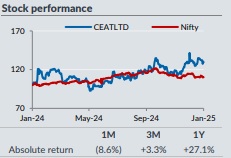

Add CEAT Ltd For Target Rs. 3,651 By Yes Securities Ltd

Margin expansion levers firming up!

View: Favorable product-mix should help cushion NR inflation

CEAT seems well poised to ride the growth wave while prudently navigating the steep RM inflation trends. Demand outlook stays unchanged; high single to early double digit volume growth is likely in FY25E. Going forward, focus on high-margin segments like exports, PCR (high rim sizes) and OHT over TBR (low ROCE biz) to aid volumes and margins. Exports are a key growth lever, led by new SKU launches for PCR, TBR and agri radials in key markets like Europe and US. We expect consistent price hikes, and recent RM basket correction (both NR and brent crude declined by 24%/11% from its recent peak) to support margins from 4QFY25 even though gross margins to stay weak even in 3QFY25. We have built in Revenue/EBITDA/Adj.PAT CAGR of ~13%/12%/10% for FY24-27E, tweaking FY25-26 EPS by 2-3% to account for NR volatility, which is partially offset by a favorable mix. Valuations at 19x/13.6x FY26/17 consol EPS (vs 10yr LPA of ~18.6x) seem reasonable and are yet to reflect the improved positioning. Reiterate ‘ADD’ with TP at Rs3,651 (SoTP).

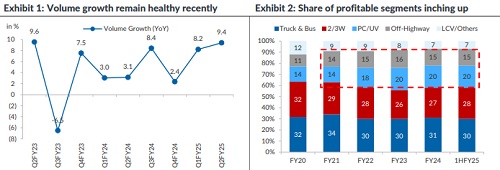

Growth outlook intact, focus on profitable segments - CEAT volumes grew by 7-8% in 1HFY25 (vs ~6% in FY24), led by double digit growth in replacement and exports. It should continue in 2HFY25E as well. Led by new product launch, revenue share from relatively better margin segments such as 2W/3W, OTR, PCR increased to ~63% in 1H (vs 57% from FY20). CEAT is focused on exports and expects the share to move up to ~25% over the medium term (vs ~19% in 1HFY25). It has guided high single-digit volume growth in FY25, based on healthy demand in replacement and export markets. Going forward, focus on high-margin segments like exports (~19% of sales) and OHT should aid volumes and margins.

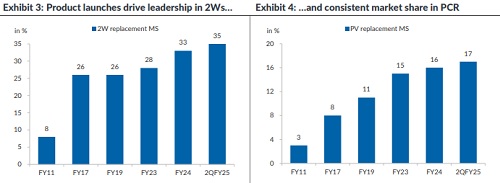

Prompt product actions boost market share for 2W, PCR in the domestic market – Led by new products launches, and distribution & marketing spends, CEAT is consistently gaining market share, especially in 2Ws and PCR. Within 2Ws, it has attained leadership in 2W replacement market: (share of ~35% in 2QFY25 vs ~33%/28%/26%/26%/8% in FY24/FY23/FY19/FY17/FY11 respectively); a gap of ~5% separates CEAT from the second seed player. Within PCR, it is number three (share of ~17% in 2QFY25 vs ~16%/15%/11%/8%/3% in FY24/FY23/FY19/FY17/FY11 respectively). Given new launches, it is targeting second position in PCR by FY25 end. We believe CEAT is well poised to capture current high share of SUVs (~56% OEM) that should reflect in the replacement segment with SKU coverage of 90-95% in PCR replacement.

New SKUs launch and expanded distribution to drive exports – OHT remain the largest target segment, wherein CEAT is expanding capacity to 160MT/day (vs 105MT/day), with ~86 SKUs added in 1HFY25 to 920+ SKUs (vs 750+ in FY23) leading to 84-85% coverage in agri segments (vs ~80% in FY23). Further, recent Camso acquisition should add 750+ SKUs (Our take on Camso's acquisition). Overall, CEAT is likely to maintain healthy SKU launch run-rate going ahead. Besides OHT, it is also focused on PCR (new SKUs launch by 4QFY25 for the US) and TBR though new production line in Chennai in 2QFY25, which will help export ramp up for Europe and US markets. EU, ME, & LATAM are mega exports markets and contribute 2/3rd of exports.

Price hikes & recent NR correction to support margins from 4QFY25 - While margins in 1HFY25 have corrected by ~260bps in 1HFY25 YoY to 11.5% and likely to contract in 3QFY25, we expect 1) Gradual price hikes of 4.5-5% in replacement (ex TBB) and OEM indexation benefit of ~3% in 2Q & ~4% expected in 3Q, 2) Favorable mix led by exports & premiumization and 3) Operating leverage to contribute towards margin expansion. Recent RM basket correction as both NR and brent crude have declined by ~24%/11% from its recent peak should also support margins. We build in ~140bp margins expansion to 12.8% in FY26E (vs ~11.5% expected in 1HFY25). Sustenance of price hikes and NR volatility remain the key thing to watch for margins ahead.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632