Buy CDSL Ltd For Target Rs.1,500 by Motilal Oswal Financial Services Ltd

Weak transaction income; high tech costs impact PAT

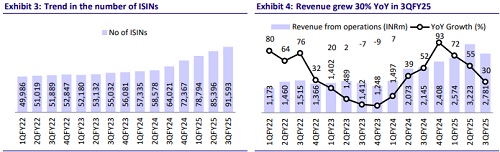

* CDSL’s operating revenue grew 30% YoY to INR2.8b (10% miss) in 3QFY25, driven by 27%/87% YoY growth in Annual Issuer Charges/IPO and Corporate Action Charges. For 9MFY25, revenues rose 50% YoY to INR8.6b.

* EBITDA grew 22% YoY to INR1.6b (15% miss), resulting in EBITDA margin of 57.8% (vs. 61.3% in 3QFY24 and 62% in 2QFY25). For 9MFY25, EBITDA increased 51% YoY to INR5.1b. Operating expenses rose 41% YoY to INR1.2b, resulting in a CIR of 42.2% vs 38.7% in 3QFY24 and 38% in 2QFY25.

* PAT for 3QFY25/9MFY25 rose 21%/47% YoY to INR1.3b (20% miss)/INR4.3b. PAT margins came in at 46.7% vs. 50.1% in 3QFY24 and 50.3% in 2QFY25.

* Tech costs increased 89% YoY to INR296m, and management has guided that such investments in tech will continue. As a market infrastructure company, CDSL is required to maintain high-quality hardware and software systems.

* We have cut our earnings estimates by 10%/8%/8% for FY25/FY26/FY27 to factor in the impact of true to label on transaction revenues and continued investments in tech and human resources. We expect Revenue/PAT to post a CAGR of 28% each over FY24-27 and reiterate a Neutral rating on the stock with a one-year TP of INR1,500, premised at a P/E multiple of 40x on Sept’26E earnings.

Continued investments in technology and human resources

* On the revenue front, transaction revenue remained flat YoY on account of the true to label regulation, which management expects will have a nearterm impact.

* Annual issuer charges increased 27% YoY to INR810m, of which INR74.7m came from unlisted companies. IPO/Corporate Action charges increased 87% YoY to INR580m on account of a higher number of folios, while the number of IPOs reduced during the quarter.

* During 9MFY25, the total income of the subsidiary, CVL, increased 61% YoY to INR2.2b, while total expenses grew 56% YoY to INR838m.

* Total expenses increased 41% YoY to INR1.2b, driven by a 27%/36%/89% YoY increase in Admin and Other Expenses/Employee/IT Costs, respectively.

* Demat account additions during the quarter reduced sequentially to 9.2m from 11.8m in 2QFY25. Meanwhile, the number of issuers increased to 31.6k from 21.9km in 3QFY24.

Key takeaways from the management commentary

* Regarding regulatory fee charges, the amount paid to IPF is calculated as a % of operating margins while annual charges paid to SEBI are calculated on the basis of custody charges collected. Hence, an increase in these factors will lead to an increase in the regulatory fee.

* Impairment costs stood at INR24.6m. Other expenses declined 6% QoQ, mainly on account of a decline in the KYC income during the quarter.

Valuation and view

* Continued investments in human resources and technology for future growth could restrict gains from operating leverage, but we still expect EBITDA margins to expand to ~63% in FY27E from 60.3% in FY24. An asset-light business model and a healthy dividend payout ratio of 64% in FY27E will translate into an RoE of ~41% in FY27E, compared to 31% in FY24.

* We have cut our earnings estimates by 10%/8%/8% for FY25/FY26/FY27 to factor in the impact of true to label on transaction revenues and continued investments in tech and human resources. We expect Revenue/PAT to post a CAGR of 28% each over FY24-27E and reiterate a Neutral rating on the stock with a one-year TP of INR1,500, premised at a P/E multiple of 40x on Sept’26E earnings.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)