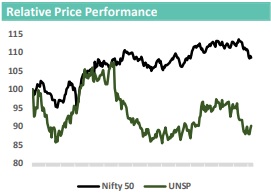

Buy United Spirits Ltd For the Target Rs. 1698 by ARETE Securities Ltd

United Spirits Limited (USL), India's leading alcoholic beverage company, demonstrated a resilient top line performance in Q3FY26. Despite a challenging volume environment, the company reported revenue growth of 7% YoY to INR 3683 Crs, driven by a robust price/mix improvement of 10%. The quarter was characterized by a premiumization narrative effectively offsetting a 3.2% decline in overall volumes. While regional headwinds in Maharashtra and Andhra Pradesh weighed on volume growth, Gross Margins expanded significantly. We maintain a BUY rating with a target price of INR 1,698, based on 60x FY27E earnings, noting the company's strong underlying portfolio strength excluding state specific disruptions.

Resilient Premiumization Story (P&A Segment)

The Prestige & Above (P&A) segment, the core driver of USL's strategy, saw revenue growth of 8.2% YoY. Although P&A volumes dipped by 2%, the segment achieved a price/mix growth of 10.2%, showcasing the company's pricing power. The P&A segment now accounts for 90% of net sales. Excluding the specific headwinds from Maharashtra and the high base effect in Andhra Pradesh, the portfolio in the Rest of India is growing at a healthy 14% in Net Sales Value (NSV). Key brands like Don Julio doubled revenue, while Signature recorded strong double digit growth during the festive season.

Regional Headwinds & Volume Pressure:

Performance was impacted by distinct regional challenges. In Maharashtra, adverse policy changes (MML) led to a shift in consumer demand toward lower end segments, causing a drag on volumes. Additionally, Andhra Pradesh witnessed a volume dip due to a high base effect from retail pipeline filling in Q3FY25; however, management expects this to normalize with volumes recovering in Q4. Consequently, overall volumes declined by 3.2%, though the broader "Rest of India" portfolio showed underlying volume growth of 6%.

Margin Expansion despite High Marketing Spend:

Gross Margins expanded significantly by 219 basis points YoY to 46.9%, aided by a premium product mix, productivity measures, and lower material costs (glass and ENA). However, EBITDA margins contracted slightly by 35 basis points YoY to 16.8%. This contraction was primarily due to a sharp 36% YoY increase in Advertising & Promotion (A&P) spends, which stood at 14% of sales, as the company aggressively invested in brand building and festive activations.

Outlook

USL remains focused on its premiumization journey and innovation, evident in its increased stake in the non-alcoholic brand 'Sober'. Management maintains guidance for double digit P&A revenue growth and expects the India-UK Free Trade Agreement (FTA) to provide an annualized benefit of INR 110-120 Crores from Q2 FY27 onwards. The strategic review of the IPL team (RCB) is on track for completion by March 2026. Despite near term policy headwinds in Maharashtra, the structural story remains intact with strong pricing power and gross margin expansion. We maintain a BUY rating.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127