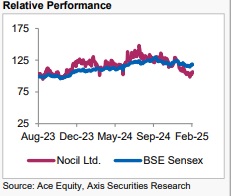

Hold NOCIL Ltd For the Target Of Rs. 240 By the Axis Securites

Recommendation Rationale

Sequential Volumes Decline: In the quarter, total volumes declined by 10% QoQ and grew merely by 3% YoY. The decline was driven by lower demand from customers due to reduced production on their part, coupled with more aggressive price-based imports compared to the previous quarter. As a result, the company’s revenue performance was well below expectations, reflecting ongoing competitive pressure on both demand and pricing. However, the company views the lower production as temporary and expects demand to improve in the coming months, with volumes recovering in the next quarter

Continued Pricing Pressure: The management mentioned that during the quarter, the company continued to face intense pricing pressure and product dumping from Chinese, Korean, and EU rubber chemical players, which significantly impacted domestic rubber chemical prices. The influx of lower-priced imports has created a challenging competitive environment, exerting downward pressure on margins and affecting market dynamics. Management expects pricing to improve as economic conditions and demand recover, though the timing remains uncertain.

Sector Outlook: Neutral

Company Outlook & Guidance: NOCIL continues to focus on balancing price and volume while aiming to boost export sales and establish long-term customer partnerships to navigate industry challenges. While management acknowledges uncertainties in the external environment, it remains optimistic about growth opportunities. Positive momentum is seen in the replacement and export markets, while the commercial vehicle sector is expected to benefit from increasing infrastructure initiatives. With an anticipated volume rise, management remains hopeful of margin recovery in the coming quarters.

Current Valuation: 18x FY27E (Earlier: 18x FY27E)

Current TP: Rs. 240/share (Earlier TP: Rs 295/share) Recommendation: We maintain our HOLD rating on th

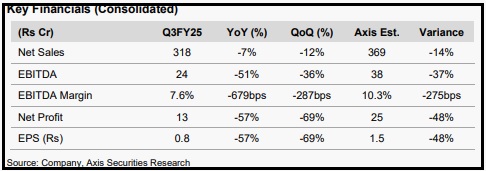

Financial Performance: NOCIL missed our estimates on all fronts. The company reported revenue of Rs 318 Cr, down 7% YoY and 12% QoQ, missing our estimate by 14%. EBITDA stood at Rs 24 Cr, down 51% YoY and 36% QoQ, significantly missing our estimate by 37%. EBITDA margin declined to 7.6% from 14.5% in Q3FY24. PAT stood at Rs 13 Cr, down 57% YoY and 69% QoQ, against our estimate of Rs 42 Cr.

Outlook NOCIL continues to take initiatives to improve its product mix, build partnerships, and reduce costs. While pricing pressures from aggressive competition by overseas players (China, Europe, and the EU) are expected to persist in the near term, demand appears to be picking up. With a focus on expanding exports and innovating new products, NOCIL is taking the right steps toward long-term growth and improved profitability. However, an apparent recovery remains uncertain, and we remain cautious about prolonged pricing pressures and logistical challenges.

Valuation & Recommendation We have revised our forecasts downward to reflect continued pricing pressure, macro uncertainties, and near-term profitability challenges. Over the long term, we expect volume growth driven by deeper market penetration in exports and the introduction of new products to positively impact profitability, leading to a steady improvement in operating performance. We maintain our HOLD rating on the stock, valuing the company at 18x FY27E earnings. This results in a revised target price of Rs 240/share, indicating a 7% upside from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633