Hold Tata Elxsi Ltd For Target Rs.5,010 by Prabhudas Liladhar Capital Ltd

Key segment outlook improves, but broader pain continues

Quick Pointers:

* Key client stabilizes, Automotive progresses well at a broader client portfolio

* Revenue stability remains weak beyond Transportation

We interacted with the CFO of TELX to reaffirm progress within automotive and structural recovery beyond Transportation. The R&D budgets are still being prioritized to improve cost parameters, while fixing the current vehicle architecture instead of new product development initiatives. The decisionmaking cycle has progressed, with a notable recovery in client sentiment and limited budget constraints. Optimizing software (for efficiency) and time-tomarket (new features) have become extremely critical to stay competitive against Chinese OEMs, which is equally balancing vehicle pricing and cost equations. Although the company hasn’t made any notable breakthroughs in Chinese market but have secured a handful of engagement with local players. The overall deal constructs have not seen any material change in terms of pricing or tenure; the overall ACV is still comparable to the earlier engagements while pricing plays a trade off against right-shoring.

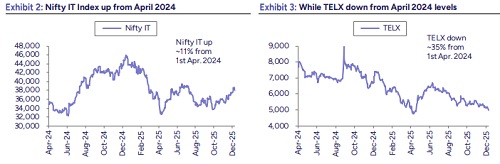

The demand beyond Transportation still looks moderate. Beyond a couple of deals within media & communications, the pocket seems to be weak, attributed to consolidation effects. Healthcare sees strong deal pipeline within Providers and Medical Devices segments, but elongated deal cycle would make the revenue stream slightly unpredictable. The operational glitch within its top account has largely been stabilized and it doesn’t anticipate any notable impact on Q3 performance. We believe the demand recovery within Automotive is still defensive and yet not achieved its full potential to drive design-oriented architecture, while beyond Transportation the verticals look unstable. We are not making any changes to our estimates, our CC revenue and margin estimates stand at 9.4%/11.2% and 20.6%/22.0% in FY27E/FY28E, which translates to an earnings CAGR of 24% (26-28E). The stock hammered notably by ~33%/~2% in FY25/YTDFY26, meanwhile Nifty IT saw an improvement of 5.3%/5.5% during the same period. Valuation remains expensive, trading at 35x (Sep-27 EPS). We assign 36x to Sep-27 EPS. The stock price correction is leading to change our rating to HOLD (REDUCE earlier).

Transportation segment: The transportation segment is gradually strengthening. The JLR-related impact in Q2 was limited to one month, and delayed programs restarted by late October, positioning the business to recover revenue in Q3. Japan is becoming a growth market as OEMs accelerate outsourcing and avoid Chinese vendors, creating opportunities for TELX. In China, TELX has started execution small engagements and is evaluating JV or acquisition-led options for long-term expansion.

Media & Comms segment: The segment continues to face a weak demand environment, with minimal new-build or discretionary work amid ongoing macro pressures. Deal flow is concentrated in cost-reduction and vendor-consolidation programs, which carry lower initial margins due to transition costs but improve as efficiencies scale. Several large consolidation deals are under discussion, and management anticipates at least one near-term closure, though overall segment outlook remains subdued.

Margins: Margin recovery is expected to be gradual and tied closely to revenue momentum. Management noted that utilization is currently ~70% and has the potential to rise to ~80% in a conducive macro environment, which would aid margins. They also highlighted that consolidation-led deals tend to dilute margins in the early stages due to onboarding and transition expenses, but these contracts typically deliver stronger margins once efficiencies ramp and delivery scale is achieved.

Other KTA’s

* Macro conditions remain unstable, but client sentiment is improving with improving client conversation and quicker decision cycles. Management expects H2 to outpace H1 as deal closures and project restarts pick up. Clients continue to focus on cost efficiency, talent access, and faster time-to-market to stay competitive with Chinese OEMs.

* As client spending models shift toward JV structures, hybrid outsourcing– insourcing, and GCC expansion, TELX is assessing how to embed itself more deeply within these evolving operating models.

* OEM momentum remains robust, with the OEM mix rising to 66% as spend continues to shift from Tier-1 suppliers to direct OEM engagements.

* TELX is expanding its focus on aerospace and defense, leveraging rising domestic and global opportunities. India’s expanding defense budget presents a long-term growth runway for service and engineering providers. The company has secured early wins and commenced smaller engagements in this segment. However, the revenue base remains modest at present, and scale is expected to build gradually as investments mature and program rampups progress.

* In the healthcare segment, TELX has invested heavily after EU MDR regulatory changes, strengthening both its sales and delivery capabilities. Although the pipeline is strong, elongated deal-closure cycles have delayed near-term conversions.

* Deal momentum is strengthening, with a robust order book and a healthy pipeline supporting H2 visibility. Improved client decision-making and resumed program start-ups are contributing to better execution. ACV levels have stabilized, helping reinforce revenue predictability as the company heads into the second half of the fiscal year.

* Hiring has been limited, with the company pausing campus recruitment as several delivery roles are increasingly supported by agentic-AI-led productivity enhancements. TELX expects employee growth to decouple from revenue growth as automation and AI-driven efficiencies become more embedded in delivery models, enabling the company to scale while maintaining a leaner talent base.

Global OEMs Pivot to Cost Discipline as R&D Cycles Peak

Recent commentary from global auto OEMs indicates a clear pivot toward tighter R&D and capex discipline, with several players noting that investment levels have peaked or are being selectively deferred. Across large auto OEM’s management emphasis has shifted to cost reductions, portfolio rationalization, and productivity improvements. Even as EV and software programs continue, spending is increasingly targeted. Overall, the industry is prioritizing margin resilience and cost efficiency, which can be seen from the management commentary below:

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271