Buy DLF Ltd For Target Rs.954 by Motilal Oswal Financial Services Ltd

Strong pre-sales; all eyes on super luxury - ‘The Dahlias’

FY25 pre-sales guidance exceeded; strong pipeline

* DLF reported pre-sales of INR121b in 3QFY25, up 34% YoY/17x QoQ (2.4x our estimate; exceeds FY25 pre-sales guidance). This strong performance was backed by healthy sales from its super-luxury project, ‘The Dahlias,’ which recorded pre-sales of INR118b (98%). DLF sold 173 units with a total area of 1.85msf at an average realization of INR0.7b/residence. By 9MFY25, the company exceeded its full-year pre-sales guidance. Hence, we now estimate FY25 pre-sales to increase to INR238b (previously INR181b).

* The launch pipeline for FY25 has further increased by INR31b to INR441b, which is INR146b higher than the initial guidance of INR295b announced in 3QFY24. The pipeline beyond FY25 now stands at INR704b vs. INR635b in 2QFY25.

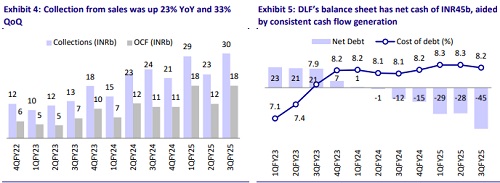

* Cash flow performance: Collections improved significantly by 23% YoY/31% QoQ to INR31b. Consequently, OCF jumped 67% YoY/53% QoQ to INR19b. The net cash position stood at INR45b vs. INR28b in 2QFY25. We estimate FY25 net cash flow from operations at INR56b (previously INR63b) due to the one-off impact of tax indemnity of INR9b for JV in FY25 (o/w INR3b charged to P&L in 3QFY25 and the remaining to be charged in 4Q).

* P&L performance: In 3QFY25, revenue came in at INR15.3b, flat YoY/down 23% QoQ (10% below estimate). EBITDA dipped 22% YoY/20% QoQ to INR4.0b (13% above estimate), while margin stood at 26% (flat QoQ; 5pp above estimate). PAT stood at INR16.3b, up 149% YoY/18% QoQ (103% above estimate, including the reversal of deferred tax liabilities or DTL), while adj. PAT (excl. DTL) was INR10.6b, up 61% YoY/37% QoQ (32% beat). In 4QFY25, although we estimate EBITDA of INR4b, DLF is estimated to report a net loss of INR9.9b due to the impact of DTL reversal and one-off tax indemnity in 2Q and 3QFY25. Excluding these impacts, PAT in 4QFY25 would be at INR7b.

* In 9MFY25, revenue came in at INR48.7b, up 13% YoY. EBITDA decreased 17% YoY to INR11.3b, with a lower margin of 23% (9pp below 9MFY24). PAT was INR36.6b, up 103% YoY (including reversal of DTL), while adj. PAT (excl. DTL) was INR24.8b, up 37% YoY.

DCCDL: Healthy growth; Debt to GAV declines 1% to 22% (down 11% from FY21)

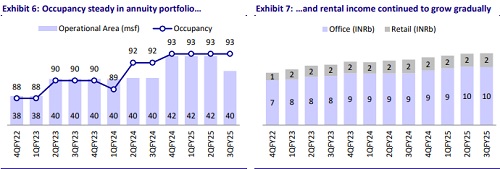

* Rental income in DCCDL’s commercial portfolio grew 10%/9% YoY for Office/Retail. Total revenue stood at INR16.1b, up 9% YoY. EBITDA stood at INR12.4b, up 10% YoY.

* Occupancy across non-SEZ/SEZ portfolios rose 1% to 98%/87%. The retail portfolio was almost fully leased with 98% occupancy, except for City Centre CHD (unchanged as of Q2FY25).

* Further, 14msf is under construction across its existing assets in Gurugram and Chennai.

Valuation and view: Growth trajectory intact

* DLF continues to enhance its growth visibility as it replenishes its launches with its existing vast land reserves. However, our assumption of a 12-13-year monetization timeline for its remaining 160msf of land bank (including TOD potential) adequately incorporates this growth.

* We have added “The Dahlias” now in operational projects and excluded from land. With this, we increase our pre-sales estimates by INR51b to INR238b for FY25 (previously at INR181b), considering the impressive bookings from “The Dahlias” in 3Q.

* DLF (Devco and DLF commercial) business is valued at INR1,731b, wherein land contributes INR1,304b. DCCDL is valued at INR708b. Gross NAV comes out to be INR2,439b, which, after net debt of INR78bn (incl. DCCDL), comes out to be INR2,361b. We maintain BUY with a revised TP of INR954 (earlier INR925).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412