Buy TCS Ltd for the Target Rs. 3,500 by Motilal Oswal Financial Services Ltd

Brave new world?

Too early to assess the data center foray; core growth still modest

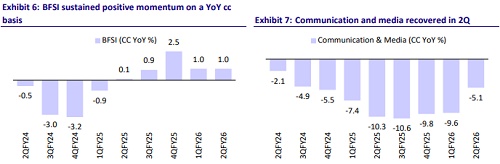

* TCS reported revenue of USD7.5b in 2QFY26, up 0.8% QoQ in CC terms vs. our estimate of 1.0%. Growth was led by the Life Science and Healthcare vertical (up 3.4% QoQ CC). Technology & Services/Manufacturing/BFSI grew 1.8%/1.6%/1.1% QoQ CC. TCS will incorporate a wholly-owned subsidiary to build a 1GW capacity AI data center in India (current datacenter capacity in India: 1GW). EBIT margin was 25.2% (up 70bp QoQ), above our estimate of 24.3%. Adj. PAT rose 1.1% QoQ/8.4% YoY at INR130b (above our estimate of INR126b).

* For 1HFY26, revenue/EBIT/PAT grew 1.9%/3.8%/3.7% YoY in INR terms compared to 1HFY25. We expect revenue/EBIT/PAT to grow by 5.8%/7.8%/7.5% YoY in 2HFY26. TCS reported a deal TCV of USD10b, up 16.3% YoY. The book-to-bill ratio was stable at 1.3x.

* While management expects FY26 growth to be better than FY25, we believe this guidance is somewhat fuzzy. Regarding the data center announcement, we await clarity on the capital structure, capex schedule, and other details such as potential rentals and signed MOUs. At present, we do not model data center investments or related revenue into our forecasts. Valuations are undemanding, and we reiterate our BUY rating on TCS with a TP of INR3,500, implying a 15% potential upside.

Our view: Core services backdrop remains unchanged

* Entry into the data center space: TCS reported revenue of USD7.5b in 2QFY26, up 0.8% QoQ in CC terms vs. our estimate of 1.0%. What stood out, however, was its foray into colocation data centers in India.

* Revenue growth was above consensus estimates across verticals and geographies (barring UK and Consumer), and TCV remained strong at USD10b. That said, the demand environment remains constrained, and there is no change in client behavior.

* While management expects FY26 growth to be better than FY25, we believe this guidance is somewhat fuzzy. The international business declined ~1% in CC (+0.7% in USD by our estimates) in 1HFY26. Even assuming a 1% CQGR in 2H, we estimate FY26 international growth at ~2.5% in USD terms. This implies only ~0.5-0.8% CC growth, indicating no material improvement over FY25.

* Adjusted EBIT margins delivered a notable beat this quarter, supported by currency and pyramid rationalization. However, we expect margins to remain range-bound over the next couple of quarters, as the BSNL ramp-up (we model it between 3Q and 4Q), wage hikes, and furloughs are likely to offset efficiency gains.

Data center foray: 1GW data center to be built over 5-7 years

* TCS has announced the formation of its new subsidiary to build a localized data center business in India. Along with partners, it plans to invest USD5-7b over the next 5-7 years to develop up to 1GW capacity. This will be structured as a colocation facility, where clients (hyperscalers, AI-native companies, Indian enterprises, and the government) bring in their own compute and storage.

* TCS will provide only passive infrastructure. Capex will be phased (~USD1b per 150MW), funded through a mix of equity, debt, and external finance partners. Initial revenue is expected within 18-24 months.

How to view this:

* Passive Model: TCS will not run cloud workloads or provide managed cloud services; the data center will function as a sovereign colocation site. This means low technology intensity, limited overlap with TCS’s core services portfolio, and hence minimal direct synergies.

* Adjacency Play: Management highlighted unmet demand—India has ~1.2GW installed capacity today vs 10x potential demand in 5-6 years, with only 5-6GW committed. TCS sees this as a stable annuity-like revenue pool and an adjacency to strengthen partnerships with hyperscalers and AI-native players.

* Return Profile: ROE at the subsidiary level will be lower than TCS’s >50% group ROE, given the capital-intensive nature. However, management guided that at the consolidated level, it will not be margin-dilutive, as external partners will share funding.

* Strategic Rationale: This is best viewed as cash deployment rather than a services-led growth driver. The move underlines TCS’s intent to expand in the AI infrastructure layer. Still, integration with its mainstream IT services remains unclear.

* We await clarity on the capital structure, schedule of capex, and other details such as potential rentals and signed MOUs. At present, we do not model data center investments or related revenue into our forecasts. We do some back-ofthe-envelope calculations to estimate the capex schedule (assuming Debt/Equity of 2:1 for now; Exhibit 2).

Valuations and changes to our estimates

* Over FY26-28, we expect a CAGR of ~4.2% in USD revenue and ~4.9% in INR EPS.

* While management expects FY26 growth to be better than FY25, we believe this guidance is somewhat fuzzy. Even assuming a 1% CQGR in H2, we estimate FY26 international growth at ~2.5% in USD terms. This indicates no incremental growth over FY25.

* We have maintained our estimates for FY26/27/28, as we do not forecast revenue or investments from the DC business until we get further clarity. Valuations are undemanding, and our TP of INR3,500 implies 23x Jun’27EPS with a 15% upside potential. We reiterate our BUY rating.

In-line revenue (beat on consensus) and beat on margins; TCV deal wins at USD10b

* USD revenue came in at USD7.5b; up 0.8% QoQ in CC terms vs. our estimate of 1.0% growth (beat on consensus estimate of 0.4% QoQ cc).

* In terms of geographies, India grew 4% QoQ CC, and International revenue grew 0.6% QoQ CC.

* 2Q growth was led by the Life Science and Healthcare (up 3.4% QoQ CC). Technology & services/Manufacturing/BFSI grew 1.8%/1.6%/1.1% QoQ CC.

* TCS will incorporate a wholly-owned subsidiary to build a 1GW AI data center in India (current datacenter capacity in India: 1GW).

* EBIT margin was 25.2% (up 70bp QoQ), above our estimate of 24.3%.

* TCS reported a deal TCV of USD10b in 2QFY26, up 6.4%/16.3% QoQ/YoY.

* Adj. PAT rose 1.1%/8.4% QoQ/YoY to INR130b (above our est. of INR126b). This excludes one-off restructuring expenses of INR11.3b.

* The net headcount reduced by 19,755 employees to 593,314 (down 3.2% QoQ) in 2QFY26. LTM attrition in IT services was 13.3% vs 13.8% in 1QFY26.

* The Board declared a final dividend of INR11/share in 2QFY26.

Key highlights from the management commentary

* TCS delivered a strong performance despite ongoing challenges, with India maintaining robust growth.

* Sales momentum remained strong across industries and markets during the quarter.

* Project deferrals have reduced compared to the previous quarter.

* IT service spending remains stable with no major change expected through FY26, as clients maintain tight discretionary budgets and prioritize vendor consolidation.

* TCS announced a strategic investment in AI data center infrastructure, planning to build 1GW capacity over the next 5-7 years in tranches, accelerating in line with demand.

* Around 150MW capacity will entail USD1b investment, funded through a mix of equity and debt. Initial revenue is expected in 18-24 months, with operations following a co-location model.

* Growth in the international business is expected to outpace both domestic growth and last year’s 70bp CC increase.

* Furloughs are expected to remain similar to last year.

* Redundancy-related costs will continue through the year, impacting the next two quarters.

Valuation and view

* While management expects FY26 growth to be better than FY25, we believe this guidance is somewhat fuzzy.

* We have maintained our estimates for FY26/27/FY28, as we do not forecast revenue or investments from the DC business. Valuations are undemanding, and our TP of INR3,500 implies 23x Jun’27 EPS with a 16% upside potential. We reiterate our BUY rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412