Bank Nifty started the week on a positive note but lack of follow through strength led to profit booking and closed at 59011 - ICICI Direct

Nifty :26042

Technical Outlook

Week that was…

Equity benchmark resumed uptrend after three weeks breather and settled week at 26042, up 0.30%, supported by favourable global cues. while broader markets outperformed with the Smallcap index gaining 2%. Sectorally, Defense, Railways Metal, Energy outperformed, while PSU Banks, Pharma and Consumer durable took a breather

Technical Outlook:.

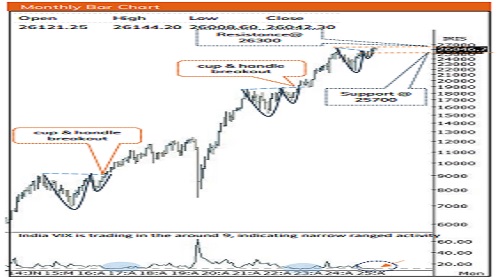

* The weekly price action has formed small bull candle with breakaway gap, signalling resumption of uptrend post healthy consolidation.

* Notably, after three week’s decline, index has resolved higher with a decisive breakout above its downward sloping channel accompanied by higher-high-low structure, indicating a pause in downside momentum and setting the stage for the next leg of the up-move towards 26,300 in the coming weeks.

* Over past two months, Nifty has been defending short-term moving average of 50 days EMA that coincided with last week’s low of 25700, highlighting key support threshold

Our constructive bias is outlined on the basis of following observations:

1. The US Dollar Index (DXY) has decisively slipped below 98 after failing to sustain above 100, easing currency-led headwinds. This has fuelled a sharp up-move in base metals, with Copper scaling fresh (all-time highs on MCX), while Aluminum breaks out from a three-year base, signalling the start of a structural uptrend.

2. Historically, since 2017 there have been two such instances when VIX slipped below the 9 mark, and on both occasion the Nifty has formed cup & handle formation and witnessed a positive breakout. In the current scenario too India VIX has fell around 9, with a formation of cup & handle pattern in Nifty, mirroring a similar past rhythm.

3. US equity markets have rebounded strongly to record highs, led by broadbased participation rather than the Magnificent Seven. The Russell 2000 (Small cap index) has consequently surged and is now trading near its alltime high, underscoring improving market breadth.

4. Santa rally on cards: Historical data since 1995 suggest that, on 90% of the occasions Nifty has delivered positive returns in last 10 days of the year with a median of 2%

5. On expected line, USD/INR has retreated from the upper band of rising wedge. Historically, there have been five instances where a retreat in USD/INR from the upper band of this wedge averaging a ~4% decline (with a maximum drawdown of ~7%) over a two-month period was followed by the Nifty delivering average gains of >10% over the subsequent two months.

6. The setup closely mirrors these past inflection points, suggesting the potential for a similar cyclical rhythm to unfold in coming weeks

Key Monitorable for the next week:

* India IIP data

* US FOMC meeting minutes

* US and India Tarde Deal

Intraday Rational:

* Trend- Breather while sustaining above 20 days EMA highlights, healthy retracement

* Levels: After a positive opening, dip towards 61.8% of previous 5 days up move (25726-26236)should be used as buying opportunity

Nifty Bank : 59011

Technical Outlook

Week that was:

Bank Nifty started the week on a positive note but lack of follow through strength led to profit booking and closed at 59011. Nifty Private Bank mirrored the benchmark and declined 0.03%.

Technical Outlook:

* The weekly price action formed an Inside bar signaling indecisiveness at current levels.

* Index has been undergoing healthy retracement over past four weeks that hauled index near 20 days ema coinciding with gap-up area which makes us believe that prevailing uptrend is intact

* Going ahead follow through strength above previous two weeks identical highs around 59500 will help index to resolve higher and gradually head towards 60100. Failure to do so would result into prolonged consolidation in the range(58500-59500).

* Nifty PSU Bank Index recent 4 weeks it has been consolidating of previous 8 weeks rally by 38.2% retracement indicating healthy consolidation. Going ahead a decisive close above 2 months identical high would indicate resumption of uptrend towards 8650 in coming weeks.

Intraday Rational:

Trend- Breather while sustaining above 20 days EMA highlights, healthy retracement

Levels: After a positive opening, dip towards 80% of previous 6day up move (58517-59950)should be used as buying opportunity

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631