of Asia, and expansion of Phoenix Palladium.

* In 4QFY25, on a like-for-like basis (excluding the contribution from new malls), consumption rose 8% YoY. In FY25, on an overall basis, jewelry/hypermarkets—key categories—outperformed with 19%/3% YoY growth, while electronics stood at 6% YoY. The entertainment and multiplex segment rose 12% YoY.

* Gross retail collections at INR8.3b were up 6% YoY. The company reported rental income of INR4.8b, up 8% YoY. In FY25, retail collections and rental income stood at INR33.1b and INR19.5b, up 22% and 18%, respectively.

* Retail EBITDA stood at INR5.0b in 4QFY25, up 11% YoY. In FY25, it was 20% at INR20.1b.

* The weighted average trading occupancy stood at 91% (vs 87% in 4QFY24).

* Palladium Ahmedabad; Mall of the Millennium, Pune; and Mall of Asia, Bengaluru witnessed a push in trading occupancy to 95%/92%/83% (vs 86%/76%/57% in 4QFY24).

Office occupancies decline while Hospitality occupancies rise

* Hospitality: Occupancy was at 92% for St. Regis in 4QFY25 (vs 84% in 3QFY25) and 87% for Marriott Agra. During the same period, St. Regis/Marriott Agra reported an ARR of INR23,542/INR6,977, up 11%/10% YoY.

* Total income in 4QFY25 for St. Regis/Marriott Agra was INR1.5b/INR188m, up 4%/4% YoY. EBITDA stood at INR760m for St. Regis and INR86m for Marriott, Agra, up 10% and 35% YoY, respectively, with margins of 51% and 46%.

* The company plans to expand its Hospitality portfolio to 988 keys by FY27, with the addition of 400 keys in Bangalore

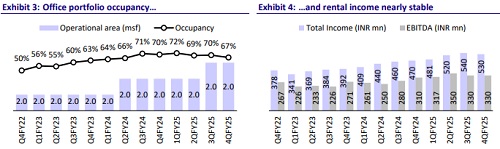

* Commercial performance: Occupancy in the office portfolio declined by 3% to 67%. Gross leasing in FY25 stood at 0.3msf, with 0.1msf contributed by new assets in Pune and Bangalore. ~4msf of area was under development.

* Income from commercial offices in 4QFY25 stood at INR530m, up 8% YoY, and EBITDA came in at INR330m, up 10% YoY. In FY25, income was at INR2.1b, up 10% YoY, while EBITDA was at INR1.3b, up 19% YoY.

* Occupation certificates were received for Phoenix Asia Towers, Bangalore (GLA of ~0.80msf) and Tower 3 of Millennium Towers, Pune (GLA of ~0.52msf).

* The company plans to add 4msf of office space by FY27, bringing its total office portfolio to 7msf.

Residential portfolio to expand by 1msf

* In 4QFY25, the company achieved gross sales of INR770m, while collections stood at INR540m. ASP was at INR25,900psf.

* In FY25, gross sales were INR2.1b and collections were INR2.2b. ASP stood at INR26,000psf.

* The company plans to expand its residential portfolio by 1msf by FY27.

Valuation and view

* While new malls continue to ramp up well, PHNX is implementing measures to accelerate consumption at mature malls. These initiatives, along with a further increase in trading occupancy, will help sustain healthy traction in consumption.

* We remain confident in long-term consumption growth, which is expected to be at least ~7-8%. We value mature malls at 20x EV/EBITDA and new malls at 25x EV/EBITDA. Reiterate Neutral with a revised TP of INR1,672.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412