Add Ambuja Cements Ltd For Target Rs. 680 By InCred Equities

Operational beat; maintains outlook

* 2Q consol. EBITDA was ~Rs17.6bn, up ~58% yoy & ~18% above expectations. Blended unit EBITDA/t declined by ~Rs5 qoq to Rs1,061 vs. our Rs914 estimate.

* ACEM to revise target capacity of 140mtpa to 155mtpa by FY28F. Also, add incremental capacity at low cost via debottlenecking. Cost savings to flow in.

* We raise our FY26F-28F EBITDA estimates by ~2-4% to factor in a strong 2Q. Maintain ADD rating with a higher target price of Rs680 (Rs660 earlier).

Strong volume growth; target capacity revised upwards to ~155mtpa

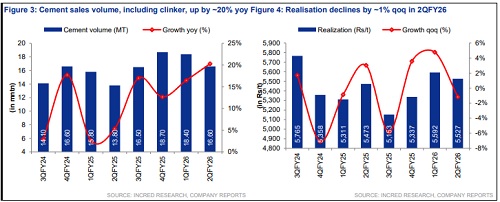

Ambuja Cements (ACEM) reported consolidated cement volume of 16.6mt in 2QFY26, up ~20% yoy and down 10% qoq. Ex-acquired assets, it grew by ~11% yoy (2-2.5x of 4-5% industry growth), and market share expanded to 16.6% vs. 15.5% qoq. Trade share declined by 68% vs. 74% qoq due to seasonally weak demand. Management maintained its guidance to grow in double digits vs. industry growth of 7-8% in FY26F. Blended realisation declined by ~1% qoq to Rs5,527/t, which was better than the industry trend. Go-to-market efforts are driving premium sales (~35% vs. 33% qoq) and improvement in realisation. Current installed cement capacity stands at ~107mtpa and it aims to reach ~118mtpa by FY26F. It has revised target capacity of ~140mtpa to ~155mtpa by FY28F (ref. Fig 11). Incremental capacity to be added by debottlenecking at EV/t ~US$48. ACEM highlighted several more opportunities to add capacity via debottlenecking. ACEM has revised its clinker target from ~84mtpa to ~96mtpa by FY28F to support GU expansion.

Profitability improves; cost savings and synergies gain traction

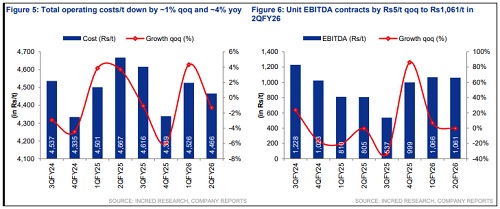

Consolidated EBITDA/t was down by ~Rs5 qoq at Rs1,061/t. During 2Q, total costs/t declined by ~1% qoq and 4% yoy, with group synergies starting to flow in. With a dip of Rs62/t on qoq basis, despite high brand spending and full benefits assumed to flow in from FY27F. Kiln fuel costs stood at Rs1.6/kcal vs. Rs1.59/kcal qoq. In 3QFY26F, ACEM to benefit from higher build-up of coal inventory at lower cost. Primary lead distance was 265km vs. 269km qoq. Total costs/t to reach Rs4,000 by FY26F, Rs3,800 in FY27F and by Rs3,650 in FY28F, with savings from heads like raw material, power and fuel, logistics and other expenses (ref Fig.10). Improving profitability of acquired assets, with faster integration at parent brand levels, to further enhanced consolidated profitability, in our view.

Maintain ADD rating with a higher target price of Rs680

We maintain our ADD rating on ACEM with a higher target price of Rs680 (roll forward to Sep 2026F vs. Jun 2026F earlier), from Rs660 earlier, based on implied consolidated EV/EBITDA of 17.5x (unchanged). Though its current valuation is at a marginal premium vs. long-term median, the premium is to reflect the possibility of a potential rise, and costsaving synergy with group companies. Both Penna & Sanghi consolidation to be completed by the end of FY26F. On the balance sheet, ACEM had a consolidated cash balance of Rs18.13bn vs. Rs30bn in Jun 2025. Minimum targeted capex for every quarter is Rs20bn (Rs80bn annually achievable). Increase in working capital requirement was due to increase in non-trade demand and tactical build-up of inventory to benefit from low coal inventory. Downside risks: Pricing pressure, delay in projects, rise in input costs, and dismal demand growth.

Above views are of the author and not of the website kindly read disclaimer