Neutral Infosys Ltd for the Target Rs.1,750 by Motilal Oswal Financial Services Ltd

Encouraging start, unchanged backdrop

Outlook for FY26E improves, despite cut to organic guidance

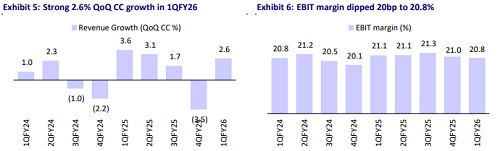

* Infosys (INFO) reported 1QFY26 revenue of USD4.9b, up 2.6% QoQ in CC/ 3.8% YoY in CC vs. our estimate of +1.5% QoQ in CC. EBIT margin stood at 20.8% vs. our estimate of 20.9%. EBIT increased 2.6% QoQ/6.2% YoY to INR88b (est. INR87b). PAT came in at INR69b, up 1.7% QoQ/8.7% YoY, above our estimate of INR66b.

* Management upgraded the lower end of its FY26 CC revenue growth guidance from 0% to 1%, now expecting growth in the 1–3% range. Large deal TCV stood at USD3.8b, up 46% QoQ. The book-to-bill ratio was 0.8x. Net new TCV was up 50% QoQ. For 1QFY26, revenue/EBIT/PAT grew 7.5%/6.2%/1.7% YoY in INR terms. We expect INFO’s revenue/EBIT/PAT to grow 7.1%/9.7%/11.0% YoY in 2QFY26. The company’s work in Enterprise AI has been promising, but near-term catalysts remain limited. We reiterate our NEUTRAL rating on INFO with a TP of INR1,750, implying an 11% potential upside.

Our view: Macro concerns still in play

* Organic growth outlook slightly better despite optics of a cut: While the organic revenue guidance was cut at the upper end by 40bp, the actual performance trajectory has improved. Earlier, we assumed 2% CC growth for FY26E; however, INFO could potentially deliver 2.5% organic growth now, on the back of a stronger 1H.

* Lower pass-through revenue a positive: FY26 will see a decline in thirdparty (pass-through) revenues, which is a growth headwind but encouragingly points to newer deal wins with lower third-party content, implying better margins.

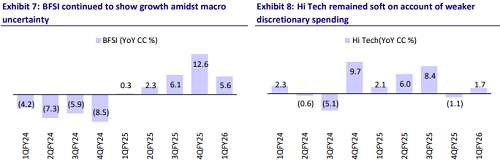

* Macro commentary still subdued: Despite the strong 1Q, INFO continues to see a wait-and-watch posture among clients, with no material improvement in discretionary budgets or decision cycles. Tariff uncertainties and geopolitical tensions continue to weigh on sentiment. Management stated that the macro environment remains unchanged vs. 4Q, which was a key reason for the cautious stance on guidance.

* Sequential margin outlook better, but AI productivity gains may create headwinds: INFO’s EBIT margin in 1Q came in at 20.8%, down 20bp QoQ— impacted by 100bp headwind from compensation hikes and variable pay, 30bp from currency, and 20bp from increased S&M. This was partly offset by a 70bp benefit from realization (Project Maximus + seasonality) and 60bp from lower amortization and third-party costs. While 2Q onwards should see tailwinds from realization, lower third-party, and stable comp costs, productivity-led AI programs may be leading to price compression and margin pressures across the industry.

Valuation and changes to our estimates

* Despite an upgrade to the lower end of the guidance, management remained cautious of discretionary spending and no material improvement from clients. INFO’s work in Enterprise AI has been promising, but near-term catalysts remain limited. Our estimates are unchanged. We value INFO at 24x FY27E EPS. This yields a rounded TP of INR1,750, implying an 11% potential upside. We reiterate our NEUTRAL rating on the stock.

Beat on revenue and deal wins up 46% QoQ; the bottom end of FY26 guidance upgraded

* INFO’s revenue in USD terms increased 4.5% QoQ to USD4.9b. In CC, it was up 2.6% QoQ, above our estimate of 1.5% QoQ. Growth for the quarter was not led by pass-through (the pass-through revenue was down QoQ).

* The company guided for FY26E CC revenue growth between 1% and 3% and upgraded the lower end of guidance from 0% to 1%.

* In 1QFY26, growth was broad-based across most verticals – BFSI/ Communications was up 2.6%/7.1%, Manufacturing/Energy also reported growth of 9.3%/5.8%, while Hi-Tech declined 1.8% QoQ.

* EBIT margin was at 20.8%, in line with our estimate of 20.9%. EBIT margin guidance was maintained in the 20-22% range.

* PAT was down 1.5% QoQ /up 8.7% YoY at INR69b (above our est. of INR66b). ? Employee count was flat QoQ and stood at 323,788.

* The large deal TCV stood at USD 3.8b, up 46% QoQ. The book-to-bill ratio was 0.8x for the quarter.

* LTM attrition was up 30bp QoQ at 14.4%. Utilization improved 30bp QoQ to 85.2% from 84.9% in 4QY25 (ex-trainees).

Key highlights from the management commentary

* The company has seen some impact in logistics, consumer products, and manufacturing, but has also benefited from its work in AI and consolidation.

* AI, digital transformation, and cloud are expected to drive future growth. The company believes it can further scale its work in Enterprise AI, potentially opening additional revenue streams.

* While logistics, consumer, and manufacturing sectors are being impacted by changing economic conditions, clients continue to prioritize cost and operational efficiency, even if not directly affected by macro headwinds.

* 1HFY26 is expected to be stronger than 2H due to seasonality and near-term visibility.

* Deal wins are broad-based across consolidation, transformation, and AI. The company remains well-positioned with clients.

* Growth was supported by pricing increases, volume expansion, and acquisitions. As utilization is near peak, future volume growth will require additional hiring.

* FY26 CC revenue growth guidance has been raised to 1-3%, with the lower end increased from 0% to 1%.

* Project Maximus continues to deliver benefits. However, headwinds from fixed costs in growth areas and transitions in large deals will play out during the year.

Valuation and view

* Despite an upgrade to the lower end of the guidance, management remained cautious of discretionary spending and no material improvement from clients. INFO’s work in Enterprise AI has been promising, but near-term catalysts remain limited. Our estimates are unchanged. We value INFO at 24x FY27E EPS. This yields a rounded TP of INR1,750, implying an 11% potential upside. We reiterate our NEUTRAL rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)