Buy ACME Solar Holdings Ltd for the Target Rs. 370 by Motilal Oswal Financial Services Ltd

Execution strength, PPA momentum, and storage upside underpin our positive stance

* With slower power demand, PPA tie-up momentum and execution ability in focus: Acme Solar (ACME) remains our top pick in the Power/Renewables space, with the stock up 45% in the last six months. With a slowdown in power demand in FY26YTD, investors have shifted focus to earnings growth backed by power purchase agreements and an ability to execute projects on time and within budget. For ACME, we are building installed capacity to rise from 2.5GW at the end of FY25 to 5.5GW by the end of FY28. Based on our estimates, the annualized EBITDA from the entire pipeline of ~6.7GW will amount to ~INR81b post-commissioning. Reiterate BUY with a revised TP of INR370.

* Sector catalysts – pick-up in power demand and govt. push to resolve PPA deadlock: In Aug'25, power demand grew 4% YoY, and peak demand remained healthy at 229GW (+6% YoY). In FY26 (Apr-Aug), power demand has been flat YoY, while peak demand at 243GW was 2.8% lower vs. the previous year's peak. Media reports indicate that around 40 GW of renewable energy projects are still awaiting power purchase agreements (PPAs; link). The government now appears to be addressing this issue by encouraging states to procure clean energy (link). This step is crucial to sustaining the current high pace of renewable energy tenders, which have surpassed 50GW.

* According to our understanding, ACME continues to bid actively for utilityscale projects, and incremental project awards are key now to building earnings growth visibility for FY29 and beyond. Demonstration of the ability to execute projects and tie up financing at competitive rates (link) has been key to shoring up investor confidence in the stock in the past few months.

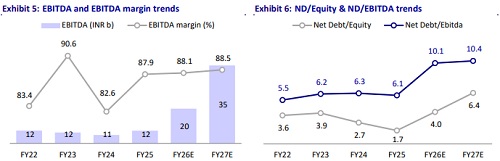

* FY28E cut by 1% due to cancellation of the 300MW solar project: We cut our FY28E EPS by 1%, mainly owing to the 300MW solar project, which was cancelled recently. We have not yet included the recent 220MW solar + BESS tender win in our earnings estimates (link). In FY27/28E, we are modeling the commissioning of 1.9GW/0.5GW capacity, which drives an EBITDA CAGR of 74% over FY25-28E. We estimate 70% of the company’s debt is floating rate-linked, and a 25bp reduction in the interest rate can boost FY27/FY28 PAT by 12%/6%.

* Catalysts include earnings from the battery initiative and commissioning of new capacity: In the 1QFY26 earnings call, ACME had highlighted the plan to put up 3-3.5GWh of battery storage by the end of 2025 and earn revenue by engaging in power price arbitrage. Assuming 2.5GWh of installed battery storage for FY27 with a 1/1.5 hour cycle and INR2/3 per unit spread, we estimate incremental EBITDA upside of 3.3/8.6% for FY27. This upside is not built into our estimates. Further, in FY27, we are modeling the start of the ~2GW of new capacity, which should drive earnings growth.

* Strong outperformance vs. peers; execution has been the key: In the past six months, ACME’s share price (+45%) has outperformed peers such as NTPC Green (+0.2%) and JSW Energy (+0.2%). ACME trades at FY27 EV/EBITDA of 15.5x vs NTPC Green (13.3x, consensus estimate) and JSW Energy (12.6x). We value ACME at 10x FY28E EBITDA (discounted by one year) to arrive at our TP of INR370, implying a 34% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)