Neutral Gujarat State Petronet Ltd for the Target Rs. 356 by Motilal Oswal Financial Services Ltd

Lower transmission volumes mar 4Q performance

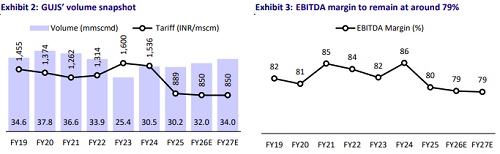

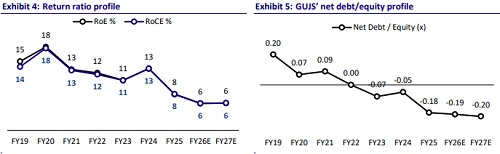

* Gujarat State Petronet’s (GUJS) reported 4QFY25 EBITDA came in 30% below our estimates, primarily due to weak volumes, which stood at 25.8mmscmd. Demand remained subdued, particularly from the fertilizer and CGD segments. The implied tariff was INR 847/mmscm. Net profit was further impacted by lower other income and a higher effective tax rate.

* During 4QFY25, overall gas-based power demand remained weak. Additionally, volume offtake from key refinery-petchem customers declined QoQ. The sharp rise in finance costs was due to a one-time adjustment related to a change in security deposit accounting, with no actual cash outflow involved. The QoQ rise in other expenses was primarily driven by INR250m in CSR expenditure. Going forward, GUJS plans to make quarterly CSR provisions.

* Following the weak 4Q performance, with volumes averaging ~26mmscmd, we have cut our volume assumption for FY26/27 by 9%/6% to 32/34mmscmd. Now, we estimate GUJS to post a 6% volume CAGR over FY25-27. Further, we maintain our tariff assumption of INR850/mmscm for FY26/27.

* Under the scheme of amalgamation and arrangement announced in Sep’24, GSPC, GUJS, and GEL will amalgamate with GUJGA, and the swap ratio for GUJS was fixed at 10:13 (i.e. 10 shares of GUJGA, at an FV of INR2, will be issued for every 13 equity shares of GUJS, at an FV of INR10). The scheme is expected to be completed by Sep’25/Oct’25. Based on this swap ratio, we derive our TP of INR356/share for GUJS. We reiterate our Neutral rating on the stock.

Weak 4Q performance

* GUJS’ 4QFY25 revenue missed our estimate by 12% and stood at INR2b.

* Total volumes came in 11% below our estimate at 25.8mmscmd (-23% YoY, - 11% QoQ).

* Tariff came in line with our estimate at INR847/mmscm.

* EBITDA came in 30% below estimate at INR1.2b, as other expenses came in higher than expected.

* While CGD volumes were flat YoY, volumes from power, fertilizer, refineriespetrochemicals, and other segments declined 22-65% YoY.

* Interest expense also came in significantly above our estimate.

* 4QFY25 PAT came in 47% below our estimate at INR0.7b (-73% YoY), on account of higher tax rates and lower-than-estimated other income.

* In FY25, revenue/EBITDA/PAT declined 42%/46%/37% YoY to INR10b/INR8b/INR8b.

* The Board has recommended a dividend of INR5 per share.

Valuation and view

* The available LNG capacity in Gujarat is expected to grow 55% to 42.5mmtpa over the next two years. Most of this volume is likely to flow through GUJS’ network. We believe the company will post a 6% CAGR in transmission volumes over FY25-27.

* We expect volumes to rise to ~34mmscmd in FY27, as GUJS stands to benefit from: a) the upcoming LNG terminals in Gujarat, and b) improved demand driven by an increased focus on reducing industrial pollution (Gujarat has five geographical areas identified as severely/critically polluted).

* Based on the announced share swap ratio of 10:13 (GUJS: GUJGA), we arrive at our TP of INR356. We reiterate our Neutral rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412