Buy JSW Energy Ltd For Target Rs.770 by Motilal Oswal Financial Services Ltd

Weak merchant spreads mar 3Q; core story intact

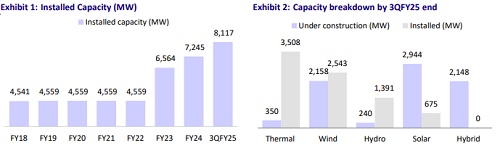

* JSWE's 3QFY25 EBITDA declined 18% YoY to INR9.1b (est. INR12.7b), dragged down by lower merchant spreads (INR2.6b impact) and high other opex due to the start of nearly 0.9GW in capacity since 3QFY24. Net generation was up 10% YoY, helped by the start of 377MW wind capacity and the continued ramp-up at Ind Barath. JSWE management has maintained its guidance of achieving 10GW in operational capacity by FY25 end. JSWE remains hopeful of consummating both the KSK Mahanadi and O2 Power acquisitions by 2QFY26. The total pipeline (organic + inorganic) now stands at ~28GW.

* Considering the weak 3QFY25 financial performance, we lower our FY25 adjusted PAT by ~5%. However, we believe the core story remains intact and the company is on track to nearly double its capacity to ~14GW by Jun’25 (assuming KSK Mahanadi and O2 Power acquisitions are consummated). We maintain our BUY rating with a revised TP of INR770.

EBITDA miss amid lower merchant spreads

* Consolidated:

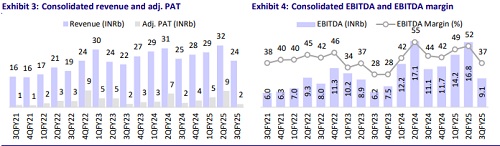

* JSWE reported 3Q consolidated revenue of INR24b (-4% YoY), which was 20% below our estimate of INR30.5b as incremental revenue from new RE capacity and Utkal Unit-1 was offset by lower short-term thermal realizations and a reduced tariff at the hydro plant due to a change in depreciation policy.

* EBITDA came in at INR9b (-18% YoY), which was 28% lower than our estimate due to lower short-term spreads.

* Adjusted 3QFY25 PAT was 56% below our estimate at INR1.6b (-27% YoY) mainly due to higher finance costs and lower other income.

* The commissioning of 377MW of incremental wind capacity occurred during the lean season and partly operational in 3QFY25, leading to higher capitalization, increased finance costs, and depreciation expenses.

* Receivables on DSO basis came in at 96 days.

* The company's operational capacity stands at 8GW. The project pipeline (entirely RE) stands at 14.2GW, with PPA yet to be signed for 6.7GW.

* Standalone:

* JSW Energy reported standalone 3QFY25 PAT of INR2.8b (-13% YoY and +24% QoQ).

* Revenue dipped 23% YoY to INR9.7b. EBITDA margin stood at 31%+, with EBITDA of INR3b (-40% YoY, +22% QoQ).

* Operational:

* The company commissioned 377MW of wind capacity, further expanding its renewable energy portfolio.

* It reported a 10% YoY increase in net generation to 6.8BUs. This growth was primarily driven wind capacity additions, enhanced hydro generation, and an increase in thermal generation from Utkal Unit-1.

* RE generation increased by 18% YoY in 3QFY25 to 1.6BUs due to wind and hydro generation, which surged YoY by 38% and 14%, respectively.

* Additionally, long-term PPA generation rose 7% YoY.

3QFY25 highlights:

* Financial Performance

* 3QFY25 revenue remained flat. EBITDA declined 18% YoY to INR11b, impacted by higher costs and depreciation. PAT fell 27% YoY to INR1.68b.

* Net debt stood at INR265b, with cash and cash equivalents of INR50b.

* Capex in 9MFY25 was INR62b. The FY25 capex target is revised to INR100b from INR150b. Receivables stood at INR25b (96 days of sales).

* Operational Highlights

* 377 MW of wind capacity added in 3QFY25. The company is constructing 7.8GW with PPAs, while 3.9GW awaits PPA agreements.

* Thermal PLF stood at 72%.

* It is on track to achieve 14GW operational capacity by Jun’25, targeting 20GW by 2030.

* Key Acquisitions

* O2 Power: Acquired 4.7GW assets for INR124b (2.3GW operational by Jun’25) with a blended tariff of INR3.7/unit and EBITDA of INR15b.

* Hetero Group: Acquired assets with a blended tariff of INR5.22/unit and a 15- year plant life.

* KSK Mahanadi: LoI for 3.6GW thermal capacity (1.8GW operational, 1.8GW near completion), offering cost benefits over greenfield projects.

Valuation and view

* The valuation of JSWE is based on SoTP:

* Thermal being valued at 10x FY27E EBITDA and renewable energy at 15x FY27E EBITDA (FY28E EBITDA discounted by 1 yr)

* Hydro at 3x FY27E book value and green hydrogen equity at a 2x multiple

* Additionally, the company's stake in JSW Steel is valued at a 25% discount to the current market price, acknowledging the strategic significance of this holding while incorporating a conservative valuation approach.

* By aggregating the values from these different components, the total equity value of JSWE was determined, leading to a TP of INR770/share.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

Ltd ( 1 ).jpg)