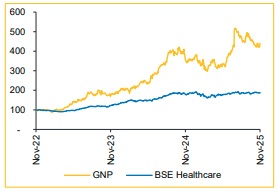

Buy Glenmark Pharmaceuticals Ltd for the Target Rs. 2,235 by Choice Broking Ltd

Underlying Strength Prevails

Glenmark 3.0 Transformation on Track Despite Near-Term Noise

While Q2 results included some one-offs and structural adjustments, the medium-term outlook remains strong, and we believe the company is well positioned for sustained growth and margin expansion. FY26 will be a transition year as India absorbs GST-linked destocking, while the USD 525 Mn ISB revenue recognition will help offset the temporary weakness. FY27 is expected to deliver a strong rebound, driven by the launch of new products across markets and continued portfolio scale-up in the US. Additionally, the USD 70 Mn per year from ISB over the next two years will fully fund IGI’s R&D pipeline, reinforcing margin stability. Management expects EBITDA margin to reach 23% in FY26, with a medium-term outlook of 25%. We believe GNP is entering a new phase of growth, but have incorporated more conservative near-term assumptions for India, resulting in a recalibration of our DCF. Consequently, our target price is revised to INR 2,235 (from INR 2,530), implying a PE of 24x and an attractive PEG of 0.6 (on adj. EPS). Despite the moderation, the core investment thesis remains intact—supported by improving margin, stronger visibility and a robust pipeline. We reiterate our BUY rating.

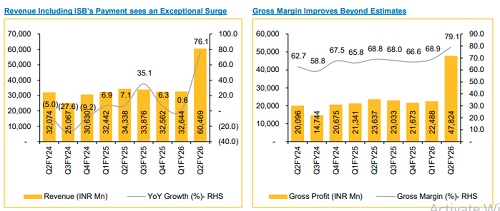

ISB Recognition Triggers Sharp Jump in Quarterly Financials

* Revenue grew 76.1% YoY / 85.2% QoQ to INR 60,469 Mn (vs. CIE estimate: INR 36,377 Mn).

* EBITDA grew 292.0% YoY / 306.5% QoQ to INR 23,595 Mn (vs. CIE estimate: INR 6,621 Mn); margin expanded 2,149 bps YoY / 2,124 bps QoQ to 39.0% (vs. CIE estimate: 18.2%).

* APAT increased 202.3% YoY / 634.4% QoQ to INR 14,844 Mn (vs. CIE estimate: INR 3,807 Mn). This adjusts for destocking-related one-off of INR 13,851 Mn.

* It is to be noted that the exceptional growth seen during the quarter includes the ISB’s revenue recognition of USD 525 Mn.

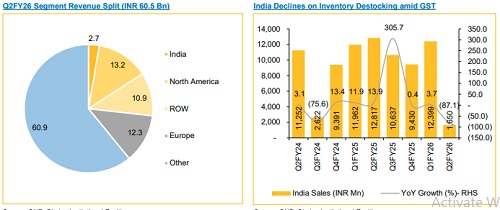

India Revenue Recovery Expected as Inventory Levels Rebuild

GNP reported a sharp decline in India revenue due to inventory destocking across its three-tier retail distribution model following the GST rate announcement. While primary sales were impacted, secondary growth remained robust at 10.8% vs IPM’s 6.4%. Management expects inventory replenishment from Q3 onward, as distributor stocks are currently below threshold levels, and with the new norms now absorbed, no further structural disruptions are anticipated. As per management guidance, quarterly India revenues are expected to reach INR 1,150–1,200 Cr, with FY27 revenues of INR 4,800 Cr. We take a more conservative view, building in a 22% decline for FY26 and a 30% rebound in FY27, implying India revenues of ~INR 4,550 Cr.

Underlying North America Business Stable With Strong FY27 Pipeline

North America reported exceptionally strong growth, driven by the one-time USD 525 Mn ISB 2001 revenue. Excluding this, underlying growth was 7.4% YoY. Over the next two years, an additional USD 70 Mn per year is expected to be recognized; however, this amount will flow through as R&D expense for IGI, rendering the subsidiary fully self-funded and neutral to the consolidated P&L. Looking ahead, organic North America growth is expected to remain robust in FY27, supported by new launches from the Monroe facility and continued strong performance in existing portfolio.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131