Add Mahindra & Mahindra Ltd For Target Rs. 4,157 By InCred Equities

Tractor biz impressive, automotive stable

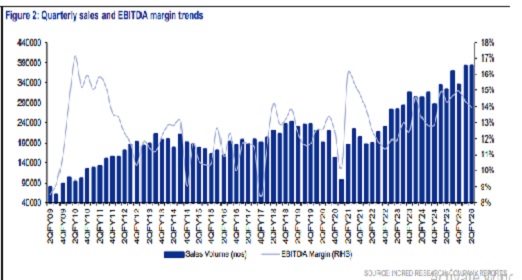

* 2QFY26 EBITDA growth of 17% yoy was driven by tractors, while the automotive biz was flattish. Missed estimate by 3%, adjusted for PLI benefit.

* Management raises tractor industry volume growth outlook to early doubledigits. Retain FY26F EBITDA estimate, with a 4% yoy rise in 2H.

* Strong sales volume momentum supports the rich forward P/E valuation of +3SD. Maintain ADD rating on the stock with a target price of Rs4,157.

PLI benefit boosts automotive biz, while tractor growth impressive

* Net sales of Mahindra & Mahindra (M&M) in 2QFY26 rose by 21% yoy but fell 3% qoq to Rs332bn post adjustment of Rs2.33bn PLI benefit, which were 3% above InCred estimate but 2% below consensus estimate.

* EBITDA rose by17% yoy but declined 5% qoq to Rs.46bn, which was 3% below InCred and Bloomberg consensus estimates.

* The EBIT margin at 8.3% for the automotive segment (-121bp yoy & -61bp qoq) was a drag due to the electric vehicle division, while the farm equipment segment was steady at 19.7%.

* Normalised EPS stood at Rs41, up 21% yoy and 27% qoq, a 10% beat vs. InCred estimate and 16% vs. Bloomberg consensus estimate.

Management conference-call highlights

* Management gave guidance of 10–12% tractor industry growth for FY26F. Export business is likely to see growth as markets such as Sri Lanka, Bangladesh, Nepal, and Algeria have recently reopened.

* Trem-5 emission norms for small tractors are expected with Apr 2026 as the deadline. However, they may get delayed as the industry body has requested for Apr 2028 deadline.

* In passenger vehicles, the company expects mid-to-high double-digit growth in FY26F. During 2Q, volume grew only by 7%, partly due to the Goods and Services Tax cut-led logistic challenges, although Oct 2025 made up for the previous month’s shortfall.

* M&M’s EV penetration stands at 8.7% vs. 7.4% for industry. Revenue market share reached 37.9% in 1HFY26, with the EBITDA margin at 5.3%. Received Rs2.33bn production-linked incentive (PLI) scheme incentive (post-tax) for its XUV 9e model, while the BE 6 model is yet to qualify for PLI benefit.

* Precious metal prices rose, but M&M’s hedging policy limited the impact. Magnet supply covered for 3QFY26 but normalization expected by 4QFY26F.

* GST rate cut on small cars to attract first-time buyers who may upgrade to sports utility vehicles (SUVs) later; lower internal combustion engine (ICE) vehicle prices haven’t affected EV demand yet.

* The light commercial vehicle (LCV) segment reported a 100bp improvement in market share but expects low double-digit growth for the full year.

Above views are of the author and not of the website kindly read disclaimer