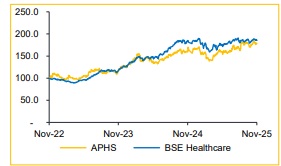

Buy Apollo Hospitals Ltd For Target Rs. 9,000 By Choice Broking Ltd

Strong Growth Outlook across Core Verticals

Strong Growth Outlook across Core Verticals: APHS’s hospital business is poised for steady growth, supported by an aggressive capacity ramp-up, from 10,200 to ~14,600 beds over the next 5 years and sustained EBITDA margin of around 24%. The diagnostics arm (AHLL) is targeting ~15% revenue growth with a ~200 bps margin uplift, driven by expansion in primary care and diagnostic services. Apollo HealthCo (pharmacy) is expected to deliver ~20% revenue CAGR, underpinned by stronger penetration in high-potential emerging cities and deeper integration across the healthcare ecosystem.

View and Valuation: We maintain our estimates and forecast Revenue/EBITDA/PAT to expand at a CAGR of 19.8%/25.4%/34.2% over FY25– 28E. Valuing the stock on an average of FY27-28E SoTP valuation, we maintain our target price of INR 9,000 and BUY rating on the stock (maintained). We value Hospitals at 20x EV/EBITDA, AHLL at 10x EV/EBITDA and HealthCo at 3x EV/EBITDA (maintained) (refer Exhibit 2).

* Hospital segment revenue is expected to grow through capacity expansion, with plans to add ~43% beds in next 5 years (current 10,200 bed capacity)

* The pharmacy business is set to achieve ~20% CAGR by FY28E, expanding its footprint from 6 major cities to 25 cities

* The diagnostics business is projected to expand at a CAGR of ~15%, supported by strategic alliances with insurers

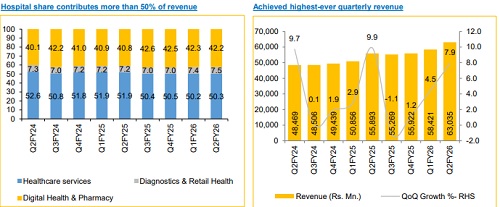

Results were in line with estimates & saw significant YoY growth on all fronts

* Revenue came in at INR 63Bn (vs. CIE est. at INR 63.81Bn), up 12.8% YoY and 7.9% QoQ, driven by better case mix

* EBITDA came in at INR 9.4Bn (vs. CIE est. at INR 9.4Bn), up 15.4% YoY and 10.5% QoQ. EBITDA margin came in at 14.9% (vs. CIE est. of 14.8%)

* PAT came at in INR 4.8Bn (vs. CIE est. of INR 4.9Bn), up 26% YoY and 10.3% QoQ, with a PAT margin of 7.6%

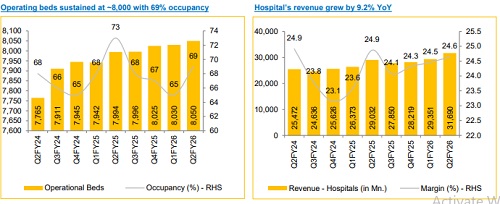

Hospital segment: Scaling up clinical excellence while expanding capacity

Revenue of Apollo’s hospitals grew 9% YoY to INR 31,690Mn in Q2FY26, with EBITDA margin steady at 24.6%. The quarter saw a dip in seasonal medical admissions but higher surgical and complex case mix. APHS is entering a capacity-led growth phase with six hospitals set to be commissioned over FY26– 27 across in key metros like Delhi, Hyderabad, Bengaluru and Gurugram. Management expects ~13% organic growth in existing beds and ~5% from new capacity over the next few years. We believe that, combining a high-acuity case mix with disciplined expansion and cost optimisation, positions APHS as India’s benchmark in clinical and operational excellence.

Diagnostics & Pharmacy: Scaling up with Profitability and Digital Leverage

Apollo HealthCo delivered INR 26,606Mn in revenue, up 17% YoY, with EBITDA margin improving to 10% to 11%. The digital platform (Apollo 24/7) crossed 44 million users, driving a GMV of INR 7,230Mn (+16% YoY). APHS is integrating its online (24/7), offline pharmacy and diagnostics networks, targeting breakeven by FY26-end. Growth will be driven by 25–30% annual GMV expansion through pharmacy scale-up, insurance offering and diagnostics. Margin gains will come from cost discipline, private-label growth and digital reach in over 7,000 stores.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131