Buy Emcure Pharmaceuticals Ltd For Target Rs. 1,695 By JM Financial Services Ltd

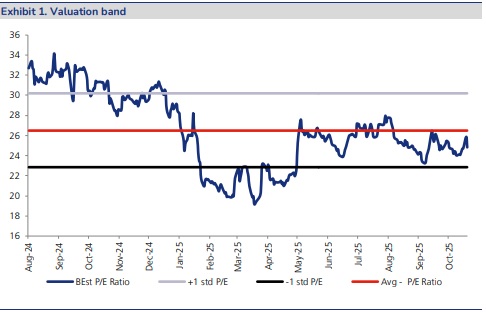

Emcure reported strong 2QFY26 results with revenue, EBITDA, and PAT growing 13%, 15%, and 25% YoY respectively, in line with Street and JMFL estimates. EBITDA margins stood at 19.3%, flat YoY and as expected. The India business grew 11% YoY in 2Q and 10% YoY in 1H, driven by strong performance in cardio, gynaecology, and dermatology therapies. The international business rose 16% YoY, supported by robust growth in the EU and Canada markets, which were up 23% and 18% YoY respectively. The India business has shown consistent improvement over the past few quarters, addressing a key investor concern, with volume growth gaining momentum and likely to sustain. Additionally, Emcure is expected to be among the first to launch GLP-1 in India, which should further enhance its growth prospects. Overall, India revenues are projected to grow at a 13% CAGR over FY25–28, while international business is also expected to deliver healthy growth driven by new launches. The stock currently trades at a 20% discount to the peer average despite expected 29% earnings CAGR over the next three years. We believe the continued recovery in the India business will help narrow this gap. We value Emcure at 24x Sep-27E EPS to arrive at a target price of INR 1,695 and maintain a BUY rating.

* India- Cardio, Gynaec and Derma drive growth, new deals to add value: The company has experienced growth driven by key segments like gynaecology and cardiology. The chronic segment, including diabetes and cardiology, is seeing strong growth and the company is targeting further penetration in this area, with additional potential seen in newer therapeutic areas such as consumer health and diabetes. In addition, the company completed the acquisition of the minority stake in Zuventus and is now fully consolidating the business, expecting backend synergies to drive growth. Emcure is also focused on enhancing its in-house manufacturing capabilities, particularly in biologics and complex injectables, which are expected to boost longterm profitability. To expand its portfolio, the company is pursuing in-licensing deals and strategic partnerships, while ensuring it doesn't become overly reliant on them

* Deal with Novo- Another feather on the cap: Emcure aims to leverage its first-mover advantage in the obesity space to shape the market before competitors enter following the patent expiry in March 2026. The company holds exclusive rights to distribute Poviztra, the second brand of semaglutide, in India, providing a strong competitive edge. Novo’s extensive clinical data on semaglutide, including phase 4 and real-world data, will help Emcure in shaping the market and gaining acceptance from both doctors and patients. Emcure plans to utilize its field force of over 5,000 representatives to promote Poviztra across India, particularly in specialties like endocrinology and cardiology. The deal does not restrict Emcure from pursuing generic versions of semaglutide or competing products in international markets outside India. Although the market for semaglutide is expected to become crowded post-patent expiry, Emcure intends to capture a major share before generic versions flood the market.

* EU- Amphotericin ramp-up leads momentum: The company’s growth has been driven by a ramp-up in Amphotericin B sales and recent acquisitions. It launched Amphotericin B in Italy and plans to expand into more Western European countries, including France and Germany, by the end of FY26. Additionally, the non-ARV portfolio in Europe is performing well and contributing to the overall growth in the region. The company is also pursuing regulatory approvals for its products across Europe, supported by a healthy product pipeline.

* EM- Non ARV portfolio remains robust: The company has experienced growth with significant contributions from non-ARV products. It has a strong product pipeline for emerging markets, particularly in biologics and complex formulations, which are expected to drive future growth. Additionally, Emcure successfully participated in the South African ARV tender, maintaining stable pricing and good demand in the region

* Canada- new launches and growing market share: Growth in Canada has been driven by market share gains and new product launches. The company is working on diversifying its product portfolio in the region, with an increasing focus on non-ARV products. It remains optimistic about continued growth in Canada, expecting sustained performance in the second half of the year and targeting mid-teens growth for the foreseeable future.

*- Sanofi portfolio- Cardio growth post restructuring: The cardiac portfolio at Emcure is now tracking in line with industry growth following a period of restructuring. The company is seeing increased sales with its own brands being co-prescribed alongside Sanofi's products. Additionally, the diabetes portfolio, which had been underperforming in the past, is now showing healthy growth, with Emcure actively promoting it. Emcure plans to increase its penetration in tier 2 and 3 cities, where Sanofi’s brands had previously had limited reach. The company is also open to potential acquisitions of Sanofi’s brands, particularly in the diabetes segment, if they become available for divestment in the future.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361