Buy SRF Ltd for the Target Rs. 3,500 by Motilal Oswal Financial Services Ltd

Chemicals segment resilient and continues to grow

Operating performance above our estimates

* SRF posted a strong overall performance in 4QFY25, with its EBIT rising 53% YoY, led by a 3.2x/50% YoY surge in packaging film/chemical businesses.

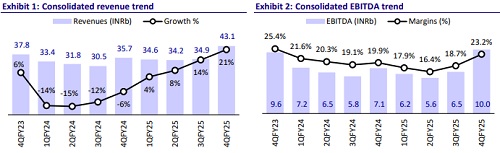

* Despite macroeconomic headwinds due to rising geopolitical tensions, SRF remained resilient and improved its performance in 2HFY25, with revenue/ EBITDA/Adj. PAT surging 20%/41%/30% YoY in 4QFY25.

* We earlier upgraded the stock following its 3QFY25 results, fueled by an anticipated demand recovery in the specialty chemical business and strong traction in the fluorochemicals business. We expect this momentum to sustain going forward. Management has also guided a healthy 20%+ growth in the chemicals business, with EBIT margin in the range of 25-26% (+/- 2%), indicating a strong momentum for FY26.

* We broadly maintain our FY26/FY27 EBITDA estimates and reiterate our BUY rating, valuing the stock on an SoTP basis to arrive at our TP of INR3,500.

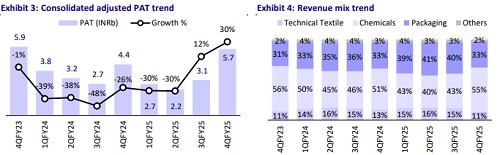

Margin improvements in Chemicals and Packaging drive performance

* SRF reported an overall revenue of INR43b (in line) in 4QFY25, up ~21% YoY. EBITDA margin expanded 330bp YoY to 23.2% (est. of 21.4%). EBITDA stood at INR10b (est. of INR8.9b), up 41% YoY. Adj. PAT grew 30% YoY to INR5.7b (est. of INR4.7b), adjusted for a forex loss of INR451m in 4QFY25.

* Chemicals' revenue (55%/83% of total sales/EBIT in 4QFY25) grew 30% YoY to INR23.5b, while EBIT grew 50% YoY to INR7.4b. EBIT margin expanded 440bp YoY to 31.8%. The specialty chemicals business demonstrated strong performance, driven by positive momentum in recently launched products and a pick-up in demand for certain key agrochemical intermediates, while the fluorochemicals business reported higher volumes and realizations.

* Packaging film's revenue (33%/12% of total sales/EBIT in 4QFY25) grew 19% YoY to INR14.1b, while EBIT grew 3.2x YoY to INR1b. Margin expanded 460bp YoY to 7.4%. The packaging films business witnessed healthy growth driven by higher volumes and realizations for both BOPP and BOPET, with margin expansion fueled by the ramping up of value-added products.

* Technical textiles' revenue (11%/4% of total sales/EBIT in 4QFY25) was down 2% YoY to INR4.5b. EBIT dipped 43% YoY to INR401m. EBIT margin contracted 600bp YoY to 8.7%. The technical textiles business underperformed because of continued weak demand and margins in belting fabrics.

Highlights from the management commentary

* Chemicals business: Management is targeting over 20% revenue growth in FY26, with 2HFY26 expected to outperform 1HFY26 due to seasonality factors. The company is aiming for >INR110b revenue over the next three years. Further, the overall chemical business’s EBIT margin is projected to be in the range of ~25-26% (+/- 2%) in FY26

* Packaging business: The Board approved the establishment of a new BOPP PE film line in Indore, with an investment of INR4.45b and an additional 50-55 KPTA of new capacity. Going forward, the company will continue to focus on increasing the sales of high-impact VAP.

* Capex: For FY26, the company has plans to incur a capex of ~INR22b-23b, with the possibility of an increase during the year. SRF witnessed a 30% rise in overall capacity by taking up small debottlenecking activity over the last 18 months.

Valuation and view

* The chemicals business (fluorochemicals and specialty chemicals) is expected to continue the growth momentum in FY26, led by a strong order book in the specialty business and ramp-up of export volumes, coupled with growth in PTFE within the fluorochemicals business. The packaging business is experiencing improvement in the near term, led by increasing focus on high-impact VAPs.

* We build in revenue/EBITDA/Adj. PAT CAGR of 18%/32%/46% over FY25-27E. We broadly maintain our estimates and reiterate our BUY rating, valuing the stock on an SoTP basis to arrive at our TP of INR3,500

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412