Add Ajanta Pharma Ltd For Target Rs. 3,100 By InCred Equities

Focus on growth over profitability

* The 2QFY26 performance was in line with estimate but missed on the margin front. Margin to be 27% (+/-1%) in FY26F, with an improvement likely in FY27F.

* The US business is likely to post robust growth (+20%) in FY26F. India biz to outperform IPM by at least 20-25%. Africa to see double-digit FY27F growth.

* Our FY26F/27F EPS estimates revised by -2%/-3%, respectively. Maintain ADD rating on the stock with an unchanged target price of Rs3,100.

In-line 2QFY26 growth; disappointment on margin front

Ajanta Pharma’s 2QFY26 performance was steady (14% YoY growth in line with our estimate). However, there was disappointment on the margin front at 24.2% (300bp/260bp lower than our/Bloomberg consensus estimates, respectively) because of lower gross margin (135bp/220bp lower YoY/QoQ), higher employee costs (up 21% YoY), R&D spending (up 11% YoY) and ex-forex loss in the case of other expenses. India business grew by ~12% YoY; however, the cardiology segment continued to underperform the market. As per IQVIA, India growth was 10% vs. IPM growth of 8%. Volume growth was twice the IPM whereas new launches were 39% higher. Company aims to outperform the IPM by at least 20-25% in FY26F. Management has given guidance of 77% gross margin for FY26F (with a 100bp possible variation on either side) and has maintained FY26F margin guidance of 27% (with a 100bp possible variation on either side) – factoring in margin pressure resulting from higher R&D spending (20bp impact), field force addition and higher sales and distribution expenses. We expect margin improvement in FY27F.

US business delivers robust growth

The US business grew by 9% QoQ (US$39m) in 2Q led by new launches (done in 1HFY26) and market share gains in certain products. The current revenue run-rate is likely to continue for the rest of the quarters in FY26F driven by new launches (including Fluvoxamine ER tablets and Oxcarbazepine having the potential to reach a decent size in FY26F), and three-to-four new product launches spread over FY26F. While the African pharmaceutical market is likely to witness moderate growth in FY26F (high base effect), management is optimistic of achieving double-digit growth in FY27F.

Other highlights

a) Current strength of medical representatives (MRs) is 5,680, of which 3,600 are for the domestic market and 2,080 for the export market. b) Looking to add 200 MRs over FY26F27F in the domestic market and 10%/7-8% in the export market in FY26F/27F.

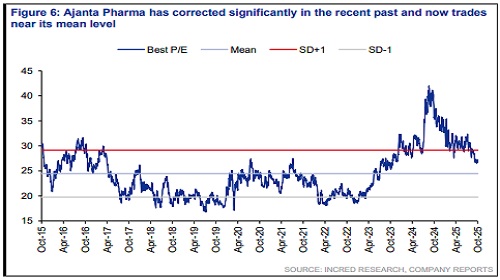

Maintain ADD rating with an unchanged target price of Rs3,100

Our FY26F/27F EPS estimates have been revised by -2%/-3%, respectively. Ajanta Pharma’s large, diversified presence in the branded generics markets of India, Asia and Africa (~70% of revenue) provides revenue stability/visibility and mitigates business risks. We maintain ADD rating on the stock with an unchanged target price of Rs3,100. Downside risk: Slowdown in the branded generics market.

Above views are of the author and not of the website kindly read disclaimer