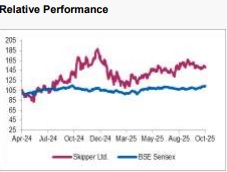

Buy Skipper Ltd For Target Rs. 580 - Axis Securities Ltd

.jpg)

Largely Inline Q2, Growth Outlook Intact

Est. Vs. Actual for Q2FY26: Revenue – Miss; EBITDA – largely INLINE; PAT – Miss

Change in Estimates post Q2FY26

FY26E/FY27E: Revenue: 0%/0%; EBITDA: 0%/0%; PAT: 0%/0%

Recommendation Rationale

* Strong Order Book: Skipper received new orders totalling Rs 1,243 Cr in Q2FY26, which included three large wins from PGCIL and key other export markets. As of Sep’25, the order book stood at its highest ever at Rs 8,820 Cr. The order book comprises 76% domestic T&D orders, 13% non-T&D orders (including Telecom, Railways, Solar, Water EPC, and other Steel Structural items), and 11% export orders. All export orders pertain to T&D. The company currently has a strong bid pipeline of more than Rs 30,000 Cr (with a 25% historical order conversion success rate). The management expects the company’s orderbook to be ~Rs. 9,000 Cr – Rs 10,000 Cr by the end of FY26.

* Capacity Expansion status: The new 75 ktpa plant is now operational and has commenced its commercial production. The 2 nd 75 ktpa capacity is also expected to go online by the end of FY26, taking its total capacity to 450 ktpa. The company is confident of increasing its capacity to 600 ktpa by the end of FY29, making it the world’s largest transmission tower manufacturer.

* Export Opportunities: Exports stood at 11% of the company’s order book as of Sep’25. The company is exploring new opportunities in new markets. It already has a strong presence in the Middle-East, African, and Latin-American Markets. The company is also exploring growth opportunities in developed markets like North America and Europe; however, they may take time to materialise. The company has completed successful plant audits for new potential customers from the Middle East and North America. It targets to achieve 50% export orders in its order book in the long term.

Sector Outlook: Positive

Company Outlook & Guidance: The management expects a 20-25% revenue growth YoY for the next 3 years, led by the capacity expansion. The next 4 years' capex guidance is Rs 800 Cr, including the capacity additions. Furthermore, the management expects the current EBITDA margins of ~10% to gradually increase YoY, led by higher T&D contribution and better-quality T&D contracts. In FY26, the Management expects EBITDA margins to be in the range of 10-10.5%.

Current Valuation: 18x on our Sep’27 EPS estimate (Previous: 20x on our FY27 EPS estimate)

Current TP: Rs 580/share (Previous: Rs 570/Share)

Recommendation: We maintain our BUY recommendation on the stock

Financial Performance: Skipper reported a largely in-line set of numbers. Consolidated net sales stood at Rs 1,262 Cr, up 14%/1% YoY/QoQ, a slight 3% miss on our estimates. EBITDA stood at Rs 131 Cr, up 16%/3% YoY/QoQ, a marginal 1% beat on our estimates. The EBITDA margins stood at 10.4% up 23bps/22bps YoY/QoQ. PAT stood at Rs 37 Cr, up 12% YoY but down 18% QoQ, a 21% miss on our estimates. However, the PAT is affected by a one-time exceptional item in the nature of settlement of disputed tax claims amounting to Rs 11 Cr.

Outlook: With the capacity expansion, robust order book, and revenue growth, along with expected improvement in margins, Skipper is well-positioned to benefit from the sectoral tailwinds. We maintain our earnings estimates as outlined in our Q1FY26 Result Update published on 1 st Aug’25.

Valuation & Recommendation: We assign a target P/E multiple of 18x (from 20x) on our Sep’27 EPS estimate (roll forward from Mar’27) and arrive at our TP of Rs 580/share (earlier Rs 570/share). We maintain our BUY rating on the stock. Our TP implies a potential upside of 14% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633