Neutral Dabur Ltd for the Target Rs. 525 by Motilal Oswal Financial Services Ltd

Execution weakness persists; weak commentary for 2HFY26

* Dabur’s 2QFY26 performance was largely in line with our estimates. Consolidated revenue grew ~5% YoY. India business revenue grew 6% YoY and domestic volume growth stood at 2%. The GST transition and prolonged monsoon weighed on performance during the quarter. The GST transition and trade pipeline adjustments impacted revenue growth by ~3-4%.

* Home & personal care revenue rose 9%, backed by strong performance in oral care, home care, and skin care. The healthcare portfolio remained muted, posting 1% growth. F&B clocked 2% YoY growth, while the food portfolio reported double-digit growth. Beverages were impacted by heavy rainfall. The international business grew 5.5% YoY in cc terms and 7.7% in INR terms.

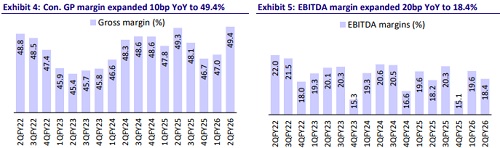

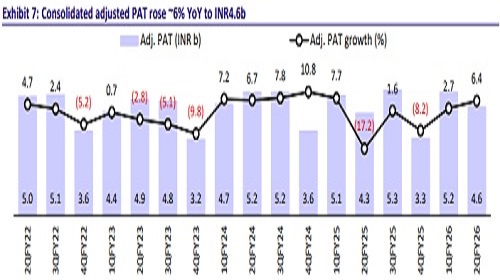

* GM expanded 10bp YoY to 49.4% (est. 48.8%), and EBITDA margin rose 20bp YoY to 18.4% (est: 18.3%). EBITDA grew 6% despite a favorable base (-16% in 2QFY25). Management highlighted that there was ~8% inflation during the quarter, which was mitigated by price hikes of ~4% and costsaving initiatives.

* The company has been witnessing muted sales growth over the past two years, primarily due to weak rural demand and unfavorable seasonal conditions. The performance has become more sluggish since 2QFY25 post channel destocking. Given the GST 2.0 benefits, shift of channel filling in 2HFY26, and expectations of better growth of its winter portfolio (favorable base too), we were expecting a much better 2HFY26 print. However, management commentary remained weak, with expectations of only mid- to high-single-digit revenue growth in 2HFY26, supported by mid-single-digit volume growth. Dabur’s consistent weak execution is limiting our confidence in its growth recovery despite macros turning positive. Given the slower-than-expected turnaround, we lower our valuation multiple from 45x to 40x and downgrade the stock from BUY to Neutral, with a revised TP of INR 525 (40x Sep’27E EPS).

In-line performance; 2% volume growth

* Mid-single digit revenue growth: Dabur’s 2QFY26 consolidated sales grew by 5.4% (inline) to INR31.9b (est. INR32.1b). Indian business revenue grew by 5.7% YoY. Indian business volume growth stood at 2%. (est. 6%).

* HPC business grew 9% YoY: Oral Care grew in double digits YoY. The toothpaste business grew 14%, backed by Dabur Red and Meswak. Skin care grew in high single digits. Home care and hair care grew in mid-single digits.

Healthcare portfolio up 1% YoY: Health supplements grew in mid-single digits, backed by Dabur honey’s double-digit growth (high twenties). Digestives grew in low single digits. OTC & Ethicals decline in mid-single digit due to the discontinuation of the Diaper Baby Super pants and temporary disruption in trade due to the GST transition.

* Foods and beverages grew 2%: Foods portfolio grew in double digits. The 100% Fruit Juice portfolio under the Real Active brand grew by over 45%, while Real Juices’ portfolio was impacted during the quarter on account of heavy rainfalls, floods, and landslides.

* International growth was at 5.5% in CC terms and 7.7% in INR terms.

* Flat margins: Gross margin expanded marginally 10bp YoY to 49.4% (est. 48.8%). Employee expenses rose 3%, ad spends increased 4%, and other expenses rose 8% YoY. EBITDA margin expanded 20bp YoY to 18.4% (est. 18.3%).

* In 1HFY26, net sales, EBITDA, and APAT grew 3%, 4% and 4%, respectively.

Highlights from the management commentary

* For the last six consecutive quarters, rural markets have outperformed urban markets.

* GST rate reductions across nearly 66% of the Indian portfolio are likely to boost consumption in the coming quarters by improving affordability and channel confidence. Currently, 86% of the company’s portfolio falls under the 5% tax bracket.

* Key inflation drivers during the quarter included higher costs of packaging materials (PET, laminates) and certain agri-linked inputs like sugar and honey, leading to a weighted average inflation of ~8%.

* In international markets, key markets such as the UK, Turkey, Bangladesh, Nigeria, and Dubai witnessed healthy performance, while Nepal saw a temporary slowdown due to political disruptions.

Valuation and view

* We cut our EPS estimates by 2% for FY26 and 3% each for FY27 and FY28.

* The company has been witnessing muted sales growth over the past two years. After delivering only 1.3% growth in FY25, revenue growth improved modestly to 3% in 1HFY26, and management is guiding for mid- to high-single-digit growth in 2HFY26, supported by mid-single-digit volume growth.

* We remain positive on consumption recovery, supported by improving macros and GST reforms; however, Dabur’s weak execution is limiting our confidence in the company’s near-term revival.

* Given the slower-than-expected turnaround, we lower our valuation multiple from 45x to 40x and downgrade the stock from BUY to Neutral, with a revised TP of INR 525 (40x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412