Buy Piramal Pharma Ltd For Target Rs.300 by Motilal Oswal Financial Services Ltd

Beat on operating profitability; tax burden dents PAT

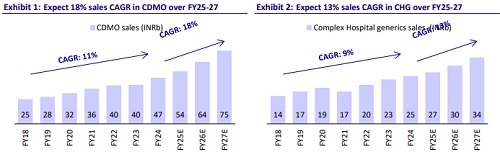

Expects a better outlook in CDMO/CHG segments

* Piramal Pharma (PIRPHARM) delivered a better-than-expected operating performance in 3QFY25; however, earnings were below expectations due to a higher tax rate. PIRPHARM witnessed healthy growth momentum in the CDMO segment and a scale-up in the complex hospital generics (CHG) segment. R&D spending by the innovator customer is yet to see a considerable ramp-up on account of increased biotech funding.

* We raise our EBITDA estimates by 3%/4%/4% for FY25/FY26/FY27 (considering superior execution in CDMO/CHG segment) but reduce our earnings estimate by 68%/53%/43% (considering higher effective tax rate). We continue to value PIRPHARM on SOTP basis (19x EV/EBITDA for CDMO business, 12x EV/EBITDA for CHG business and 13x EV/EBITDA for consumer health (ICH) business) to arrive at a TP of INR300.

* The supply chain diversification initiatives by the innovator customer and PIRPHARM’s offering as an integrated CDMO company offer healthy business prospects. Further, the differentiated specialty portfolio in CHG segment is expected to boost the overall performance of PIRPHARM over the next five years. Reiterate BUY.

Segmental mix impact more than offset by higher operating leverage

* 3Q revenue grew 12.5% YoY to INR22.0b (our est.: INR20.7b). CDMO (58% of total sales) revenue grew 13% YoY to INR12.8b. CHG (30% of total sales) revenue grew 14% YoY to INR6.5b. ICH (13% of total sales) revenue rose 10% YoY to INR2.8b.

* Gross margin contracted 210bp YoY to 63.4% due to product mix change.

* However, EBITDA margin expanded 160bp YoY to 15.3% (our est.: 11.0%), largely due to a decrease in employee costs/other expenses (down 150bp /220bp as a % of sales).

* EBITDA grew 25.8% YoY to INR3.4b (our est.: INR2.3b), supported by operating leverage, cost optimization, and a superior revenue mix.

* Adj. profit declined 89.5% YoY to INR37m (our est.: INR108m) owing to the high tax burden (94% of PBT in 3QFY25 vs. 48% of PBT in 3QFY24).

* In 9MFY25, revenue/EBITDA grew 14%/33% YoY to INR64b/INR8.8b, while adj. loss widened by 7% YoY to INR625m

Highlights from the management commentary

* The company has reiterated its guidance for FY25 revenue/EBITDA growth in early-teens.

* PIRPHARM aims to double its revenue by FY30 with ~25% EBITDA margins.

* The net debt-to-EBITDA ratio for 3QFY25 stood at 2.8x

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412