Buy Mankind Pharma Ltd For Target Rs.3,050 by Motilal Oswal Financial Services Ltd

Operationally in-line; outshines industry in chronic category

Course correction impact/BSV integration – Medium-term monitorables

* Mankind Pharma (Mankind) delivered in-line operational performance for 3QFY25. The earnings were below estimates due to higher interest outgo on debt raised to fund the BSV acquisition. While Mankind continues to deliver industry-beating growth in chronic therapies, regulatory headwinds in certain products and course corrections across the prescription (Rx) business affected the DF segment. Interestingly, the strategic reset has driven a healthy 30% YoY growth in the consumer health segment.

* We reduce the earnings estimate by 10%/6%/3% for FY25/FY26/FY27, factoring in: a) higher interest outgo, b) course correction to gradually revive growth prospects, and c) industry-level challenges in acute therapies. We value Mankind at 45x 12M forward earnings to arrive at a TP of INR3,050.

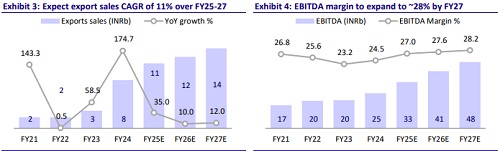

* Mankind’s focus on a differentiated portfolio, comprising: a) prescription products (including the recently acquired BSV), b) consumer wellness, and c) exports, positions the company for robust growth over the next 4-5 years. Consistent marketing efforts to support niche offerings, along with capital allocation to add unique growth levers, are expected to drive 20% earnings CAGR over FY25-27. Additionally, it is subject to lesser earnings volatility compared to companies focusing on US generics. Reiterate BUY.

Ex-BSV, DF revenue up 7% YoY/organic EBITDA up 32% YoY for 3QFY25

* Sales grew 23.9% YoY to INR32.3b for the quarter (vs est. of INR33.6b), while the Domestic business (86% of sales) grew 15.5% YoY to INR27.7b. The Prescription business (Rx) (93% of domestic sales) grew 14.6% YoY to INR25.8b, partly led by the BSV addition. The Consumer business (7% of domestic sales) grew 30% YoY to INR1.9b. Export (14% of sales) grew 121% YoY to INR4.6b, aided by new launches and BSV addition.

* Gross margin expanded 280bp to 71% due to a change in the product mix and a decline in RM prices.

* Adjusted for a one-time M&A spend, the EBITDA margin expanded 430bp YoY to 27.7%, led by higher gross margins/lower other expenses (-180bp YoY).

* Consequently, EBITDA grew 47.5% YoY to INR8.9b (vs est. INR9.2b). Excluding BSV, organic EBITDA grew 32% YoY for the quarter.

* However, Adj. PAT declined 5.2% YoY to INR4.3b (vs est. INR5.7b) due to the higher interest outgo for the quarter.

* Revenue/EBITDA/PAT in 9MFY25 grew 17%/27%/14.7% to INR92b/INR24.7b/INR16.5b.

Highlights from the management commentary

* Mankind has implemented measures such as optimizing doctor coverage and making leadership changes at the divisional level to improve prospects in the Rx business.

* The organic growth in Rx/exports was 7.4%/43% YoY for 3QFY25.

* Regulatory tailwinds related to emergency contraceptives and an antiinfective drug impacted acute therapy growth by ~0.5% YoY for 3QFY25.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)