Neutral Tata Communications Ltd For Target Rs. 1,660 by Motilal Oswal Financial Services Ltd

Weak margins take the sheen off growth recovery

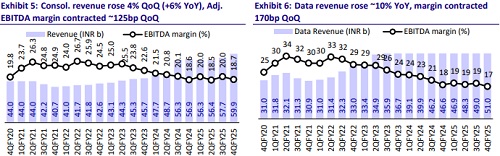

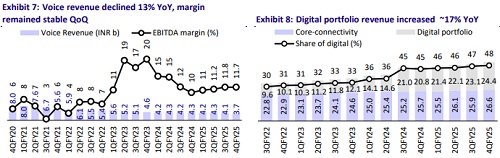

* Tata Communications (TCOM)’s 4Q results were once again a mixed bag, as ~17% YoY revenue growth in the Digital portfolio was offset by a sharp ~125bp QoQ contraction in consolidated EBITDA margin.

* TCOM’s consolidated EBITDA came in ~8% below our estimate on account of weaker gross margin and rising salience of the lower-margin digital business.

* Management indicated that following a strong 1HFY25, the order booking pace has normalized in 2H. Further, given the global macro uncertainties, there is an elevated level of caution among customers, which has led to a deferral of some deals from 4QFY25 to 1QFY26.

* Management remains committed to doubling data revenue to INR280b by FY27 and improving margins to 23-25% over the medium term.

* However, we build in ~9% data revenue CAGR over FY25-28, with data revenue reaching INR262b by FY28, and believe the ambition of doubling data revenue by FY27 would be a tall ask without further acquisition.

* We cut our FY26-27E EBITDA by 3-4% as we now assume a gradual margin expansion to 21.5% by FY27.

* We value TCOM’s data business at 9x EV/EBITDA and voice & other businesses at 5x EV/EBITDA. Our SoTP-based TP remains unchanged at INR1,660 as our EBITDA cut is offset by the roll-forward of the valuation base to Jun’27 (from Mar’27). We reiterate our Neutral rating on the stock. Acceleration in data revenue growth along with margin expansion remains the key to re-rating.

Growth recovers but weaker margins lead to an 8% miss on EBITDA

* TCOM’s consolidated gross revenue was up ~4% QoQ (+6% YoY) to INR60b (in line). However, consolidated net revenue at INR33.3b was flat QoQ (+3% YoY) due to a weaker gross margin in the digital portfolio.

* Data revenue at INR51b (in line) grew 10% YoY (+4% QoQ), driven by ~17% YoY (~6% QoQ) growth in the digital portfolio and ~3% QoQ/YoY growth in Core connectivity.

* Consolidated adjusted EBITDA declined 3% QoQ (+4% YoY) to INR 11.2b (~8% miss) due to higher network costs (+8% QoQ), likely on account of higher costs on cable repairs and higher marketing expenses.

* Consolidated adjusted EBITDA margin contracted 125bp QoQ (-35bp YoY) to 18.7% (175bp miss) due to weaker gross margin (lower net revenue) and rising contribution of the lower-margin digital portfolio.

* Reported consolidated PAT, including discontinued operations, was INR10.4b driven by gains on the sale of land to STT Datacentres (INR6.6b). Further, TCOM booked gains of ~INR3.1b on the completion of the sale of TCPSL.

* Adjusted for the land sale and TCPSL divestment gains, PAT on a like-for-like basis was lower than our estimate due to lower EBITDA.

* Net debt moderated to INR94b (vs. INR105b QoQ), following the receipt of proceeds from the sale of land and TCPSL.

* TCOM delivered ~14% YoY growth in data revenue in FY25. This was driven by the full impact of Kaleyra consolidation, while EBITDA grew by a modest ~6% YoY as margin contracted another ~100bp YoY to 19.8% due to adverse mix and impact from consolidation of currently loss-making acquisitions.

Key takeaways from the management interaction

* Order book and funnel additions: The order book was relatively stronger in 1H, driven by a few large deals across sectors such as BFSI, OTT, World Athletics, etc., which led to high double-digit growth. However, the growth in order book normalized in 2H, with fewer large deal wins. Overall, the order book grew by double digits during FY25. Further, management indicated that the funnel continues to remain healthy with a good representation of deals across India and internationally.

* Demand environment: Given the global macro uncertainties, there is an elevated level of caution among customers. TCOM has faced deferrals in a few deals that were expected to close in 4QFY25 and have slipped to 1QFY26. However, the company is not seeing any knee-jerk reaction from the customers or deal cancellations and believes that the customers will continue to make investments.

* Margin: 4Q margins were hit by certain customer-specific issues, spillover costs from cable repairs, and higher marketing costs for new product launches. However, the core business’s EBITDA margin (excl. subsidiaries and acquisitions) at 23.3% dipped marginally by 40bp YoY in FY25 and was within the management’s guided range of 23-25%. The contraction in core margin was due to increased provisions for certain deals in the SAARC region (~50bp impact). Further, management remained committed to improving the margin to 23-25% over the medium term, driven by an uptick from the ongoing cost synergy programs in the acquisitions.

* FX impact: Adjusting for the rupee depreciation, consolidated revenue growth would have been ~2.3% QoQ and ~4% YoY, as compared to 3.3% sequential and ~6% YoY reported consolidated revenue growth.

Valuation and view

* We currently model ~13% CAGR in digital revenue over FY25-28 and expect digital to account for ~54% of TCOM’s data revenue by FY28 (vs. ~48% in 4QFY25). An acceleration in digital revenue remains key for re-rating.

* We raise our FY26-27E revenue by ~1-2%, but we believe TCOM’s ambition of doubling data revenue by FY27 remains a tall ask without further acquisitions. Overall, we build in ~9% data revenue CAGR over FY25-28, with data revenue reaching INR262b by FY28 (vs. TCOM’s ambition of INR280b by FY27).

* We lower our FY26-27E EBITDA by ~3-4% each as we build in a more gradual margin expansion. We now assume the FY27 EBITDA margin at ~21.5% and believe that margin expansion to 23-25% by FY27 could be challenging, given a rising share of inherently lower-margin businesses in TCOM’s mix.

* We ascribe 9X EV/EBITDA to TCOM’s data business and 5X EV/EBITDA to voice and other businesses. We ascribe an INR30b (or INR104/share) valuation to TCOM’s 26% stake in STT data centers. Our SoTP-based TP remains unchanged at INR1,660 as our EBITDA cut is offset by the roll forward of the valuation base to Jun’27 (from Mar’27 earlier). The stock currently trades at 10.7x one-year forward EV/EBITDA (~5% premium to LT average). We reiterate our Neutral rating as we await acceleration in data revenue along with margin expansion.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412