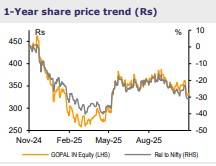

Buy Gopal Snacks Ltd for the Target Rs.500 By Emkay Global Financial Services Ltd

Focus on topline recovery

We hosted the management team of Gopal Snacks, represented by Bipin Hadvani (MD and Promoter), Naveen Gupta (Chief Business Officer), and Rigan Raithatha (Chief Financial officer), for its domestic Non-Deal Roadshow (NDR). Modasa commissioning saw a delay, but is set to help the company recoup 90% of the supply chain ahead; also, with the reinstatement of its Rajkot facility by Q1FY27 (crucial for its Saurashtra market supplies), we see 100% recovery in Gopal’s supply chain. We are confident about the execution ahead and expect the company to see a recovery in sales – competition would be key to watch. The management is looking to maintain its margin and focus on growth acceleration ahead – this panning out well will aid operating leverage, which in turn would support margins. We see Gopal getting back on the growth path from Q3FY26, on a low base. The management refrained from giving guidance ahead, but is looking to sustain YoY sales—a consistent trend since its inception. We maintain BUY on Gopal Snacks with Sep-26E TP of Rs500, as we continue to see sales recovery for the company, with trade interventions.

With Modasa capacity, 90% of the supply chain to normalize from Dec-25

Gopal targets ramping up its Modasa capacity (by Nov-25-end) while addressing the full portfolio, and expects 90% recovery in its supply chain. For the Saurashtra region, supply from Rajkot is crucial and likely to come onstream by Q1FY27. Backed by its Rajkot capacity, Gopal expects logistics to normalize; this is crucial for cost efficiency. As regards its current capacity in Gondal (Gujarat), Gopal is facing storage constraints – this impacts its supply chain. The mgmt has intensified focus on its distributor management system, geotagging of stores, and sales-force automation—all crucial for revenue ramp-up ahead. Modasa commissioning ahead of the festive season would have accelerated sales during Festive, but its delay has led to the mgmt turning cautious on giving sales guidance. Gopal would see a growth rebound from Q3FY26, aided by sales ramp-up and a low base.

Focus on sales over margin

The mgmt expects sales recovery with stable margins. Any raw-material price benefit would help margins; operating leverage too would boost margins. The mgmt sees trade actions in place for driving sales. It is looking to air its national TVC (Exhibits 1-2; to come onstream from Dec-25), which is likely to support the trade-push and, hence, revenue ahead. Dual servicing outlets and thrust in dealer expansion (858 dealers as of Sep-25) are added positives. New product launches have been accretive and are likely to see a push, with sales recovery. Gopal is looking to expand its product offerings, with additions in the bakery segment. The mgmt targets adding scalable+profitable categories that it can manufacture at its own facilities. In the organized channel, Gopal lagged in the QCom fill-rate, albeit witnessed 3x sales improvement (YTD) vs FY25. With improved supplies, the company would enhance thrust in organized channels.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354