Neutral Can Fin Homes Ltd for the Target Rs.900 by Motilal Oswal Financial Services Ltd

Execution on loan growth remains a key monitorable

NIM expansion aided by transitory lag in pass-through to customers

* Can Fin Homes’ (CANF) PAT for 1QFY26 grew ~12% YoY to ~INR2.24b (in line). NII grew 13% YoY to ~INR3.6b (in line). Fees and other income stood at ~INR93m (PY: INR70m) for the quarter.

* Opex rose ~40% YoY to INR682m (~15% higher than MOFSLe). The cost-toincome ratio stood at ~18.3% (PY: 14.9%). The increase in the cost-toincome ratio on a YoY basis was due to salary revisions to align with market compensation and an increase in rent and taxes for 32 additional offices (25 branches, 6 zonal offices, and an extension of the Head Office).

* PPoP grew ~9% YoY to INR3.04b. The effective tax rate for the quarter was ~19.4% (PQ: 16% and PY: ~22%). CANF’s RoA/RoE for 1QFY26 stood at ~2.2%/~17%.

* CANF guided for disbursements of INR25b for 2QFY26 and INR105b in FY26. While overall growth momentum is picking up, regional challenges persist. In Karnataka, disbursements remained flat in 1QFY26 due to ongoing issues with E-Khata, which affected both loan growth and resolutions under SARFAESI. In Telangana, disbursement trends remained weak; however, early signs of improvement are visible following the State government’s withdrawal of property demolition threats under Project Hydra.

* CANF guided for a minor increase in spreads going forward (in the nearterm), as PLR benefits are being passed on to customers with a lag (since ~67% customers are still on an annual reset as of Jun’25).

* We estimate an advances/PAT CAGR of ~13%/10% over FY25-28, with an RoA/RoE of ~2.1%/~16.5% in FY27. CANF, in our view, is a robust franchise with strong moats on the liability side. However, we await: 1) execution on loan growth guidance and 2) disruptions (if any) from the tech transformation that the company will embark on in the current calendar year, before turning constructive on the stock. The stock’s valuation of 1.6x FY27E P/BV suggests management’s inability to deliver on its loan growth guidance because of recurring external events that impede business momentum. We reiterate our Neutral rating with a TP of INR900 (premised on 1.8x Mar’27E P/BV).

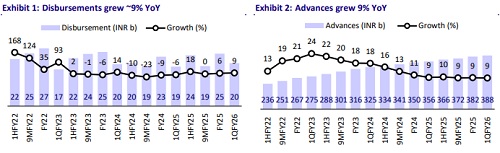

Disbursement up ~9% YoY, driving similar YoY growth in advances

* CANF’s 1QFY26 disbursements grew ~9% YoY to INR20.2b.

* Advances grew ~9% YoY and ~1.5% QoQ to ~INR388b. The annualized runoff in advances stood at ~15.3% (PQ: 15.0% and PY: ~14.8%), suggesting a mild rise in BT-OUTs.

Reported NIM expands ~7bp QoQ; bank borrowings rise QoQ

* NIM (reported) expanded ~7bp YoY to ~3.64. Management continued to guide for spreads of 2.5% and NIMs of 3.5% in FY26. We model largely stable NIMs of ~3.75%/3.7% in FY26-FY27.

* Reported spreads rose ~7bp QoQ, mainly due to ~10bp QoQ dip in CoB to 7.47%.

* Bank borrowings rose to 53% of the total borrowings (PQ: 52%).

Seasonal deterioration in asset quality; GS3 rises ~10bp QoQ

* Asset quality exhibited minor seasonal deterioration, with GS3 increasing ~10bp QoQ to ~0.98% and NS3 rising ~8bp QoQ to ~0.54%. PCR on stage 3 loans declined ~280bp QoQ to ~45.2%.

* Credit costs stood at INR263m (vs. MOFSLe of INR240m), resulting in annualized credit costs of ~27bp (PQ: ~16bp and PY: ~28bp).

* CANF conservatively guided for credit costs of ~15bp in FY26. We model credit costs of ~15bp each for FY26/FY27.

Highlights from the management commentary

* The company indicated that a 10bp rate cut was passed on to both existing and new customers in May’25, followed by an additional 15bp reduction in lending rates effective Jul’25.

* Management guided for a cost-to-income ratio of ~18% in FY26, factoring in the anticipated increase in employee expenses. This is expected to rise to ~19% in FY27, driven by IT transformation-related costs.

* Total delinquencies declined from March levels, marking the lowest delinquency ratio in the last five quarters. However, a marginal rise in GNPA was observed, driven by seasonal weakness in the first quarter of the fiscal year.

Valuation and view

* CANF reported in-line earnings; however, loan growth remained subdued, with advances growing only 9% YoY. The company saw a seasonal deterioration in asset quality, resulting in sequentially elevated credit costs. Furthermore, the company expressed confidence in sustaining margins at current levels, which we view as a key positive, especially in the backdrop of a declining interest rate environment.

* CANF has successfully demonstrated its ability to maintain its pristine asset quality for several years, and we expect the same to continue. However, CANF will have to accelerate its disbursements to deliver on its guided loan growth. We estimate a CAGR of 11%/9%/10% in NII/PPOP/PAT over FY25-27, with an RoA of 2.1% and RoE of ~16.5% in FY27. Reiterate Neutral with a TP of INR900 (premised on 1.8x Mar’27E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412