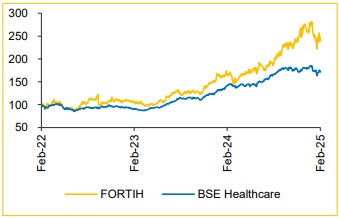

Buy Fortis Healthcare Ltd For the Target Rs. 738 by Choice Broking Ltd

Hospital & Diagnostic Revenue Surge; PAT Boosted by One-Off Gain

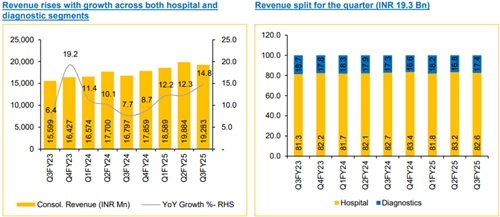

* Revenue stood at INR 19.3 Bn, reflecting a 14.8% YoY increase but a 3.0% QoQ decline (vs. consensus estimates at INR 18.8 Bn).

* Hospital revenue grew by 16.8% YoY to INR 16.2 Bn; Diagnostic revenue increased by 18.0% YoY to INR 3.4 Bn.

* EBITDA rose 32.1% YoY but declined 13.7% QoQ to INR 3.8 Bn, with a margin of 19.5% (+255bps YoY, -241bps QoQ), in line with consensus estimates.

* Adjusted PAT saw strong growth of 85.3% YoY and 8.3% QoQ, reaching INR 2.6 Bn, with a margin of 12.4% (vs. consensus estimates of 9.5%).

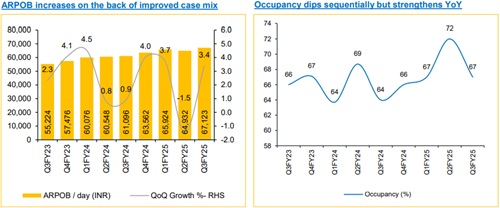

* ARPOB stood at INR 67,123 (+9.9% YoY and 3.4% QoQ); Occupancy was recorded at 67%, vs 64% last year and 72% in in Q2FY25.

Hospital Growth to Continue, Driven by 5-6% ARPOB Growth & Capacity Expansion

Fortis’ hospital business, which contributes ~83% of total revenue, delivered a strong quarter supported by improved occupancy and ARPOB growth. 11 of 27 facilities accounted for 74% of hospital revenue, reporting an EBITDA margin of 20%. We expect occupancy to improve as new beds and facility capacities become operational. Additionally, a better case mix, with a higher share of high-value specialties such as orthopedics, neurology, and cardiology, is expected to drive growth. Management anticipates ARPOB to grow at 5-6% annually, supported by the addition of 350-450 beds each year.

Agilus Expansion on Track; Rebranding Impact to Fade Post FY25

The company now holds an 89.2% stake in Agilus, and while the business is still adjusting to the impact of rebranding from Fortis to Agilus, the management expects it to taper off post FY25. The company continues to add new customer touch points (CTPs) and has added 500+ in 9MFY25. Going forward, we expect the company to continue expanding its CTPs by adding 500-600 new ones every year. The reduced rebranding expenses will also boost margins, which will be further aided by increased test volumes and an expanded B2C business.

View and Valuation:

We have reduced our FY26/27 estimates by 3.4%/3.7% and maintained our ‘BUY’ rating with a target price of INR 795, valuing the company on an SOTP basis. The Hospital Business is valued at 23x EV/EBITDA, reflecting continued ARPOB growth and capacity expansion, while the Diagnostic Business is valued at 16x EV/EBITDA, factoring in CTP expansion and margin improvement. We expect the company’s case mix to improve further, supporting margin expansion in the hospital segment.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131