Daily Derivatives Report 29th December 2025 by Axis Securities Ltd

The Day That Was:

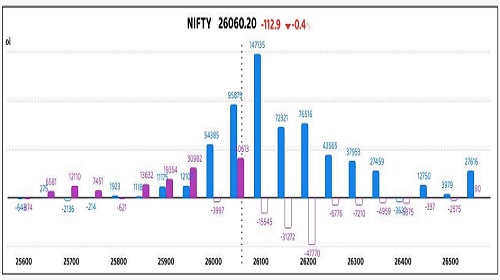

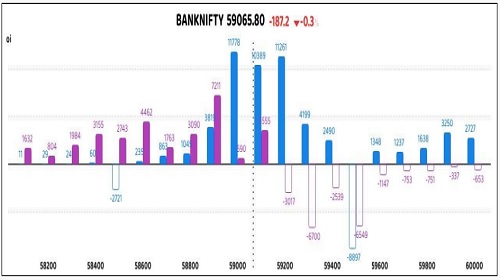

Nifty Futures: 26,060.2 (-0.4%), Bank Nifty Futures: 59,065.8 (-0.3%).

Nifty Futures and Bank Nifty Futures ended with modest cuts on Friday as profit booking during a holiday-truncated week and sustained selling by Foreign Institutional Investors (FIIs) weighed on sentiment, reflecting a cautious environment. Intraday price action featured a gap-down opening followed by range-bound consolidation, yet final-hour profit booking triggered a breakdown below key support level, signalling late-session weakness. Bank Nifty exhibited relative resilience against the broader market primarily due to selective buying in private-sector heavyweights, illustrating diverging sectoral strength. Despite Tokyo’s headline inflation dropping to the 2.0% target in December and easing Bank of Japan rate-hike expectations, the resulting "yen carry trade" revival and stabilized USD demand failed to provide a structural floor for equities, suggesting global macro tailwinds remained secondary to local selling. Nifty Consumer Durables and Nifty Metal emerged as top gainers due to defensive buying and value hunting, while Nifty IT and Nifty NBFC underperformed on tech spending concerns and valuation de-rating, marking a clear rotation into defensives. Nifty Futures fell 112.9 points as open interest increased by 0.8% or 1.35 lakh shares to 166.50 lakh shares, indicating a bearish Short Build Up. Conversely, Bank Nifty Futures fell 187.2 points as open interest decreased by 5.8% or 1.04 lakh shares to 16.91 lakh shares, signalling Long Unwinding. Derivatives dynamics saw the Nifty premium decline to 18 from 31 points and the Bank Nifty premium drop to 54 from 69 points, confirming a reduction in bullish conviction. The Rupee fell 15 paise to close at 89.86 against the U.S. dollar, adding pressure to imported inflation expectations. Finally, the India-VIX cooled by 0.71% to settle at 9.13, remaining near historical lows due to year-end exhaustion and thin participation.

Global Movers:

US markets paused on Friday as the "Santa Claus" rally met year-end profit-taking in thin post-holiday trade. The Nasdaq eased 0.09% to 23,593, the S&P 500 slipped 0.03% to 6,930 after hitting a fresh intraday record, and the Dow dipped 0.04% to finish at 48,711. Despite the minor retreat, indexes maintained robust weekly gains of over 1% amid optimism for a 2026 AI-driven economic boom. Momentum is expected to remain positive but fragile as low holiday volume amplifies minor price swings in the final sessions of the year. In fixed income, the 10-year yield held steady at 4.13%, as traders consolidated positions following the week's growth data. Yields are forecasted to stay range-bound as light institutional participation limits significant price discovery before the new year. Commodities saw a massive divergence; Gold surged 0.70% to $4,585 and Silver skyrocketed 5.66% to $79.00 on safe-haven demand. Conversely, WTI Crude tumbled 2.76% to $56.74 as supply fears eased. While precious metals are poised to test higher resistance levels, crude remains vulnerable to further technical corrections.

Stock Futures:

RVNL extended its northward trajectory for the sixth consecutive session, delivering a staggering 25% return over the period as sectoral tailwinds reached a crescendo. The equity ignited on news of the Dec 26 regulatory pivot regarding passenger fare restructuring, a move that drastically recalibrated revenue visibility across the railway ecosystem. Intraday price action remained relentless, with the stock briefly tagging the upper circuit before consolidating at valuation parity near daily peaks. Quantitatively, RVNL witnessed a 12.2% price surge accompanied by a 0.5% contraction in Open Interest (OI), signalling a classic Short Covering profile. The futures basis widened as the discount to cash deepened to 10.15 points, up from 6.95, reflecting a tactical lag in derivative pricing relative to the aggressive cash-market accumulation.

IRFC staged a vertical pivot, gaining 9.8% as the state-owned lender benefited from a tectonic shift in its borrower's fiscal health. Market sentiment was fortified by the dual catalyst of the nationwide fare hike and a landmark Rs 10,000 Cr refinancing pact with DFCCIL for the Eastern Freight Corridor. Unlike its peers, IRFC demonstrated a Long Addition setup, with futures OI expanding by 5.2% (an addition of 643 contracts) alongside the price gain. The futures premium to spot narrowed slightly to 0.81 points from 0.95, indicating efficient price discovery during the ascent. The robust alignment of rising prices with fresh OI accumulation confirms institutional conviction in the lender’s long-term credit profile.

NBCC orchestrated a commanding breakout to multi-month peaks, gaining 5.1% despite a lack of fresh immediate corporate disclosures. The rally leveraged latent momentum from a Rs 345 Cr IIT Mandi mandate and a strategic capital injection by LIC, which raised its stake beyond 4.5%. The derivative desk reported a significant Long Addition, with OI surging 10.5% to hit a three-series high of 14,344 contracts. The futures premium remained stable, edging up to 0.99 points, confirming that the price-volume breakout is backed by high-conviction momentum. While PCR remains low at 0.62, the record high Put OI suggests that bears are being flushed out as the stock breaks historical resistance zones, leaving the path of least resistance to the upside.

Coforge buckled under a 3.5% price contraction, marking its third day of selling as the market reacted to a $550 Mn QIP and a potential $2 Bn acquisition of Encora. This aggressive capital call sparked fears of significant equity dilution and integration complexity, driving a Short Addition of 14.7% in futures OI. Interestingly, the futures premium expanded to 12.7 points from 4.8, creating a massive basis divergence that often precedes heightened volatility. The PCR decay from 0.54 to 0.50, coupled with superior Call Intensity, indicates that traders are aggressively writing calls to capture the downward drift, suffocating any recovery attempts.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.76 from 0.98 points, while the Bank Nifty PCR fell from 0.77 to 0.74 points.

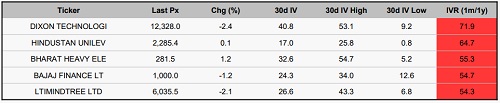

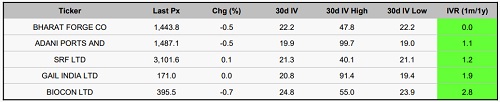

Implied Volatility (IV):

Dixon Technologies retreated 2.4% to close at 12,328.00, with its elevated Implied Volatility (IV) of 40.8 and a high IVR of 71.9 suggesting that the stock is moving out of its erratic swing phase and into a more predictable, range-bound channel a shift that currently favors neutral hedging strategies. Meanwhile, Hindustan Unilever edged up 0.1% to 2,285.40; its moderate 64.7 IVR signals a "coiling" effect, offering a strategic buying window for investors betting on a breakout from its current narrow trading band into a wider expansion. Conversely, Bharat Forge and Adani Ports both slipped 0.5%, ending at 1,443.80 and 1,487.10 respectively. Both stocks are currently characterized by "floor-level" volatility readings near 22.2 and 19.9 IV which indicates a lack of near-term catalysts and reinforces a strict wait-and-watch approach as they continue to drift sideways in a period of sterile consolidation.

Options volume and Open Interest highlights:

IRCTC and Titagarh Rail System, have entered a precarious late-stage momentum phase. Both counters exhibit an aggressive 5:1 Call-to-Put volume ratio, signaling excessive retail exuberance that often precedes a price normalization or a sharp retracement as technical limits are stretched to their breaking point. Similarly, RVNL and IRFC find themselves trapped in "crowded" trades; their one-sided Put Open Interest (OI) near annual peaks has created a fragile risk architecture, making them highly susceptible to rapid, chain-reaction liquidations if the price begins to falter. In contrast, Chola Finance and Polycab Ltd demonstrate defensive resilience despite broader market volatility. Both stocks are bolstered by significant Put Open Interest concentrated at deeper strikes, establishing a formidable demand zone that serves as a protective floor against systemic pullbacks. Meanwhile, the metals duo of Vedanta (VEDL) and Hindustan Zinc face "congestion risk" on the call side. With heavy directional OI clustered at elevated levels, these stocks remain vulnerable to abrupt price shocks should forced hedge adjustments or speculative exits trigger a volatility spike. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Index Futures witnessed a marginal shift of 9,610 contracts, characterized by a sharp divergence in institutional sentiment. Proprietary traders and FIIs spearheaded the long side, aggressively adding 4,903 and 4,707 contracts, respectively. This bullish conviction stood in stark contrast to DIIs, who offloaded a substantial,9,585 contracts, while retail clients remained largely side lined with a minor reduction of 25. In Stock Futures, a more robust 32,637 contracts changed hands as sentiment shifted toward broad-based accumulation. DIIs led the buying spree with 12,996 additions, followed closely by FIIs at 10,394 and clients at 9,247. Conversely, proprietary desks executed a complete tactical exit, slashing their exposure by 32,637 contracts to offset the collective inflow.

Securities in Ban for Trade Date 29-December-2025:

1. SAMMAANCAP

Nifty

Banknifty

Stocks with High IVR:

Stocks with Low IVR:

.

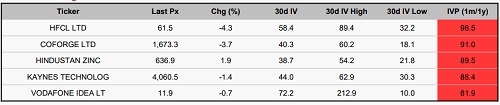

Stocks With High IVP:

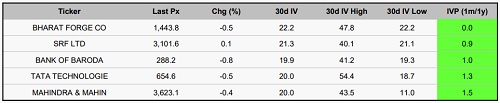

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)