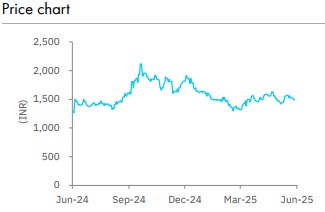

Accumulate Mrs Bectors Food Specialities Ltd for Target Rs. 1,572 by Elara Capitals

Margin blip in the near-term

Mrs Bectors Food Specialities’ (BECTORS IN) Q4 revenue grew 9.8% due to slower growth in the export business. BECTORS continues to focus on product innovation and has added capacities and capabilities to expand its product offering in the frozen and health segments. New manufacturing facilities will enable it to improve its service beyond markets in North India and reduce distribution cost. While near-term sales growth remains moderate, the long-term outlook is intact as we pencil in a 17% revenue CAGR forecast for FY25-28E. We maintain Accumulate with TP at INR 1,572 (unchanged) based on 45x FY27E P/E (unchanged).

Bakery segment outperforms; Biscuits sees moderate growth: Q4 net sales rose 9.8% YoY to INR 4.5bn (3% below our estimates), impacted by continued urban slowdown and slower growth momentum due to higher-end prices to consumers. Sales growth was led by growth in the Bakery segment (+18.5% YoY), while the Biscuits segment posted a slower growth of 7.1% YoY. In the Biscuits segment, the domestic business saw a positive trend since Q4, aiding mid-single digit value growth in FY25, while the exports business reported a slower growth amid higher base and exponential growth in the past 3-4 years. For FY25, BECTORS recorded high single-digit volume growth. The management expects this to improve to double-digit volume growth in FY26. Within Biscuits, domestic and export segments are projected to grow in low teens and mid-teens, respectively. The Bakery segment is expected to grow in mid-tohigh teens in FY26.

Capacity expansion on track; launch of new brands to drive innovation: BECTORS plans to expand its capacity by ~15% in the Biscuits and Bakery segments. The newly commissioned Dhar facility, which became operational in May 2025, is expected to enhance serviceability in the western and central regions, reduce freight costs, and unlock significant potential for new product development (NPD). Further, the company has launched a new clean label brand ‘Nature Baked’, aimed at offering healthier and differentiated products.

Aims to return 13-14% EBITDA margin by Q3FY26: Q4 EBITDA margin contracted 198bps YoY/flat QoQ to 12.5% (versus our estimates of 12%) as gross margin loss of 345bps YoY was partly offset by lower employee cost (-79bps YoY) and other expenses (-69bps YoY). However, BECTORS aims to return to 13-14% EBITDA by the end of Q3FY26 on the back of: 1) recent import duty cut from 20% to 10% in palm oil (17-20% of raw material basket), 2) calibrated price increases; 3) cost efficiency programs and 4. commodity deflation.

Maintain Accumulate with TP retained at INR 1,572: We cut our earnings estimates by 2.6% for FY26E while largely maintaining FY27E estimates to factor in lower revenue. So, we maintain our TP at INR 1,572 (unchanged) on 45x (unchanged) FY27E P/E. We remain positive on long-term growth prospects, especially in the Bakery segment. We introduce FY28 estimates.

Please refer disclaimer at Report

SEBI Registration number is INH000000933