Buy ITC Ltd for the Target Rs. 515 by Motilal Oswal Financial Services Ltd

Core business remains healthy; pressure points abate

* ITC continued to deliver a healthy performance in core segments despite a challenging consumption environment. Though margins remained under pressure YoY, sequential improvement was seen. Consol. gross cigarette sales grew 6% YoY (est. 7%), and volume growth was ~6% (vs. est. 6%). The premium cigarette segment continued to outperform. Cigarette EBIT grew by 4.2% YoY (est. 5% YoY). EBIT margin contracted 100bp YoY to 58% (est. 58%), impacted by the inflationary leaf tobacco prices.

* Consol. FMCG segment sales grew 8.5% YoY. Notebooks continued to weigh on business performance, and staple products have seen strong demand growth. Snacks and noodles have seen increased grammage in LUP, while biscuit LUPs have seen price cuts as a temporary measure. EBIT declined 17% YoY, and the EBIT margin contracted 70bp to 7.2% (in line).

* Agribusiness sales declined significantly by 31% YoY (est. 15%), hit by delayed call-offs by customers amid uncertainty due to the US tariffs. EBIT margin expanded by 360bp YoY to 11.2% (est. 7.5%).

* The paper business continued to struggle due to low-priced supplies into global markets (including India), subdued realizations, and elevated wood prices. But performance improved vs. 1QFY26. Revenue grew 5% YoY, while EBIT margin contracted 290bp YoY to 8.2% (est. 7.5%).

* ITC’s core business growth has been steady, with healthy cigarette volume growth. Consistent focus on new launches, stable taxes, and a variety of other initiatives led to 7% cigarette growth in FY25, and the momentum continued in 1HFY26. Cigarette EBIT margin is likely to improve from 4QFY26. FMCG performance was below par in FY25, but with demand experiencing a recovery, we expect improving trends from 2HFY26. The paper business is also bottoming out for growth and margin. We reiterate our BUY rating on ITC with our SoTP-based TP of INR515 (implying 27x Sep’27E P/E).

Cigarette volume up ~6%; FMCG eyes strong growth

* Consolidated performance (ex-hotel business): ITC’s 2QFY26 net revenue declined 2% YoY at INR195b (est. INR216.8b); ex-agribusiness, the sales grew ~8% YoY. Gross margin improved 240bp YoY to 58.3% (est. 55%); the base was hurt by high food inflation and the rise of certain input costs (leaf, wood, etc.). EBITDA margin improved 170bp YoY to 34.3% (est. 31.8%). EBITDA dipped 1% YoY to INR66.9b (est. INR69b). PBT/APAT grew 1%/3%.

* Cigarette volume rises ~6%, with 4% EBIT growth: Consol. gross cigarette sales grew 6% YoY to INR94.1b (est. INR95.4b). Standalone gross cigarette sales grew 6.7% YoY to INR87.2b. Cigarette volume is likely to have grown 6% (est. 6%). EBIT grew by 4.2% YoY to INR54.6b (est. INR55.3b). Cigarette EBIT margin contracted 100bp YoY to 58% (est. 58%). Consumption of highcost leaf tobacco inventory weighed on margins. Procurement prices moderated in the current crop cycle.

* FMCG – Others: Consolidated FMCG-Others sales grew 8.5% YoY to INR60.6b (est. INR60b). Standalone FMCG-Others sales grew 6.9% YoY to INR59.6b, while ex-notebook growth was 8%. Growth was driven by categories such as staples, dairy, premium personal wash & agarbattis. The standalone EBITDA margin compressed 60bp YoY while improving 50bp QoQ to 10%. Consolidated EBIT declined 1% YoY to INR4.4b (est. INR4b) in 2QFY26. EBIT margin contracted 70bp to 7.2% (est. 6.9%).

* Agribusiness sales declined significantly by 31% YoY to INR40b (est. INR67.2b). EBIT grew by 2% YoY to INR4.5b. EBIT margin expanded by 360bp YoY to 11.2% (est. 7.5%).

* The paperboards business sales grew 5% YoY to INR22.2b (est. INR22b). EBIT was down 23% YoY to INR1.8b and EBIT margin dipped 290bp YoY to 8.2% (est. 7.5%).

* FoodTech Business, a key growth area in ITC Next's strategy, combines ITC’s food science, FMCG brands, and culinary expertise to rapidly build a capital-efficient, tech-enabled full-stack platform with ~60 cloud kitchens in five cities currently. GMV crossed INR900m in 1HFY26 (FY25 GMV appx. INR1,050m). ? In 1HFY26, ITC’s revenue/EBITDA/APAT grew 9%/3%/4%.

Valuation and view

* There are no material changes to our EPS estimates for FY26-28.

* ITC’s core business of cigarettes saw steady performance. With stable taxes on cigarettes, we anticipate stable growth in this business. We model a 6% revenue CAGR in FY25-28E.

* We expect supportive macroeconomic factors to act as a catalyst for boosting consumption sentiment. In line with that, we expect FMCG performance to improve in the coming quarters. We model 9% revenue CAGR during FY25-28E.

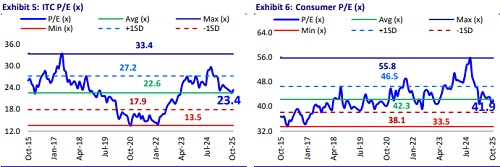

* If ITC sustains mid-single-digit volume growth in the cigarette business and the FMCG business sees a recovery in 2HFY26, we expect a valuation re-rating. We reiterate our BUY rating on ITC with our SoTP-based TP of INR515 (implying 27x Sep’27E P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412