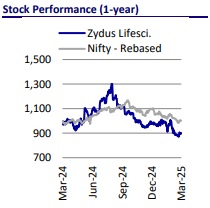

Neutral Zydus Lifescience Ltd For Target Rs. 950 by Motilal Oswal Financial Services Ltd

Gears up for expansion into medtech through Amplitude

* Zydus Lifesciences has entered into exclusive negotiations to acquire Amplitude Surgical, extending its scope of business in the medtech segment.

* Amplitude delivered 5% YoY growth in sales for six months ending in Dec’24, with EBITDA margin of 25.4%. The acquisition would be at 4x EV/12M sales and 15.7x EV/12M EBITDA.

* The acquisition is a part of Zydus’ priority verticals in the medtech segment to build its global presence.

* Zydus is enhancing its existing growth levers such as a) differentiated product pipeline/manufacturing for US generics, b) day-1 launches/next generation drug delivery platforms for India market, and c) niche product pipeline in biosimilar, vaccine and NCE segments. Zydus is further adding growth levers in its medtech segment (cardiology, nephrology, orthopaedics). However, considering stable earnings over FY25-27, we maintain Neutral rating on the stock.

Amplitude – In-house R&D/manufacturing/marketing/distribution company

* Amplitude is a leading French company for lower-limb orthopaedics. It develops and markets high-end products for orthopedic surgery covering the main disorders affecting the hip, knee and extremities, and notably foot and ankle surgery.

* Amplitude’s revenue has been stable at EUR106m and EBITDA posted a 5% CAGR to EUR27m over the past five years ending in Jun’24. Over the past six months, it delivered 5% YoY growth in revenue to EUR51m with EBITDA of EUR13.8m.

* Amplitude’s 60% of revenue comes from knee-related products and 33% from hip-related products.

* Its assets include a manufacturing plant (60-65% utilization) and an international logistics center.

Transaction to be completed by Jun’25

* Zydus will acquire a 100% stake in Amplitude for a cash consideration of EURO300m (INR28.5b), comprising a block acquisition of an 85.6% stake at EUR6.25 per equity share (EURO256.8m) and the remaining 14.6% stake at EURO6.25 per equity share (EURO43.2m) after the completion of the block acquisition.

* It is expected that the block acquisition would be completed and the offer would be filed with the French market authority (AMF) by June’25.

* The said transaction is done at an EV/EBITDA of 15.7x of 12M EBITDA.

* The acquisition will be funded through a mix of internal accruals and external financing.

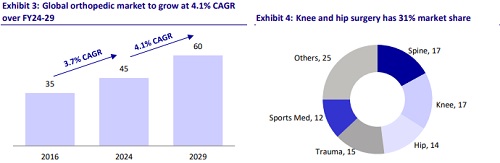

Global Orthopaedics – Decent market size with concentrated market share

* Orthopaedics is a USD45b market globally, which has clocked a 3.7% CAGR over FY16-24.

* Of the total orthopaedics market, knees and hips represent ~31% market share.

* Going ahead, the global orthopedics market is expected to see a 4.1% CAGR to USD60b over FY24-30, driven by technological advancements, a demographic shift, an increase in healthcare expenditures, and a regulatory landscape promoting innovation and quality.

Aims to establish global presence in other key segments in med-tech

* Cardiology (product launches, inorganic opportunities): Zydus plans to build a presence in interventional cardiology. It has acquired a manufacturing facility of Nano Therapeutics in 2024, located at Surat, Gujarat. It plans to expand its portfolio through new launches and partnerships.

* Nephrology (product pipeline): Zydus plans to focus on the nephrology segment to address the growing burden of chronic kidney diseases globally and establish a dialyzer manufacturing plant to produce high-end membranes.

Valuation and view

* ZYDUSLIF continues to work on limited-competition products such as gPalbociclib and g-riociguat to improve its outlook over FY25-28.

* It is working on a few NDA drugs that are in various stages of clinical trials, viz. CUTX101, Saroglitazar with PBC indication, Unsoflast, and a few other drugs, which would drive growth over FY26-27.

* Apart from these products, Zydus has a pipeline of 25 products (incl 3 ADCs) in the biosimilar segment, as well as 20+ vaccine products across platforms.

* Further, Zydus is expanding its scope of business in the medtech space, specifically in cardiology, nephrology and orthopaedics.

* Amplitude provides foundation through a presence in product development, manufacturing and distribution.

* While medtech ventures would play out over the medium to long term, we expect earnings to remain stable over FY25-27 due to competitive pressures in g-Revlmid and efforts to enhance the product pipeline. Maintain Neutral on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

Ltd.jpg)