Add Karnataka Bank Ltd For Target Rs. 220 By Emkay Global Financial Services Ltd

.jpg)

Leadership void may disrupt retailization thrust; D/g to ADD

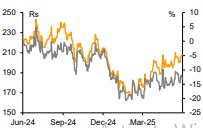

We change our rating to ADD from Buy for Karnataka Bank (KBL) and cut our TP by 15% to Rs220. KBL’s MD and CEO Srikrishnan Hari Hara Sarma (ex-Jio Payments Bank), appointed in Jun-23, and ED Sekhar Rao tendered their resignation and will be relieved effective 15-Jul-25 and 31-Jul-25, respectively. These exits reportedly followed Board-level differences over a Rs15.3mn consultancy spend flagged by auditors in May-25 which exceeded the directors’ delegated authority and was not ratified, making it recoverable from the directors. We believe this could be just another reason for the friction gradually building up between the new management and the Board. Such leadership churns are not uncommon in regional PVBs post management overhauls, with mixed outcomes across peers—some successful (KVB, RBL, Federal, SIB), and others less so (DCB, LVB). We believe the management void would impact KBL’s transformation process, including retailization and hence growth. Factoring this in, we trim earnings by 6-13% over FY26-28E and our target multiple to 0.6x Jun-27E ABV from 0.8x Mar-27E. We however take comfort in KBL’s inexpensive valuations, higher capital levels, and hopes of the Board hiring an external MD to help the bank maintain its transformational journey.

Friction with the Board leads to resignations

Reportedly, the friction with the Board on alleged superseding of authority to approve consultancy bills being flagged by auditors ultimately led to resignations by the CEO and ED. However, we believe that the management’s flip-flop view on growth and the relative underperformance vs guidance too could have played a role in this friction with the Board. Additionally, we believe that a radical business approach in an otherwise traditional organization could have added to the discord. In a separate event, the bank identified cross-border UPI transaction discrepancies of ~Rs0.19bn, calling for appointment of a forensic auditor in Apr-25 to probe the issue.

MD and ED resignation – Setback to the bank’s transformational journey

Srikrishnan Hari Hara Sarma, a seasoned banker, was Karnataka Bank’s first external MD and CEO, appointed in Jun-23 for a 3-year term, with an aim to transform KBL into a new-age, retail-oriented entity. Under his leadership, KBL initiated bold management, portfolio, and tech overhaul, while raising Rs15bn capital to boost its CET 1 capital to a high of 18.4% in 4QFY25 from ~13%. Sarma had also launched a major digitalization and retailization drive in the bank which could now be disrupted, in our view, and thus hurt growth. Notably, the first round of radical top management changes in regional PVBs has typically ultimately met with such a fate; hence, this occurrence within KBL is not surprising. However, such changes have also been successful in a few banks (eg KVB, RBL, Federal Bank, SIB), while being been less so for a few others (DCB, LVB). Thus, the onus will be on the Board to hire an external MD and CEO, who takes the transformational journey ahead and aligns well with the bank’s vision.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)