Buy HDFC Bank Ltd for the Target Rs. 1,175 by Motilal Oswal Financial Services Ltd

Steady quarter; margin decline controlled at 8bp QoQ

Asset quality remains robust

* HDFC Bank (HDFCB) reported 2QFY26 profit at INR186.4b, up 11% YoY (11% beat), led by healthy NII and robust other income.

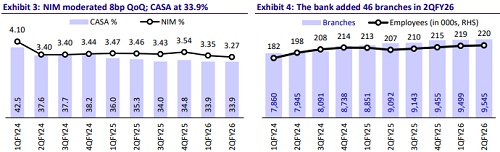

* NII grew 5% YoY to INR 315.5b (in line). Margins on total assets declined 8bp QoQ to 3.27% (est. 3.24%).

* Other income stood at INR143.5b (16% beat, 25% YoY growth), led by treasury gains of INR23.9b (INR2.9b in 2QFY25).

* Provisions grew 29.6% YoY to INR35b (8% higher than MOFSLe). The bank has made additional contingent provisions of INR15b and general provisions of INR7b in 2QFY26.

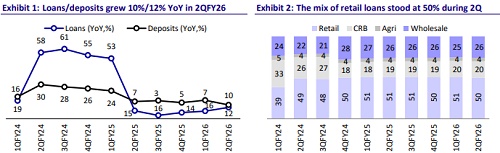

* Advances book grew 10% YoY/4.5% QoQ to INR27.5t. Deposits grew 12.1% YoY/1% QoQ to INR28t. CASA ratio stood at 33.9%, while CD ratio increased to ~98%.

* Fresh slippages stood at INR74b (INR63b ex-agri). GNPA/NNPA ratios improved by 16bp/5bp QoQ to 1.24%/0.42%. PCR was broadly stable at 66.6%.

* We fine-tune our earnings estimates for FY27 and expect HDFCB to deliver FY27E RoA/RoE of 1.84%/14.3%. Reiterate BUY with a TP of INR1,175 (2.7x FY27E ABV + INR137 for subs).

Growth outlook turning stronger; Core credit cost well in control

* Profit grew 11% YoY to INR186.4b (11% beat). NII rose 5% YoY to INR315.5b (in line). Margins on total assets declined 8bp QoQ to 3.27%.

* Other income stood at INR143.5b (16% beat, 25% YoY growth), led by treasury gains of INR23.9b (INR2.9b in 2QFY25).

* Opex grew 6% YoY to INR179.8b (in line). C/I ratio for the quarter stood at 39.2%. PPoP was INR279.2b (13% YoY growth, 10% beat), while provisioning expenses stood at INR35b (est.: INR32.3b).

* Loan book grew by a healthy 10% YoY/4.5% QoQ. Agri grew 7% QoQ, while corporate grew 4.7% QoQ. Business banking grew 4.1% QoQ. Deposits rose 12.1% YoY/1.4% QoQ. CASA ratio stood at 33.9%, while CD ratio increased to ~98%. The bank aims to grow advances higher than system in FY27.

* Fresh slippages stood at INR74b (INR63b ex-agri). GNPA/NNPA ratios improved by 16bp/5bp QoQ to 1.24%/0.42%. PCR declined 24bp QoQ to 66.6%.

* Recoveries increased to INR68b (vs. INR42b in 1QFY26) as there was a 10bp benefit due to an NPA, which was upgraded in 2Q. Credit cost stood at 51bp.

* Subsidiary performance: HDB Financial reported loan growth of 13% YoY/ 1.9% QoQ to INR1114b, while PAT stood at INR5.8b. GS3 assets stood at 2.81%, while CAR was 21.8%. HDFC Securities: Revenue grew 23% YoY to INR7b, while PAT rose 33% YoY to INR2.1b.

Highlights from the management commentary

* Loan growth is expected to grow faster than system growth in FY27. LDR will come below 90% mark in the medium term.

* The bank tends to have a slightly longer duration, especially on the retail side, and therefore, tailwinds on costs would last a little longer.

* In gold loan, yields have been pretty rich given that it is a fully collateralized product. HDFCB has been growing this in a steady manner and will continue that but will remain cautious.

* It is now selling home loan products from wider distribution than it used to do before the merger. HDFCB has also brought down the turnaround time.

Valuation and view: Reiterate BUY with a TP of INR1,175

HDFCB posted a steady quarter with an earnings beat, aided by healthy NII and robust treasury gains. NIMs moderated 8bp QoQ and are expected to pick up going forward. Loan growth has started gaining traction, which led the CD ratio to increase to 98%; however, management expects this to reduce below 90% in the medium term. Slippages moderated, while recoveries were healthy, enabling a decline in core credit cost. HDFCB made additional contingency provisions of INR15b and maintained its floating provisions of INR214b, taking the total such provisions to INR381b (1.4% of loans). The gradual retirement of high-cost borrowings, along with an improvement in operating leverage and the provision buffer, will support return ratios over the coming years. We fine-tune our earnings estimates for FY27 and estimate HDFCB to deliver FY27E RoA/RoE of 1.84%/14.3%. Reiterate BUY with a TP of INR1,175 (2.7x FY27E ABV + INR137 for subs).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)