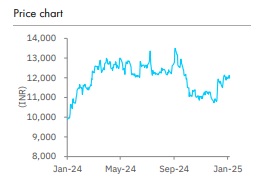

Accumulate Maruti Suzuki Ltd For Target Rs. 14,382 By Elara Capital Ltd

Commodities aid gross margins

Maruti Suzuki (MSIL IN) reported revenue growth of 15.6% YoY and 3.5% QoQ at INR 384.9bn, mainly due to volume growth of 13% YoY and 4.6% QoQ. However, ASP contracted 1% QoQ on higher discounts. Despite gross margin expansion of 30bps sequentially, EBITDA margin contracted to 11.6%, due to high sales promotion activities related to new product launches and discounts. The management expects retail growth in 9MFY25 at ~3.5% to continue in Q4FY25 as well. However, overall demand scenario continues to be tepid, with the lower end continuing to underperform the upper end, per MSIL.

We monitor sustained recovery in industry growth as a further trigger for MSIL. Exports continue to remain strong and with EV exports, we increase our ASPs for FY25-27E. However, as EV margin is lower, the EPS upgrade should be limited to 5-6% in FY26E-27E. Maintain Accumulate with TP raised to INR 14,382 (from INR 13,368), on FY27E P/E of 25x as we roll forward.

Rural growth outperforms urban growth:

MSIL anticipates low single-digit growth in terms of overall volumes for FY25. MSIL has observed a growth of ~3.5% in retails (AprDec growth in 2024 with expectations on similar growth outlook in Q4FY25). Rural demand growth outperformed urban growth, up 15% YoY versus urban growth of 2.5% YoY. Dealer inventory was at comfortable nine days as at end-Q3 (down from 30 days + as at end-Q2). As regards exports, MSIL is witnessing demand traction across geographies such as Latin America, the Middle East and Africa, driven by robust distribution network and encouraging response to new model launches.

Margins hit by sales promotion and higher discounts:

EBITDA margin in Q3 contracted by 30bps QoQ on higher sales promotion expenses (impact 20bps, discounts per vehicle at INR 30,999). To cushion against commodity inflations, MSIL undertook minor price hikes (of 30bps).

New E-Vitara unveiled at Bharat Expo; exports to remain key focus:

MSIL recently unveiled the new E-Vitara at Bharat Expo 2025 with best-in-class features and a long range of 500+kms on a 61kWh battery pack. MSIL aims to export the product to 100+ countries, with Europe and Japan being the key geographies to begin with. Also, MSIL has guided for fast charging network in the first-100 cities during phase 1 of the plan.

Maintain Accumulate; TP raised to INR 14,382:

We await sustained growth of 5%+ for the PV industry, which we have factored in FY26. We factor in ~50,000 units incremental EV volumes in FY26E, net of cannibalization and so, increase our ASP and EPS by ~5-6% each in FY26E-27E. We believe key positive triggers for MSIL are: a) revival in industry growth, led by revival in first-time buyers; b) new model launches in FY26-27E and c) market share sustaining and ramp-up in hybrid. So, we raise TP to INR 14,382 (from INR 13,368), based on FY27E P/E of 25x as we roll forward – Reiterate Accumulate

Please refer disclaimer at Report

SEBI Registration number is INH000000933