Hold J K Cement Ltd For Target Rs. 6,225 By InCred Equities

Scaling organically; stretched valuation

* 2QFY26 consolidated EBITDA stood at ~Rs4.5bn, up ~57% yoy, vs. our expectation of Rs5.1bn. Elevated fixed costs dent profitability.

* JKCE maintained its volume guidance of ~20mtpa for FY26F, with 2HFY26F growth to be moderate on a high base. Confident of its North India position.

* We cut our EBITDA estimates by ~2-3% for FY26F-28F to reflect weak 2Q performance. Maintain HOLD rating with a lower target price of Rs6,225.

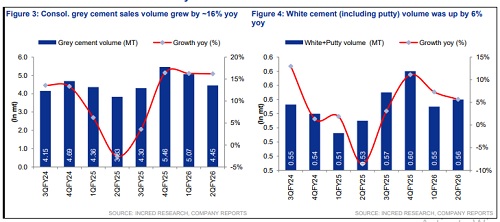

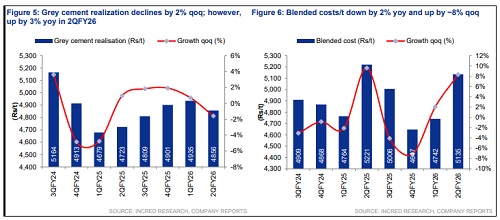

Central, South regions outperform; prices see pressure post GST cut

JK Cement or JKCE’s 2QFY26 grey cement volume grew by ~15% yoy to 5.01mt, with the overall volume being ~7% above expectation, and outperformance in South and Central India. In its core markets, JKCE grew in mid-to-high teens. North India was flattish, at industry growth rate. JKCE reiterated its FY26F grey cement volume guidance of 20mtpa (+10% yoy). The focus is to grow better than industry (7-8%) in FY26F, while maintaining profitability. Saifco’s branding and distribution ramp-up positions it to tap into the ~4mtpa regional market, bridging access to non-trade projects where local players lack scale. Grey cement realisation fell by ~2% qoq due to seasonal weakness and GST rate cut. As per JKCE, post-GST rate cut, some visible pressure on prices was observed across markets.

Fixed costs hit profitability; Rs75-90/t structural savings in FY26F

Blended costs were down by ~2% yoy & up by ~8% qoq at Rs5,135/t. Blended fuel consumption costs stood at Rs1.56/kcal vs. Rs1.53/kcal qoq. Increase in fuel costs was due to higher production of clinker and unavailability of WHRS during the quarter. Other expenses increased due to shutdown of three kilns & higher brand spending; however, they are expected to fall by Rs100/t in the coming quarters. Lead distance to decline by 12-15km after the commissioning of major expansion projects. On its guidance of Rs150- 250/t savings, it expects savings of Rs75-90/t in FY26F and the remaining to flow in FY27F.

Targets ~30mtpa capacity by FY26F; aggressive on capex

JKCE commissioned 1mtpa GU in Prayagraj, while the remaining expansion projects at Panna, Hamirpur, and Bihar to take its capacity to 30mtpa by FY26F. JKCE revised its capex guidance to Rs28bn for FY26F and Rs35bn for FY27F vs. earlier ~Rs20bn/year, due to the expansion announcement. Jaisalmer’s IU capacity to be completed by 1HFY28F. Jaisalmer plant to contribute incrementally to Rs20bn net debt level.

Retain HOLD rating with a lower TP of Rs6,225 amid rich valuation

We like JKCE's presence and fresh expansion into regions having favourable dynamics, but we feel the current EV/t limits further upside in the stock price. We retain our HOLD rating on it and roll forward valuation to the Sep 2026F target price of Rs6,225 (Rs6,550 earlier), set at an EV/EBITDA of 17x. Downside risks: Weak demand, pricing pressure, & delay in commissioning. Upside risks: Strong demand & pricing, sharp deleveraging, & cost control.

Above views are of the author and not of the website kindly read disclaimer