Sell MRF Ltd for the Target Rs. 121,162 by Motilal Oswal Financial Services Ltd

Margins improve due to low input costs

Demand to accelerate in 2HFY25, fueled by the GST rate cuts

* MRF’s 2QFY26 PAT at INR5.1b was in line with our estimate. While the EBITDA margin at 15% was ahead of our estimate of 14.2% due to lower input costs, revenue came in below our estimate due to a temporary GST-led destocking impact on distributors.

* Following the recent rally, the stock currently trades at 32.5x/27.6x FY26E/ FY27E EPS above its 10-year LPA of ~25x, which appears expensive when compared to peers. Hence, we reiterate our Sell rating on the stock with a TP of INR121,162 (valuing it at 20x Sep’27E EPS).

PAT below our estimate due to margin pressure

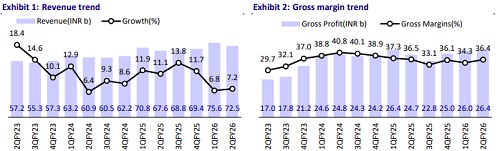

* The company’s standalone revenue grew 7% YoY (-4% QoQ) to INR72.5b, below our estimate of INR75.7b.

* Sales are lower in 2Q due to seasonality. However, OE sales continued to have strong double-digit growth. Exports also performed well despite tariff issues. Towards the second half of 2QFY26, the GST cuts had a temporary impact on replacement sales, although a reduction in GST augurs well for the industry in the coming quarters.

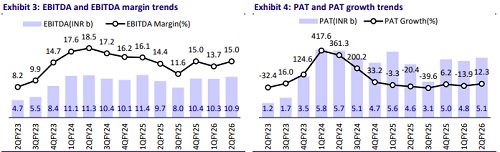

* MRF’s gross margin at 36.4% was above our estimate of 35% due to reduced input costs. Gross margins were largely flat YoY but up 200bp QoQ. This in turn led to a higher-than-estimated EBITDA margin at 15%, up ~60bp YoY (vs. our estimate of 14.2%).

* MRF’s EBITDA grew 12% YoY and 5% QoQ to INR10.9b (vs. our estimate of INR 10.7b).

* As a result, PAT was up 12% YoY to INR5.1b (vs. our estimate of INR5b).

* The Board declared an interim dividend of INR3 per share.

Valuation and view

* MRF’s competitive positioning in the sector has weakened over the past few years, which is reflected in the dilution of its pricing power in the PCR and TBR segments. MRF is likely to continue to focus on recovering its lost share across segments. This is anticipated to limit margin upside, even in a falling input cost scenario. Overall, we expect MRF to post 13% earnings CAGR over FY25-28.

* Following the recent rally, the stock currently trades at 32.5x/27.6x FY26E/ FY27E EPS above its 10-year LPA of ~25x, which appears expensive when compared to peers. Hence, we reiterate our Sell rating on the stock with a TP of INR121,162 (valuing it at 20x Sep’27E EPS).

* Dilution in competitive positioning: MRF’s leadership across major segments of T&B, 2Ws, and PCR had led to the creation of a strong brand and pricing power. However, aggressive competition in the recent past has dethroned MRF from the top spot in PCR and T&B and has resulted in an overall market share loss. Peers have started focusing on better-margin segments like 2Ws and PVs, resulting in the dilution of MRF’s competitive positioning.

* Return ratios to remain under pressure: We expect a ~9% revenue CAGR over FY25-28E, led by stable OE demand and expected recovery in the replacement segment. MRF is likely to continue to focus on recovering its lost share across segments. This is likely to limit margin upside, even in a declining input cost scenario. We expect margins to inch up over our forecast period. Overall, we expect MRF to post 13% earnings CAGR over FY25-28E. We expect MRF’s return ratios to remain stable at lower levels: expect RoE at 11% by FY28E.

* Steep valuations do not factor in changing competitive dynamics; reiterate Sell: Following the recent rally, the stock currently trades at 32.5x/27.6x FY26E/ FY27E EPS above its 10-year LPA of ~25x, which appears expensive when compared to peers. Hence, we reiterate our Sell rating on the stock with a TP of INR121,162 (valuing it at 20x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412