Buy Sunteck Realty (SRIN IN) Ltd For the Target Rs. 700 By PL Capital- Prabhudas Lilladher

Strong pre-sales aided by Uber luxury projects

Quick Pointers: * Continues to guide pre-sales growth of 25-30% in FY26.

* Collections to improve in coming quarters.

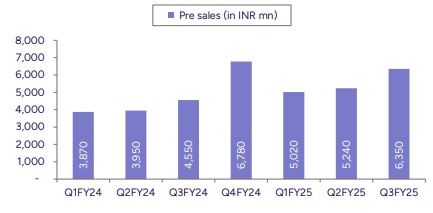

Sunteck Reality (SRIN) reported healthy pre-sales (40% YoY) and steady collections (up 26% QoQ) in Q3. SRIN’s proven ability to market ultra-luxury projects, aggressive and multi-pronged land acquisition capabilities in various micro markets across Mumbai Metropolitan Region (MMR) is an interesting play on Mumbai’s high value real estate market. We expect company’s presales to grow +35% CAGR over FY24-27E aided by ongoing projects and strong new launches pipeline including new Dubai JV project. Further given likely strong cash flow generation and JV with IFC, we see SRIN to step up new project additions which will be a key catalyst for stock performance. Adoption of asset light model has enabled the company to acquire scale without straining its balance sheet. Maintain ‘Buy’ rating with a TP of Rs. 700/share.

BKC projects aided sales momentum: Operationally, SRIN reported EBITDA of Rs 484mn vs Rs 374mn in Q2FY25. Consolidated revenues grew robust by 281% YoY to Rs. 1.6bn. The revenues were aided by BKC projects. PAT came in at Rs. 425mn vs Rs. 346mn QoQ and a loss of Rs. 97mn YoY. During the quarter, the company continued to improve its net cash position by Rs. 20mn to Rs. 610mn.

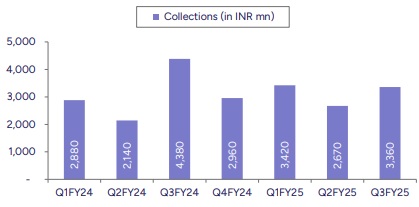

Pre-sales aided by newly launched Nepean Sea Road phase 1 project: SRIN’s presales improved 40% YoY to Rs 6.35bn (up 21% QoQ); aided by newly launched Nepean Sea Road project. Uber luxury projects (3 BKC projects and Nepean Sea Road projects) contributed 66% (Rs 4.2bn) to total pre-sales while high midincome projects (Sunteck City, Beach residencies, Sky Park projects) contributed 19% (Rs. 1.2bn) to total pre-sales. During Q3, average realization increased 106% YoY (104% QoQ) to Rs. 22,615 psf. Collections de-grew by 23% YoY. However, it increased by 26% QoQ to Rs3.4bn and expect to see pick up in coming quarters.

Key con-call takeaways: (1) Pre-sales guidance – Continue to guide 25-30% presales guidance for FY26E.

(2) New launches plan for Q4FY25 and FY26 - Mgmt plans to launch two towers at ODC Goregaon with ~1msf area (GDV of Rs. 30bn), a tower at Beach Residences in Vasai (GDV of Rs. 2.5-3bn), and a tower in Mira Road (GDV of Rs. 6-7bn) in Q4. All projects are at an advanced stage in their approvals process. Subsequent phases and new towers are planned to launch in ODC Goregaon, Naigaon, and Dubai in FY26. Management also intends to launch new projects from Sunteck's existing portfolio, which comprises developments in Bandra, Borivali, and other key locations.

(3) Nepean Sea Road project - encompasses a total area of 0.25-0.27 msf with a GDV of Rs. 54bn. This includes incremental GDV of Rs. 24bn from Nepean Sea Road phase 2 added during Q3.

(4) Annuity project - The commercial project at ODC in Goregaon is slated for completion by FY28.

(5) Collections – Completion of 4th Avenue in ODC and the commencement of construction at Sky-park in Mira Road, coupled with ongoing progress at SBR in Vasai and Crescent Park in Kalyan, are expected to substantially boost collections in coming quarters.

(6) Generated Rs 3.1bn of net operating cash flow for 9MFY25.

(7) Next debt to equity stood at 0.02x in Q3.

Above views are of the author and not of the website kindly read disclaimer