Buy Sun Pharma Target Rs.2,160by Motilal Oswal Financial Services Ltd

Domestic formulations/EM/ROW drive earnings growth

Delay in clinical trials further reduces the budget for FY25 R&D spending

* Sun Pharmaceutical Industries (SUNP) exhibited in-line 3QFY25 performance, adjusted for USD45m milestone income received for its global specialty products. Domestic formulations (DF), EM, and ROW exhibited robust traction, which drove 21% YoY growth in earnings for 3QFY25.

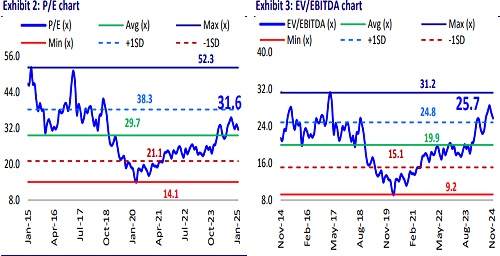

* We largely maintain our estimates for FY25/FY26/FY27. We value SUNP at 33x 12M forward earnings to arrive at our TP of INR2,160.

* Strong traction in the global specialty portfolio and industry outperformance in the branded generics segment across key markets have enabled significant gross margin expansion of 500bp to ~79% over FY21-9MFY25. With increased MR presence as well as strong marketing efforts, we expect SUNP to deliver 17% YoY growth in earnings over FY25-27.

* While a delay in R&D projects is improving near-term profitability, faster implementation of R&D projects is a must for a sustainable global specialty engine of growth. Reiterate BUY.

Better product mix drives EBITDA margin on a YoY basis

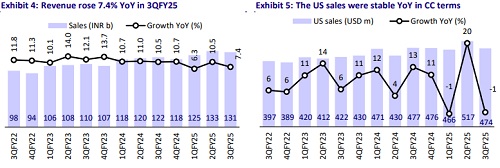

* SUNP’s sales grew 7.4% YoY, excluding the milestone income of USD45m to INR130.6b (vs. our est of INR133.8b). DF sales grew 13.8% YoY to INR43b (32% of sales). The US sales remained flat YoY to INR40b (USD474m, flat YoY in CC terms; 30% of sales). EM sales grew 12% YoY to INR23.4b (17% of sales). ROW sales grew 23% YoY to INR21.8b (16% of sales).

* Global specialty sales stood at USD325m (excluding one-time milestone income), up 17.5% YoY for 3QFY25.

* Gross margin expanded 150bp YoY to 79.6% for the quarter.

* EBITDA margin expanded 160bp to 27.4% (vs. our est. of 26.9%) led by better GM and lower other expenses (down 20bp as a % of sales).

* Accordingly, EBITDA grew at 14.2% YoY to INR35.7b for the quarter (vs. our est. of INR36).

* After adjusting the forex gain, one-off expenses, and milestone income (USD45m) of INR1.2b the Adj. PAT grew 21% YoY to INR30b (vs. our est. of INR29.6b) for the quarter.

* In 9MFY25, revenue/EBITDA/PAT grew 9%/21%/23% YoY to INR392b/ INR112b/INR88b

Highlights from the management commentary

* SUNP has reduced its guidance for R&D spending to sub-7% from 7-8% earlier. This is the second revision in R&D guidance by SUNP, due to further delay in clinical trials related to certain products in FY25.

* SUNP witnessed lower sales of g-Revlimid on a QoQ basis.

* The trial related to Leqselvi is expected to start in Apr’25.

* Specialty R&D formed about 41% of total R&D spend for the quarter.

* SUNP launched 12 products in DF in 3QFY25. SUNP remains focused on new introductions, which will be one of the growth drivers for the DF market.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412