Add IDFC First Bank Ltd For Target Rs. 70 By Yes Securities Ltd

Initiated with cautionary report in March 2023, IDFCB reaches then price target

Our view – Valuation still precludes an upgrade, in our opinion

Asset Quality – Slippages rose on sequential basis from already elevated levels, with microfinance being the key reason: Gross NPA additions amounted to Rs 21.92bn for 3QFY25, translating to an annualized slippage ratio of 3.9% for the quarter. Of the QoQ incremental gross slippages of Rs 1.62bn in 3QFY25, Rs 1.43bn was contributed by the microfinance business. MFI slippages are expected to peak in 4QFY25 and trend lower from 1QFY26. Provisions were Rs 13.38bn, down by -22.8% QoQ but up by 104.3% YoY. The annualized credit cost was at 240bps, down -86bps QoQ. Excluding the micro-finance portfolio, the annualized credit cost for Q3FY25 was stable at 180bps. Again, excluding microfinance, the credit cost in 4QFY25 would be around 180- 190bps.

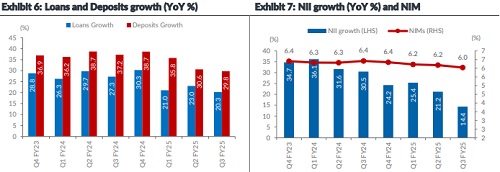

Net Interest Margin – NIM declined materially on sequential basis due to multiple factors: NIM was at 6.04%, down -14bps QoQ and -38bps YoY. The breakdown of the 14 bps sequential decline was: (1) 6 bps due to lower microfinance lending (2) 5 bps due to higher wholesale lending and (3) 3 bps due to tighter liquidity driving higher cost of funds.

Balance sheet growth – Relatively high balance sheet growth outcomes continued like they have since long: Total gross advances grew by 22% YoY. Total customer deposits were up 28.8% YoY to Rs 2,273bn. Management stated that, in FY26, total advances are to grow by 18-20% and total deposits are to grow by 22-23%.

We maintain a less-than-bullish ‘ADD’ rating on IDFCB with a revised price target of Rs 70: We value the bank at 1.3x FY26 P/BV for an FY25/26/27E RoE profile of 4.5%/11.0/14.7%. We had initiated IDFCB with a cautionary report dated March 2023 and reiterated our cautious stance in another report dated April 2024.

(See Comprehensive con call takeaways on page 2 for significant incremental colour.)

Result Highlights (See “Our View” above for elaboration and insight)

* Opex control: Total cost to income ratio at 73.7% was up by 379/60bps QoQ/YoY and the Cost to assets was at 6.0% up/down by 19/-33bps QoQ/YoY

* Fee income: Core fee income to average assets was at 2.1%, up/down 7/-5bps QoQ/YoY.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632