Buy Kirloskar Pneumatic Company Ltd for the Target Rs. 1,636 By Prabhudas Liladhar Capital Ltd

Structural growth intact despite short term woes

Quick Pointers:

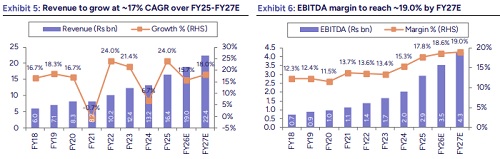

* Management has guided ~18-20% revenue growth in FY26, followed by ~20% revenue growth CAGR over the next few years.

* KKPC continues to gain market share in Air compression, driven by Tezcatlipoca, and Refrigeration compression segments.

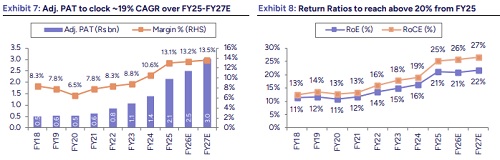

We interacted with the management of Kirloskar Pneumatic Company (KKPC), who reiterated a strong demand outlook for Air and Refrigeration compressors despite subdued order bookings amid finalization delays which is expected to show strong rebound in H2FY26. In the Air compression segment, Tezcatlipoca centrifugal compressors are witnessing strong traction and gaining market share. Refrigeration compressors continue to see robust demand from industrial and commercial end-users, with revenue contribution expected to rise to ~45% (vs ~35% earlier). The Gas compression segment remains subdued, although demand for gas booster packages continues to be healthy. KKPC’s continued new product launches, such as Tyche, are expected to drive the next leg of growth while new initiatives such as RenovAir replacement scheme is expected to pave way for market share gains. Looking ahead, management targets ~20% CAGR in revenues with EBITDA margins scaling up to ~20%, supported by market share gains, new product launches and eventual foray into export markets. The stock is currently trading at a PE of 32.5x/26.9x on FY26/27E. We reiterate our ‘Buy’ rating valuing the stock at a PE of 35x on FY27E (same as earlier), arriving at a TP of Rs1,636 (same as earlier).

KKPC is witnessing strong traction across Air & Refrigeration compression: the indigenous Tezcatlipoca series has crossed ~100 dispatches, with ~30 units booked per quarter and annual sales expected at ~200 units. Covering ~80% of domestic demand, it is the fastest-growing centrifugal compressor in the industry. Refrigeration is set to be the fastest-growing business, lifting its revenue mix to ~45% (vs. ~35% currently), led by Khione screw compressors targeting a ~Rs5.0bn import substitution market and Tyche semi-hermetic compressors addressing a ~Rs30–50bn (~2,000 units annually) opportunity. Gas compression, however, remains weak, with revenue mix expected to fall from ~45% to ~35% as large pipeline orders slow, though booster packages and storage cascades provide steady demand.

Growth is further supported by KKPC’s RenovAir refurbishment scheme, which leverages its ~40,000-unit ammonia compressor base and is now extended to air compressors, including old MNC units. The program is gaining traction, enabling faster adoption and market share gains. Aftermarket services add resilience, contributing ~15% of Air & Refrigeration revenues via rapid-response service and competitively priced spares, and up to ~35% in Gas compression through comprehensive O&M contracts. Together, these initiatives enhance customer stickiness, create recurring revenue streams, and strengthen KKPC’s growth visibility alongside its new product launches.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)