Buy Blue Dart Express Ltd for the Target Rs. 7,600 by Motilal Oswal Financial Services Ltd

High operating costs drag margins; focus remains on volume growth

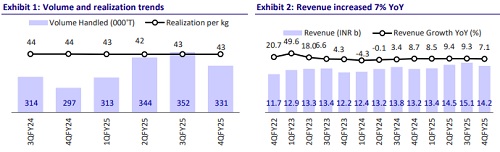

* Blue Dart Express (BDE)’s revenues grew 7% YoY to INR14.2b (6% below our estimate). The company handled 0.33m tons of cargo volumes (+11% YoY) in 4QFY25. Realization dipped ~4% YoY to INR42.8/kg. It carried 91.9m shipments in 4Q.

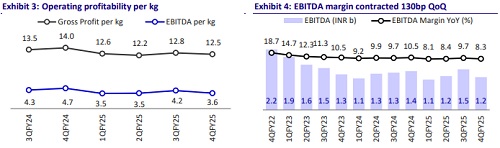

* EBITDA margins stood at 8.3% (against our estimate of 10.1%), down 220bp YoY. High operating expense and employee costs as a percentage of revenue dragged margins. EBITDA declined 15% YoY to INR1.2b (22% below our estimate).

* Weak operating performance and higher tax outgo led to a 30% YoY decline in APAT to INR532m (our estimates of INR827m).

* During FY25, revenue was INR57.2b (+9% YoY), EBITDA was ~INR5b (-4% YoY), EBITDA margin came in at 8.7%, and APAT was INR2.4b (-15% YoY).

* In 4QFY25, tough tonnage growth was largely in line with expectations. Margins were pressured due to higher costs from prior investments and fewer business days due to holidays.

* We expect an improvement in volumes, realizations, and margins as newly launched routes and recently added aircraft achieve optimal utilization. Additionally, the ground express segment—contributing ~35% to total revenue—is expected to act as a key driver of high single-digit growth. As the integration of new routes and freighters into the network progresses, we have revised our FY26 and FY27 estimates downward. However, we reiterate our BUY rating with a revised TP of INR7,600 (based on 20x FY27 EV/EBITDA).

BDE operating at optimum utilization levels; balanced growth across B2B and B2C segments

* In 4QFY25, BDE reported shipment volume of 91.9m (flat YoY) and tonnage of 0.33mt (+11% YoY). However, margins were pressured due to higher costs from prior investments.

* Revenue composition remained stable, with air express contributing ~65% and surface express ~35%, while B2B and B2C segments accounted for ~73% and ~27%, respectively, in FY25. Both segments saw a balanced ~11% volume growth for the year.

* In the surface express segment, BDE is expanding its e-commerce presence, achieving 10% B2B and 9% B2C growth in 4QFY25.

Highlights from the management commentary

* BDE successfully implemented price increases, though lower crude oil prices did not translate into margin expansion due to corresponding reductions in fuel surcharges. ROCE hit a decadal low, reflecting the impact of significant investments in owned assets.

* Capex in 4QFY25 was focused on capacity enhancement, particularly for aircraft servicing. BDE maintained or grew its air express market share while leveraging both commercial and passenger airlines.

* Looking ahead to FY26 and FY27, BDE anticipates strong and consistent growth regardless of broader industry trends, with a continued emphasis on service quality as a competitive edge.

Valuation and view

* BDE is targeting growth through a strong focus on service quality, expansion within the e-commerce segment, and potential freighter additions.

* The ground express segment, which accounts for roughly 35% of the total revenue, is expected to be a key growth driver, supporting high single-digit expansion. However, as the integration of new routes and freighters continues, we have lowered our EBITDA estimates for FY26 and FY27 by 11% each. We reiterate our BUY rating with a revised TP of INR7,600 (based on 20x FY27 EV/EBITDA).

.150625.jpg)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412