Sell Hitachi Energy Ltd for the Target Rs. 12,500 by Motilal Oswal Financial Services Ltd

Order book cycle turning longer

Hitachi Energy’s 4QFY25 revenue came in below our estimates, whereas PAT beat our expectations on the back of better margins and higher other income. Order inflow was healthy for the quarter, while FY25 inflow was boosted by HVDC order wins. We believe Hitachi Energy will continue to be a key beneficiary of green energy initiatives across domestic and international markets. However, the execution period of the order book is turning longer due to large-sized HVDC projects where execution contribution will be lower in the initial two years and will ramp up mainly after 1.5-2 years. We increase our FY26/FY27 earnings estimates by 19%/15% to factor in higher margins. Our estimates currently bake in at least one HVDC win for the company every year and consistent improvement in margins. The stock is currently trading at 91.5x/62.2x P/E on FY26E/27E earnings. We reiterate our Sell rating on the stock with a revised two-year forward TP of INR12,500 based on DCF, as we already bake in 38% revenue CAGR and 80% PAT CAGR over FY25-27.

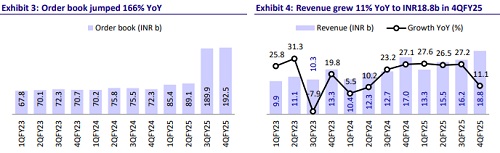

PAT boosted by better-than-expected other income

Hitachi Energy’s 4Q revenue came in 19% below our estimates as execution remained weak during the quarter. However, with a better-than-expected EBITDA margin of 14.4% and higher other income, reported PAT came in 7% ahead of our estimates. Revenue grew 11% YoY to INR18.8b (vs. our estimate of INR23.4b), led by execution mix and improved operational efficiencies. EBITDA margin was 330bp above our expectation of 11.1%, driven largely by gross margin improvement and better absorption of employee costs. EBITDA at INR2.7b (vs. our estimate of INR2.6b) grew 49% YoY even on a high base. Higher other income and better revenue mix boosted reported PAT by 62% YoY to INR1.8b. Excluding the exceptional items, PAT came in at INR1.9b (+74% YoY), 15% above our estimate of INR1.7b. Other income spiked due to higher cash balances from QIP proceeds. The order book stood at INR192.5b. In FY25, orders jumped 228% YoY to a record INR181.7b (including HVDC orders), while reven /EBITDA/adj. PAT stood at INR63.8b/5.96b/3.5b, up 22%/71%/111% YoY.

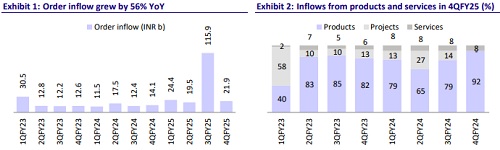

Shift in order mix

The company’s order inflows for the quarter surged 56% YoY to INR21.9b. The company, in consortium with BHEL, has received LOI from Rajasthan Part 1 Power Transmission Limited to design and execute the high voltage direct current (HVDC) link to transmit renewable energy from Bhadla III (Rajasthan) and Fatehpur (Uttar Pradesh). Management expects the same order to be finalized in early FY26. Earlier in FY25, the company was also awarded the Khavda-Nagpur HVDC order by PGCIL. These orders have led to a shift in the company’s order mix, with Products’ share decreasing from 92% last year in the same quarter to 65%. Projects’ share in order mix has increased from 0% to 31% in 4QFY25. On sector basis, the share of Utilities has further expanded to 80% (from 71% in 4QFY24), while Industry/Transport & Infra accounted for 9%/11% share in the order mix.

Export capabilities to accelerate growth

Exports maintained their growth momentum, contributing significantly to the total order book. Excluding HVDC orders, exports contributed to almost 37% of total order inflows in FY25, up 77% YoY. Diverse geographies and industries helped the company to sustain its export momentum. Key export orders received by the company in FY25 were:

* 45kV DTB for Google Data Center in Thailand

* 72.5kV DTB for Aboitiz Group Philippines

? 420 kV, 245kV & 72.5kV Circuit Breakers for Lawaamer, Chemaia, Morroco, Turkey

* 245 kV & 72.5 kV AIS Equipment for Eurl Hamdi project of Sonelgaz, Algeria

* 420 kV & 123 kV AIS Equipment for NAF - KM - 2024 project of MAVIR, Hungary

* GIS I&C Services - orders from Greece and Singapore

Services as a separate business unit on track

As of 1st Apr’25, the company has set up Services as a fully functional separate business unit (BU). Management emphasized that its focus will be on strengthening the segment and exploring, and tapping into potential opportunities and offerings across this BU for its customers. India has INR600b worth of installed and aging base. The company sees an annual opportunity size of INR20b, which will be catered to by combining the services expertise from various BUs under one unified service umbrella. During the quarter, Service orders accounted for ~4% of the order inflow. On the full year basis, its contribution to order book increased by 60% YoY, led by 7.4% YoY increase in Service orders.

QIP proceeds to be utilized for expansion

In Mar’25, the company raised INR24.8b by way of QIP. It intends to utilize INR15b of these proceeds as capex for capacity enhancement, factory expansion, purchase of machinery, safety improvements and infrastructure upgrades of its BUs. The proposed capex will allow the company to increase its operational efficiency, optimize costs and increase its total revenue over the years. From the balance proceeds, INR3.5b will be used to fund working capital requirements and INR6b for general corporate purposes.

Financial outlook

We increase our FY26/FY27 earnings estimates by 19%/15% to factor in higher margins. Our estimates currently bake in at least one HVDC win for the company every year and consistent improvement in margins. This should result in EBITDA margin improvement to 13.0%/14.1% in FY26/FY27.

Valuation and view

The stock is currently trading at 91.5x/62.2x P/E on FY26E/27E earnings. We reiterate our Sell rating with a revised two-year forward TP of INR12,500 (vs. INR10,500 earlier) based on DCF, as the current valuations factor in most of the positives related to inflow and margin improvement.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412