Hold Tech Mahindra Ltd for the Target Rs. 1,500 By Prabhudas Liladhar Capital Ltd

Margin improvement trajectory continues…

Quick Pointers:

* Q2 results both on revenue & margin above expectation

* Deal wins remain steady at USD 816 mn vs USD 809 mn in Q1

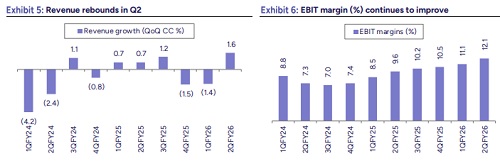

The revenue growth (+1.6% CC QoQ) exceeded our estimates (+0.5% CC QoQ), margins also outperformed our estimates by ~50bps in Q2. The revenue performance in Q2 saw steady recovery after two consecutive quarters of negative growth (in CC). The growth was dominated by selective pockets and clients, while Communications vertical de-grew 2.0% QoQ, implies Telcos under stress. Manufacturing reported solid growth (+5.1% QoQ), however the Automotive outlook remains bleak, especially on the commercial side. The deal TCV remains elevated in Q2 is a positive and a testament of putting efforts to scale “Must Have” accounts. The early signs are visible in scaling the high potential accounts (at least 17) to USD1m+, while pruning the tail and onboarding potential logos would be continued exercise going forward. On margins, we believe the cost optimization efforts would continue at a similar pace of FY25/FY26 with continued efforts to rationalize employee pyramid and leveraging project Fortius. We are baking in revenue growth of flat/+4.1%/5.2% CC YoY with margin improvement of 190bps/250bps/30bps YoY in FY26E/FY27E/FY28E. We roll forward to Sep’27 and assign 19x to arrive at a TP of Rs. 1,500. The stock is currently trading at 26x/20x FY26E/FY27E EPS, leaving no potential upside. Retain, HOLD.

Revenue:

TechM reported Q2 revenue of USD 1.58 bn, up 1.6% QoQ in CC and 1.4% in reported terms, outperforming our estimate of 0.5% QoQ growth in CC and the consensus expectation of a 1% QoQ growth. Sequential growth was driven by Retail (+9%), Manufacturing (+5.3%) and BFSI (+3.8%), while the Communications segment declined by 2%. Geographically, the Americas and RoW grew by 2.6% and 1.4% QoQ, respectively, whereas Europe declined by 1%.

Operating Margin:

EBIT margin continued its upward trajectory, expanding by ~110 bps QoQ to 12.1% in Q2, ahead of both our and consensus estimate of 11.6%. The improvement was driven by FPP productivity gains, volume growth, and SGA optimization, further supported by a 40-bps currency tailwind.

Deal Wins:

Deal wins remained steady at USD 815.7 mn in Q2, compared to USD 809 mn in Q1. On a TTM basis, deal wins rose to USD 3.17 bn in Q2FY26 from USD 2.01 bn in Q2FY25.

Valuations and outlook:

We expect TechM to report USD Revenue & Earnings CAGR of 3.3% & 19.4% over FY25-28E. The stock is currently trading at 20x FY27E, we are assigning P/E of 19x to LTM Sep. 27E with a target price of INR 1,500. We maintain our “HOLD” rating

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271