Neutral MCX Ltd for the Target Rs. 10,700 by Motilal Oswal Financial Services Ltd

Healthy participation and product launches driving growth

* MCX’s operating revenue came in at INR3.7b in 2QFY26, up 31% YoY (in line). For 1HFY26, revenue rose 44%, to INR7.5b.

* Total expenses jumped 23% YoY to INR1.3b, with staff costs up 37% YoY and other expenses up 17% YoY. EBITDA stood at INR2.4b, up 36% YoY in 2Q (in line). For 1H, EBITDA rose 56% to INR4.9b.

* 2Q PAT of ~INR2b was up 29% YoY (in line). 1H PAT rose 51%, to INR4b.

* MCX introduced several new products, including Silver (30kg) and Silver Mini (5kg) monthly expiry contracts, Cardamom Futures, and Nickel Futures, and Options on the MCX iCOMDEX Bullion Index (MCX BULLDEX), covering both Gold and Silver. These launches have witnessed healthy traction, and management indicated that the product pipeline remains robust with necessary regulatory approvals already in place.

* We have raised our EPS estimates for FY26/FY27/FY28 by 21%/27%/18%, factoring in strong volume growth in Sep-Oct’25. We reiterate a Neutral rating on the stock with a one-year TP of INR10,700 (premised on 40x Sep’27E EPS).

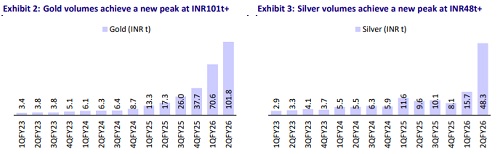

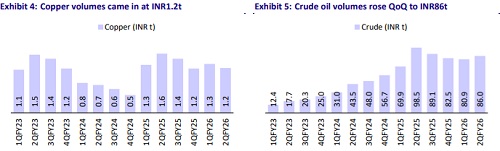

Volumes at all-time high

* Transaction fee for 2Q stood at ~INR3.2b, up 27% YoY, comprising options and futures in the ratio of 68:32 (vs. 2QFY25 at INR2.5b in the ratio of 70:30).

* Overall ADT was up 87% YoY at INR4.1t, largely driven by 91%/55% YoY growth in Options Notional ADT/Futures ADT to INR3.7t/INR417.6b.

* Options notional ADT surged 91% YoY to INR3.7t, largely supported by 700%/95% YoY growth in bullion/base metal contracts, while energy contracts remained flat YoY. Options premium ADT rose 25% YoY to ~INR41b, with 356%/3% YoY rise in bullion and energy contracts.

* Futures ADT rose 55% YoY to INR417.6b, fueled by 82%/21% YoY growth in bullion/energy contracts, while base metal futures volumes declined 32% YoY.

* MCX continues to dominate the commodity futures market with 98.9% share as of 1HFY26, with 100%/99.4%/100%/100%/1.3% share in precious metals/energy/base metals/index futures/agri commodities.

* Other income at INR266m grew 5% YoY but dipped 19% QoQ.

* Total expenses jumped 23% YoY to INR1.3b, with CIR at 34.9% vs. 37.2% in 2QFY25 and 35.2% in 1QFY26. Staff costs rose 37% YoY to INR448m, while other expenses were up 17% YoY at INR858m, including mainly software charges/computer tech costs/contribution to SGF, which rose 10%/8%/56% YoY to INR231m/INR188m/INR268m.

* Client participation increased 16% YoY, with traded clients at 0.79m0.64m in options and 0.27m in futures—reflecting growth across all participant categories (participation mix being futures: options at 54.84%:42%)

* The number of UCCs at the end of 2QFY26 stood at 36.7m compared to 28.9m in 2QFY25 and 34.7m in 1QFY26.

Key takeaways from the management commentary

* Domestic mutual funds and AIFs exhibited strong participation, while PMS participation is yet to gain similar momentum. The exchange added 17 new members during the year and maintains a healthy pipeline of prospective members currently under engagement.

* Weekly options remain under evaluation, with no confirmed launch timeline. The exchange continues to assess feasibility, regulatory considerations, and market dynamics for potential offerings across both equity and commodity derivatives. Co-location facilities remain restricted by regulators, with no visibility on approval in the near term.

* On Oct’25, a technical issue led to a temporary shift of operations to the disaster recovery (DR) site. Disruption was caused by a predefined parameter limit within gateway services, which has since been rectified. Normal operations have resumed at the primary site. Exchange continues to engage with SEBI, though no penal action has been taken to date.

Valuation and view

* Sep-Oct’25 saw record volumes for bullion contracts given the surge in process. We expect normalization in bullion contract volumes and have factored in a decline of ~30% in Nov’25, followed by a modest recovery with ~1% MoM growth. For other commodities we factor in 1% MoM growth until Mar’28. We have not built any major contribution from electricity or index contracts. Our monthly transaction revenue forecast for Mar’28 still is lower than Oct’25.

* We have raised our EPS estimates for FY26/FY27/FY28 by 21%/27%/18%, given stronger volume growth observed in Sep-Oct’25. We reiterate a Neutral rating on the stock with a one-year TP of INR10,700 (premised on 40x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)