Reduce Titan Company Ltd For Target Rs. 3,200 By Emkay Global Financial Services Ltd

Strong margin-led beat; retain Reduce on margin band retention

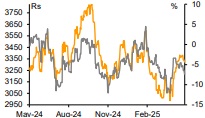

TTAN’s Q4 EBITDA was ~10% better than Street/our estimates, led by stable EBIT margin in the jewelry segment (~12%) vs expectations of a 100-150bps decline. Revenue growth of ~25% in Q4 was strong and in line with the company’s business update. TTAN attributed the better than expected margin to operating leverage and one-off benefits from hedging/higher-margin International sales, as gross margin was under pressure due to the 300bps weaker revenue mix (less studded/more coins). Despite the beat, TTAN retained its margin band of 11.0-11.5% (vs 11.4% in FY25) as its focus remains on market share gains. Given the high gold price volatility, consumer sentiment remains slightly suppressed which is also weighing on the balance sheet (Exhibits 1-2). However, TTAN targets high double-digit growth in FY26, with lower operation disruptions and GoI’s thrust on boosting consumption. TTAN offered a divergent commentary vis-à-vis the LGD ecosystem, as it believes new price warriors/automation may continue to disrupt LGD prices and challenge the viability of such operations. On retention of margin band and in-line topline, we retain our TP/estimates and our REDUCE. Our estimates are toward the lower end of TTAN’s outlook of 15-20% topline CAGR and 11-11.5% for the jewelry segment, as we fear risk from high competitive intensity/weaker mix. Traction in LGD is a downside risk to our estimates.

Strong execution in Q4; continued volatility in Gold price needs to be monitored

Ex-bullion sales, standalone revenue grew 24% in Q4, led by 25% growth in Jewelry, while Watch/Eyewear growth was slower albeit a healthy 16-20%; growth in emerging segments was weak, with Taneira seeing a 4% decline. Among subsidiaries, CaratLane reported a strong ~23% growth, while TEAL’s topline declined ~24% though the ~500bps margin improvement helped restrict the EBIT decline for TEAL. Customer-level growth for the jewelry business was a tad slower at 20% (15% SSG). Among regions, growth was led by the South and East, while weak momentum sustained in the North and West (weakest among all). Macro-led spike in gold price continues to dampen the overall consumer sentiment, though Titan sees this as a short-term challenge as it is targeting high double-digit growth on the back of lower operating disruptions and GoI thrust on boosting consumption. Eyewear/Watch segments grew 16%/20%, led by strong 18% growth in the Analog portfolio for watches (Helios/ Fastrack/ Sonata) and International brands/Sunglasses for Eyewear. TTAN has added 43 Tanishq stores in FY25 and increased its retail space by a healthy ~16%, with a similar run-rate expected in FY26 as well. Despite a weak product mix impacting Titan’s gross-margin, the adjusted Jewelry EBIT margin decline was restricted to a mere ~20bps in Q4 (vs 100bps in Q3), offset by better overhead management/hedging gains. Better margin performance in Watches, Eyewear, CaratLane, and TEAL helped improve consol EBIT margin by ~20bps to 10.6% in Q4.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH0000003