Hold Aarti Industries Ltd for the Target Rs. 403 By Prabhudas Liladhar Capital Ltd

Multiple projects set to commission in next one year

Quick Pointers:

* The Calcium Chloride plant will commission this quarter, with the MPP at Zone IV and PEDA project expected online in Q4 FY26 and H1 CY26, respectively.

* Reiterated FY28 EBITDA guidance of Rs18-22bn; debt/EBITDA < 2.5x and ROCE > 15%

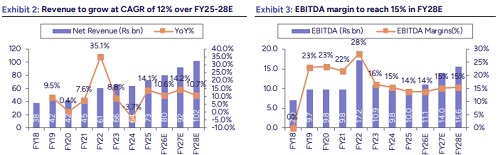

Given the upcoming commissioning of multiple new projects, Reiterate HOLD with a target price of Rs403, valuing the stock at 24x Sep’27E EPS. ARTO reported a topline of Rs21bn, up 29% YoY and 25% QoQ, largely driven by a 65% QoQ increase in MMA volumes. Volumes in the Energy business which largely comprises MMA rose 118% YoY and 48% QoQ, with overall margins expanding by 190 bps YoY, supported by a favorable gasoline–naphtha crack during the quarter. However, Q3 FY26 is expected to see some margin compression as winter season progresses. The Non-Energy business recorded a 17% YoY and 15% QoQ increase in volumes. Agrochemical volumes recovered in select product categories, though margins remained under pressure. Demand growth in dyes and pigments was muted, while U.S. tariffs impacted polymer volumes during the quarter, with pricing pressure persisting across the segment. Management reiterated its EBITDA guidance of Rs18–22bn by FY28, implying a ~30% CAGR over the next three years. The company is pursuing multiple growth initiatives, including MMA debottlenecking, calcium chloride, PEDA, and other projects at Zone IV which are expected to drive growth going ahead. However, impact of U.S. tariffs and margin pressure across much of the product portfolio remain key concerns. The stock is currently trading at 23x Sep’27 P/E. Reiterate ‘HOLD’ rating.

* Revenue increased by 25%QoQ and 29% YoY: Consolidated net revenue stood at Rs21bn, 29% YoY/ 25% QoQ (PLe: Rs20bn, Consensus: Rs19.4bn), Revenue grew YoY and QoQ, driven by higher MMA volumes and the realization of deferred bulk shipments from Q1 in Q2. H1FY26 revenue increased by 8% YoY. Gross margin decreased by 300bps YoY to 34.5% but improved by 150bps sequentially as raw material prices stabilized (vs 37.5% in Q2FY25 and 33% in Q1FY26).

* EBITDAM increased by 190bps YoY: EBITDA increased 48% YoY and 38% QoQ to Rs2.9bn (PLe: Rs2.4bn, Consensus: Rs2.5bn). EBITDAM stood at 13.9% (PLe: 12.2%) as against a margin of 12% in Q2FY25 and 12.6% in Q1FY26, increased both YoY and sequentially by 190bps and 130bps sequentially. PAT stood at Rs1,060mn increased by 108% YoY/ 147% QoQ, sharp increase supported by extraordinary income of Rs220mn related to tax relief as well as negative tax rate. PAT margins were at 5% vs 3.1% & 2.6% in Q2FY25 and Q1FY26 respectively.

* Key concall takeaways: (1) US tariffs impacted volumes for few products. (2) The company entered into an agreement with DCM Shriram for chlorine supply of 200tpd. (3) Rs10bn capex expected in FY26, capex for Q2FY26 was Rs2.7bn. (4) The new multipurpose plant (MPP) in Zone IV is expected to be commissioned in Q4FY26. (5) Calcium Chloride facility is expected to commission in ongoing quarter. (6) PEDA project is expected to start in H1CY26, with a capacity of 4,000mtpa. (7) Capex in FY27 will be significantly lower than Rs10bn. (8The Chloro Toluene project, part of Zone IV expansion, includes five blocks scheduled to start operations in FY27. (9) MMA delivered highest ever quarterly volumes, driven by geographical diversion as well as spillover of Q1 shipments to Q2. (10) Gasoline naphtha cracks were strong during Q2FY26; some compression is expected in Q3FY26. (11) In non-energy business Agrochemicals select products showed volume improvement while pricing remains under pressure. (12) Dyes, pigments and polymers business remained subdued during the quarter. (13) DCB volumes are expected to be strong in H2FY26.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271