Neutral IndusInd Bank Ltd for the Target Rs. 800 by Motilal Oswal Financial Services Ltd

NII in line; spike in provisions drives losses

NIMs decline 14bp QoQ

* IndusInd Bank (IIB) reported 2QFY26 loss of ~INR4.4b (vs. our estimated profit of INR3.1b), owing to accelerated provisions on MFI and write-offs.

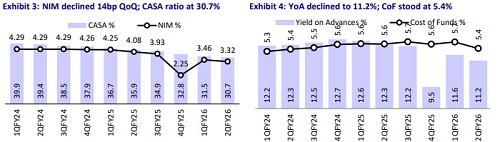

* NII declined 18% YoY to INR44.1b (in line). NIMs stood at 3.32% (down 14bp QoQ /76bp YoY).

* Other income fell 24% YoY to INR16.5b (13% miss). Operating expenses grew 2% YoY/5% QoQ to INR40.1b (8% lower than MOFSLe).

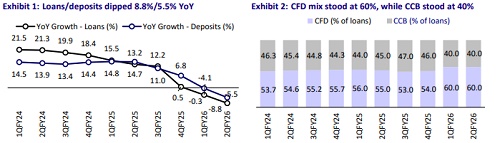

* Loan book declined by 2% QoQ (down 9% YoY), while deposits declined by 2% QoQ (down 5.5% YoY).

* Fresh slippages were INR25.4b vs. INR25.7b in 1QFY26. GNPA/NNPA ratios improved by 4bp/8bp QoQ to 3.6%/1.04%. PCR improved 163bp QoQ to 71.8%.

* We cut our earnings estimates by 20% for FY27 and project IIB’s RoA/RoE at 0.7%/5.8% for FY27. Retain Neutral with a TP of INR800 (premised on 0.9x FY27E ABV).

Business growth muted; PCR ratio improves marginally

* IIB reported 2QFY26 loss of ~INR4.4b (vs. our estimate of INR3.1b profit) mainly due to accelerated provisions on MFI and write-offs.

* NII declined 18% YoY to INR44.1b (in line). NIMs stood at 3.32% (down 14bp QoQ/76bp YoY). MFI slowdown contributed 22bp to NIM contraction.

* Other income dipped 24% YoY to INR16.5b (13% miss) owing to lower treasury income of INR1.1b vs. INR6.3b in 1QFY26. Operating expenses grew 2% YoY/5% QoQ to INR40.1b (8% lower than MOFSLe). C/I ratio increased to 66.2%. PPoP declined 43% YoY/20% QoQto INR20.5b (6% higher than MOFSLe).

* Provisions increased by 45% YoY to IN26.3b (73% higher than MOFSLe, 50% QoQ growth) as the bank made high provisions on MFI.

* Loan book declined 8.8% YoY (down 2.3% QoQ), due to a drop in consumer finance (down 3.2% QoQ). MFI book declined by 25% QoQ. In consumer business, VF segment remained flat QoQ.

* Deposits declined 5.5% YoY (down 2% QoQ), while the CASA book declined 19% YoY/4.2% QoQ. CASA ratio declined 73bp QoQ to 30.7%. Wholesale deposits declined as part of a portfolio rationalization, while retail deposits remained steady, forming 47.3% of total deposits.

* Fresh slippages were INR25.4b vs. INR25.7b in 1QFY26. Asset quality ratios improved marginally, with GNPA/NNPA ratios reducing by 4bp/8bp QoQ to 3.6% /1.04%. PCR improved 163bp QoQ to 71.8%. During the quarter, IIB’s restructured book declined 2bp QoQ to 0.08%.

Highlights from the management commentary

* IIB aims to achieve 1% RoA in the medium term, led by a low cost-to-assets ratio, better productivity, and reduced funding costs through diversification. Management stated it is too early to define a timeline, as a three-year plan is still being developed.

* The bank aims for a fee-to-avg assets ratio of ~1.5% over a period of time.

* Gross slippages: VF – INR6.94b, Corporate – INR640m, Other Retail – INR6.97b, MFI – INR10.83b.

* SMA improved to 26bp (vs. 33bp YoY), while net SR declined to 17bp (vs. 31bp YoY).

Valuation and view

IIB reported a loss due to increased provisions in MFI. Other income was hit by lower treasury income, but opex was lower than our expectations. NIM contracted 14bp QoQ due to a slowdown in MFI loans. Advances growth was muted as the bank strategically slowed down MFI growth. Deposit growth remained subdued as the bank reduced its wholesale deposits as part of a portfolio rationalization, though the CD ratio remained comfortable at 83.6%. Asset quality ratios improved slightly, but management remains cautious regarding MFI. The auditor of Bharat Financial Inclusion (BFIL), a subsidiary of IIB, has given a qualified report related to its investigations on the matter relating to operational losses, but this is not material to the group’s financial results and BFIL is taking corrective actions in this matter. We cut our earnings estimates by 20% for FY27 and project IIB’s RoA/RoE at 0.7%/5.8% for FY27. Retain Neutral with a TP of INR800 (premised on 0.9x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412