Buy Allied Digital Services Ltd For the Target Rs. 264 by Choice Broking Ltd

Analyzing Q3 Results amid Trump Tariffs & Macroeconomic Challenges

ALDS Revenue above estimates, EBIT & PAT missed expectations

* Revenue for Q3FY25 came at INR 2.2Bn up 28.9% YoY and 8.6% QoQ (vs CEBPL est. at INR 2.0Bn).

* EBIT for Q3FY25 came at INR 0.2Bn, up 22.0% YoY and 40.6% QoQ (vs CEBPL est. at INR 0.3Bn). EBIT margin was down 52bps YoY but up 208bps QoQ to 9.2% (vs CEBPL est. at 13.3%).

* PAT for Q3FY25 stood at INR 0.2Bn, up 51.2% YoY and 52.3% QoQ (vs CEBPL est. at INR 0.2Bn)

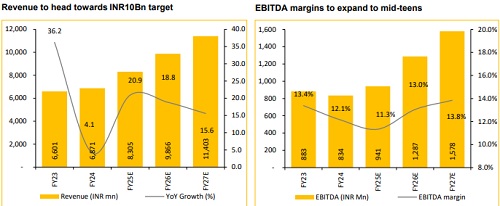

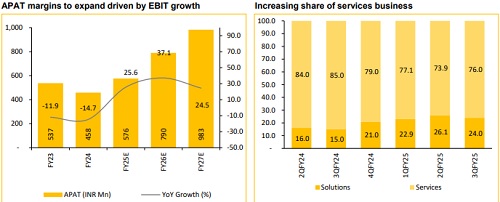

Revised & optimized timeline for achieving INR10Bn revenue by FY26: In Q3FY25, ALDS secured over INR2Bn in new orders and contract renewals, also marking its second consecutive quarter with revenues exceeding INR2Bn. This performance sets a new base for the company’s top-line growth. Management remains confident in achieving its revised revenue target of INR10Bn by FY26 (earlier FY27). We believe this growth will be driven by a recovery in global business demand, strong momentum in government Smart/Safe City projects, and a robust pipeline of large-scale projects. However, the risk of not securing the projects that were bid on still remains. The company is also tapping into new opportunities in the Rest of the World (ROW). Business visibility remains robust, particularly in India, reflected in recent order wins and contract renewals. ALDS is poised to capitalize on increasing global technology spending, especially in high-growth areas like digital engineering, cloud, and cybersecurity. With its focus on innovation through AI, Machine Learning, and Big Data, ALDS is enhancing its services and positioning itself for larger contracts, targeting 75% from services and 25% solutions by FY26.

INR400Bn opportunities awaits in smart town projects: India's business is thriving, with strong growth prospects, especially in the smart cities sector. The company is negotiating several deals for Q4, capitalizing on the government's focus on infrastructure and the launch of 1,000 smart-town projects worth INR400Bn. Opportunities are expanding beyond India, with smart city initiatives growing in the UK, Africa, and UAE. Tapping into new enterprise markets and leveraging GCC strengths will enhance global reach. In cybersecurity, increasing demand, particularly for smart city solutions, offers significant potential. The company's expertise in data centers further positions it for growth in this space.

ALDS may sidestep Trump tariff risks: The overall focus of the Trump tariffs will likely be directed towards the IT services sector, potentially leading to a slowdown in IT spending. However, ALDS may be less affected by this trend. The company's contract-based business model ensures more stable and predictable revenue for the coming years.

Aspirational margin goals of above 13%: EBITDA margin for the quarter stood at 12%, consistent YoY and showing sequential improvement. Despite cost pressures and strategic investments, margins rebounded from the previous quarter. Going forward, management plans to maintain a 12% EBITDA margin with a target of 13%+ in the next 3–4 quarters. We anticipate that this will be driven by cost reduction efforts, stronger margins in the US market due to its service focus, and growth in high-margin regions, all contributing to overall margin expansion.

View and Valuation: ALDS is uniquely positioned to capitalise on the emerging opportunities leveraging next-gen technologies given the skill sets, empowered teams, global partnerships and strategic relationships with marquee customers. We expect Revenue/EBIT/PAT to grow at a CAGR of 17.2%/ 35.0%/ 30.6% respectively over FY25E-FY27E. We maintain our rating to BUY with a revised target price of INR264 implying a PE of 16x on FY27E EPS of INR16.5.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131