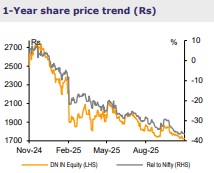

Reeduce Deepak Nitrite Ltd for the Target Rs.1,800 By Emkay Global Financial Services Ltd

Uncertain macros keep realizations under pressure

Deepak Nitrate (DN)’s Q2FY26 EBITDA at Rs1.9bn (down 37% YoY; up 9% QoQ) was in line with consensus/our estimates. The AI segment’s uncertain operating environment was defined by sharp pricing pressures (better traction to be seen in H2 for select intermediates). DN launched 7 new products in Q2. The phenolics business fared better sequentially owing to better product mix and reduced feedstock prices. Current environment remains challenging, and we expect gradual recovery in the AI segment from Q4, though phenolics segment spreads remain under pressure. The management expects projects worth Rs20bn to commission over Mar-26 to Jun-26. It expects to spend Rs15bn in FY26 (Rs6.6bn spent in H1) and plans to incur capex of Rs30-40bn in FY27/28, to set up an integrated phenol-BPA-polycarbonate plant. We trim our EBITDA estimate for FY27/28 by 1-3%; REDUCE with unchanged TP of Rs1,800.

Advanced intermediates business saw sharp pricing pressure

Revenue of the advanced Intermediates (AI) segment was down 3% YoY/QoQ at Rs5.9bn, on demand headwinds from US tariffs leading to underpriced imports (sodium nitrite, DASDA, nitro aromatics). The mgmt shifted volume to non-core geographies and protected market share and volume. EBIT margin fell to 3.9% in Q2FY26 (7.8% in Q2FY25/5.9% in Q1FY26), on lower pricing leading to operating deleverage. DN was aggressive on cost optimization efforts, which has offset some of the impact. In Q2, the company launched 7 new products in the life sciences, polymer, mining chemicals, etc segments. Ramp-up is expected in FY27 with a fairly limited capex. We expect a gradual recovery in the agchem portfolio from H2, and commissioning of the nitric acid plant.

Phenolics business benefits on reduced feedstock prices

The phenolics segment posted adj revenue of Rs13.2bn (down 9% YoY/2% QoQ), owing to lower pricing compared to last year. Adj EBIT margin improved to 9.7% in Q2FY26 (+192bps QoQ/-514bps YoY), largely due to higher volumes of IPA, favorable mix, and lower feedstock prices. The company expects stable demand trends for its products and some volume growth owing to better productivity/yield in winters. DN recorded government incentive income (GII) of ~Rs164mn in Q2FY26 (Rs337mn in H1). We expect this segment to see a relatively muted volume growth till FY28E.

Commissioning of projects from Q4; Phenol-2 capex revenues to come in FY29

DN commissioned its hydrogenation asset in Sep-25 with investment of ~Rs1.2bn (under DCTL). The mgmt expects commissioning of the nitric acid, MIBK, and MIBC plants in Q4. Later in Q1FY27, it would commission two MPP plants for the AI business. The Oman project would start after 24 months. Capex guidance for FY26 stood at Rs15bn (revised downward to Rs8-10bn in Q1), while FY27/28 capex is likely to be ~Rs30-40bnpa. It expects the new phenol-BPA-polycarbonate plant (worth Rs85-100bn) to commission by Mar-28 (Dec-27 earlier). We expect meaningful revenue to come in FY29 onward.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)